UK Jobless Claims Change: Impact on GBP/USD

An increase in expenses financed from the budget almost always has a negative impact on the national currency.

the national currency.

This is why this aspect is always taken into account when conducting fundamental market analysis on Forex.

The amount of financial flows that must be paid for unemployment benefits is one of the most expensive for each state, and the more developed the country, the more money is spent on supporting citizens.

This is primarily due to the social standards that are accepted within the country.

However, the chain by no means ends with simple financing, since as the unemployment rate increases, tax revenues paid by employers decrease, leading to impoverishment of the population, which in turn leads to a deterioration in a number of economic indicators.

The UK Jobless Claims Change is an indicator released on a monthly basis and its main purpose is to reflect the number of unemployed people in the UK.

For the UK, due to its high social standards, an increase in unemployment significantly impacts the country's budget, as unemployment benefits can be paid for a long time and also represent a significant amount of money. Every year, the UK government struggles to contain the influx of immigrants, whose primary goal is to claim unemployment benefits, which are available upon citizenship.

Interpreting news when trading forex is very simple. If the number of people filing for unemployment benefits increases, this indicates a deterioration in the labor market, which in turn leads to a weakening of the pound.

A reduction in the number of people filing for unemployment benefits is a good sign of an improving economic environment, which leads to a strengthening of the pound.

However, despite the logical nature of this indicator's influence, it's quite difficult to apply this knowledge in practice. This is because you never know how the market will react to a news release, how far the price might move, and, most importantly, what stop order to use to avoid being thrown out of the market during high volatility.

To answer these questions and draw a general conclusion about the potential profitability of trading on this news, let's look at how the market reacted to the last four data releases on the GBP/USD currency pair.

On May 13, 2015, after the -12.6K figure was released, we can see that the number of people filing for unemployment benefits increased significantly, as the previous month's figure was -16.7K. Therefore, based on this data, we conclude that the pound is weakening against the euro, and we should see a sharp decline in the GBP/USD . The market's reaction to the news can be seen below:

Five minutes before the news release, you might have seen a gap , which could have led you down a confusing trail. But the market didn't keep you waiting, and the price successfully moved 105 points in 3 hours and 55 minutes. The news ended with the formation of a new trend in the opposite direction.

Five minutes before the news release, you might have seen a gap , which could have led you down a confusing trail. But the market didn't keep you waiting, and the price successfully moved 105 points in 3 hours and 55 minutes. The news ended with the formation of a new trend in the opposite direction.

On June 17, 2015, the number of jobless claims fell significantly compared to the previous month, leading many to expect a strong rally in the GBP/USD pair, as an improving labor market should significantly impact GBP appreciation. Market participants' reaction to the data release can be seen in the image below:

The market, as expected, responded quite adequately to the positive data release and successfully closed the 91-point gap. The news's impact lasted for at least two hours and 30 minutes.

But when examining this example, it turned out that literally 15 minutes before the news was published, negative news about the US economy came out, so the release of data on the number of applications for unemployment benefits simply intensified the market reaction to the previous news.

On July 15, 2015, almost all analysts predicted a decline in unemployment and a reduction in benefit payments. However, instead of the expected decline to -8.8K, they saw an increase to 7.0K. Therefore, the market should have reacted strongly to such a significant difference in expectations, and the GBP/USD currency pair should have plummeted. Market participants' reaction can be seen in the image below:

Following the publication, a sharp price gap and a rapid 77-point drop in the chart over four hours can be observed. The end of the news signaled a new emerging trend.

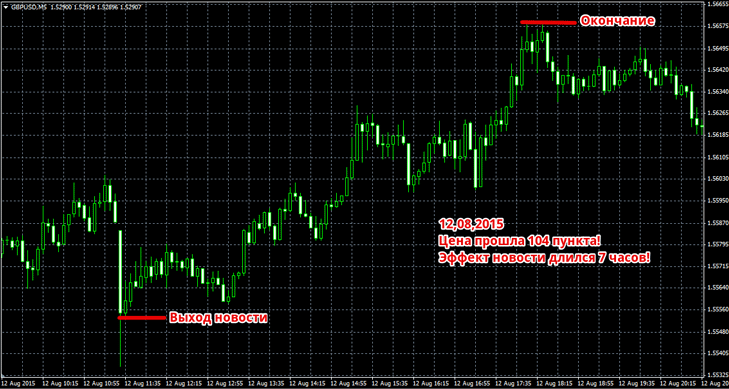

On August 12, 2015, a critical majority of economists predicted an increase in unemployment and welfare claims to 1.5K. However, after the publication, it became clear that the unemployment population and welfare claims had declined, reaching -4.9K. Logically, the GBP/USD pair should rise sharply.

The example shows that the price, after a false gap five minutes before the news release, performed well and moved 104 points within seven hours.

Analyzing all four examples, we can conclude that the market almost always reacts strongly to the release of the indicator. Following the release of the data, the market typically forms a new micro trend that lasts for at least two and a half hours.

In simple terms, if we set the minimum profit and stop loss that we recorded during our research, then with a target of 77 points and the same stop, we would earn: 77 + 77 + 77 + 77 = 308 points of profit for four positions.