Fundamental analysis of the Forex currency market

Forex trading requires not only the ability to open trades and work with a trader's trading terminal, but also knowledge of fundamental analysis.

analysis.

This type of forex market study is easier for a novice trader to understand, so it is recommended to begin learning the basics with this discipline.

Fundamental Forex analysis examines the key factors that influence exchange rates. The resulting data not only provides information about the current market situation but also serves as a basis for forecasting.

Learning the basics of this discipline will only take you a few weeks, but after that, you will no longer be opening trades blindly, but will be able to develop your own effective trading strategy.

It's worth noting that we're talking specifically about the basics, as a full course in fundamental analysis could take you more than one month.

What does fundamental analysis study?

1. The economy of the country issuing the currency —improvements or declines in economic indicators cause changes in the currency's value. The publication of economic data serves as signals for opening trades on the forex exchange.

The main economic indicators in this case are inflation or devaluation, employment and unemployment levels, GDP and trade balance.

Positive changes in the economy lead to an increase in the exchange rate of the national currency, while negative changes, on the contrary, contribute to a decrease in prices.

2. Finance – this section includes a fundamental analysis of the country's financial sector. Specifically, the analysis examines the stability of the banking system, the national bank's key interest rate, the state of gold and foreign exchange reserves, the volume of money in circulation, and several other indicators.

Changes in any of the above-mentioned indicators can also lead to a rise or fall in the exchange rate. For example, an announcement about a reduction in gold and foreign exchange reserves always causes a fall in the value of the national currency.

3. Political situation – instability in the political environment always leads to exchange rate instability, with changes potentially veering in either direction depending on the prevailing situation. Currencies are sensitive to elections or changes in key figures holding important positions.

4. External factors – also included in the scope of fundamental forex analysis, these can include events related to any of the above-mentioned categories. For example, the refusal of one country to use the euro as a reserve currency falls under the financial sphere and leads to a weakening of the euro's position against other global currencies.

It is therefore important to follow not only the news within the country, but also abroad. This can be achieved quite simply by subscribing to the news feed of one of the leading news agencies.

Sources of information for the analysis

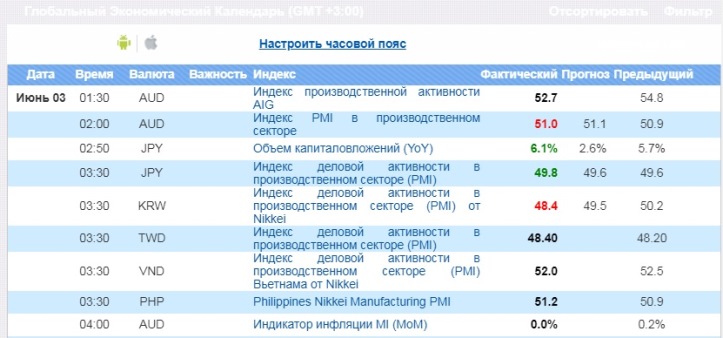

The main sources for obtaining information that can be used for forex trading are news feeds and the forex events calendar.

News feeds allow you to track unscheduled news releases, such as weather events, disasters, terrorist attacks, and statements by politicians and leading financial figures. A special news indicator can also be used as a news feed. It allows you to receive the latest news directly in your trading terminal.

The Forex calendar provides information on scheduled news, including the publication of various economic and financial indices and scheduled speeches by financial executives.

We should also not forget about the so-called anticipation factor, when bookmakers place bets on a particular event, thereby pushing the price in the direction of the forecast even before the news is released.

Using the obtained data in Forex trading

The data obtained from fundamental analysis is well suited for forex trading. There are two main trading strategies:

1. Short-term trading – or so-called news trading – is one of the simplest options for trading on the forex exchange. A trade is opened immediately after the release of important news, and its direction depends on the nature of the event.

2. Long-term trading is a more complex form of trading, with trade durations ranging from several weeks to several months. Its essence lies in identifying long-term price trends and opening trades in the direction of the prevailing trend.

This type of trading requires a more in-depth understanding of the country's economy and a study of possible development scenarios. Long-term trading requires significantly more time and effort spent on analysis.

For Forex beginners, it is recommended to use the first strategy option, as the second requires some specialized knowledge in economics and analysis.

Key Points of Fundamental Analysis in the Forex Market - http://time-forex.com/fundamental