Trend Forex

Trading recommendations often recommend trading only with the trend. What is a Forex trend, and how can it be used when choosing a trade direction?.

Trend Forex is the predominant direction of exchange rate movement over a specific timeframe. It shows the current direction of the currency pair's price.

It is characterized by such indicators as strength, duration, speed and dynamics.

Key characteristics of a Forex trend

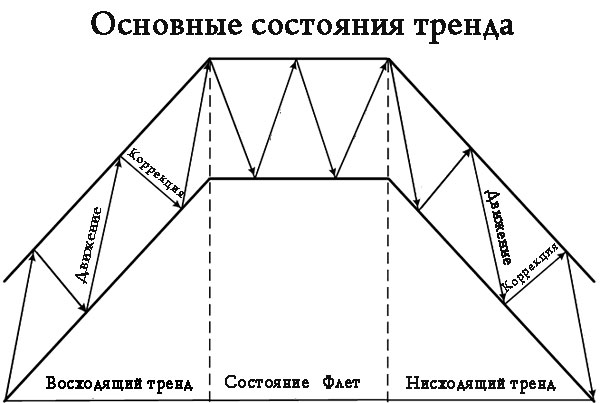

1. Direction is the most accessible indicator, and it's crucial when choosing the direction of future positions. It's usually determined based on price highs and lows . If each successive high is higher than the previous one, then an uptrend . However, if each low is lower than the previous one, then a downtrend .

Sometimes, it's impossible to clearly determine the direction of the price movement; the price moves horizontally, virtually unchanged, and the market is flat .

The timeframe plays a decisive role , as different trend directions can be observed on adjacent timeframes. For example, on the H1 timeframe, a price drop may simply be another pullback lasting only one hour, while on the M1 timeframe, it is a sustained trend.

2. Strength is a relatively relative indicator, as it is virtually impossible to measure the strength of an existing trend. Trend strength depends on the factors that influenced its emergence. Therefore, it is more appropriate to use fundamental analysis of the latest news that caused the price reversal when determining it. The more significant the event that affected the currency, the longer the existing trend will last.

3. Duration is determined by analyzing all available timeframes. If on the H1 timeframe, you see that the price reversal occurred 24 hours ago, this will be the trend duration for the H1 timeframe. A similar approach is used for other timeframes.

4. Speed – the price can move just a few points in an hour, or it can go as high as 100. In practice, I usually use the average price movement speed, which can serve as a guide for placing pending orders and predicting trade profitability.

5. Dynamics – or the range of price movement. A trend never moves in a straight line; more than half of its fluctuations occur during a correction. The average value of this correction, along with the indicator of movement in the direction of the main trend, characterizes the current trend.

For example, over a given time period, the average correction is 15 points, while the main movement lasts no more than 12 points, a value of 27 points characterizes the dynamics.

This value can have other interpretations as well.

The Forex trend is one of the most important factors a trader considers when opening trades. Most positions are opened following the trend, during periods of its greatest strength, and its dynamism serves as a guideline for setting stop-loss orders .