How to Use an Economic Calendar for Stock Trading

Effectiveness on the stock exchange directly depends on the ability to analyze; an analytical mind is one of the most important qualities of a trader.

First and foremost, a trader must not only understand the processes occurring with a given currency instrument, stock, or futures, but also be able to track, find, and sort through vast amounts of relevant data that can influence price movements.

However, few traders can boast the ability to make forecasts based on analytical data.

Fundamental market analysis has generated so many myths that beginners avoid news like the plague as soon as they hear the word "news," much less master the specific patterns it evokes.

Economic calendar presents a selection of the main news stories from specific countries, covering all sectors of the economy without exception.

An economic calendar is not just a list of news items with their release dates, but a truly professional tool that no professional stock market player can do without.

Information provided by the economic calendar

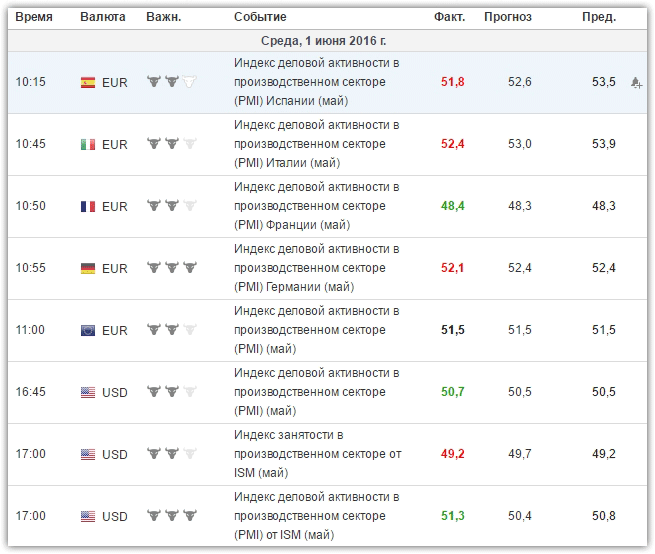

The economic calendar for stock trading clearly indicates the time and date of news releases, sorts by market impact, and displays current, previous, and potential values for specific statistics.

In the economic calendar you can find a wide variety of news, ranging from macroeconomics and key indicators such as GDP, various indices and ending with speeches and statements by heads of central banks with clear times of their speeches.

All news in the calendar can be sorted by impact level and by specific countries, allowing you to quickly formulate an action plan in the event of positive or negative data releases for specific statistics.

Almost all beginners avoid using fundamental analysis due to its complexity, not even realizing that before each of them, there is an explanation in the calendar that indicates the importance of the news and how the price may behave if the forecast comes true.

Thus, the Forex economic calendar acts as a cheat sheet, allowing you to always react appropriately to any given situation without having to be an economics expert. To view the significance of a news item, simply click on its title, and special symbols with three dots indicate its strength.

Practical application of the economic calendar

Traders are generally divided into three categories: those who trade on the news, those who consider news only to stop trading at uncertain times, and those who don't care about the news.

If you fall into the latter category, you're likely not interested in this article. In practice, the algorithm is simple and divided into several stages:

Stage 1. Selecting daily news that can impact the market.

At this stage, you select news specifically for the countries of the currency pairs you'll be trading. For example, if you're trading EUR/USD, you'll be interested in economic data from the US and the European Union.

After selecting the countries, you need to filter out insignificant, weak news and select information with two or three key factors.

Stage 2. Understanding the news.

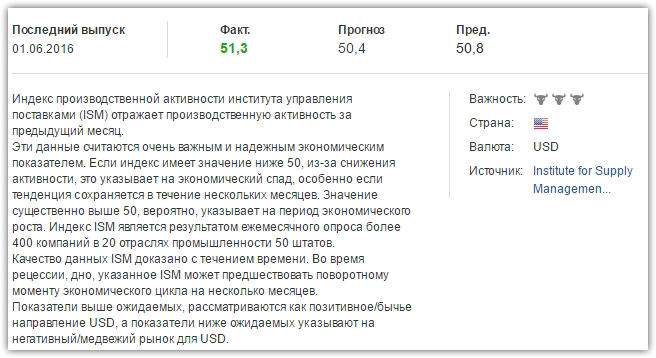

To learn what a particular piece of news means, click on its title, which will provide clear information and options for how a trader should react to the data.

Stage 3. Developing a clear algorithm.

Once you've learned the news and know its exact release time, it's time to pay attention to the forecast and the actual value. When the actual value is released, you should clearly know how you'll act—buy or sell—and not rush around searching for information.

Remember! A timely reaction to news is the key requirement for trading based on fundamental analysis.

In conclusion, I'd like to point out that an economic calendar for stock trading is an indispensable tool, underused only out of stupidity or prejudices inspired by common myths about fundamental analysis .