US ADP Nonfarm Payrolls. Impact on the EUR/USD currency pair

For virtually any trader who practices fundamental analysis and news trading, the release of new data on US non-farm payrolls is a tempting morsel that would be a shame not to snatch.

news trading, the release of new data on US non-farm payrolls is a tempting morsel that would be a shame not to snatch.

The release of this indicator is extremely important, as the market almost always reacts strongly to it. The fact is that the number of employed people in a country is a direct indicator of the strength of the US economy.

It's important to remember that there's a direct correlation between the growth of the employed population and the growth of a country's GDP. The more people work, the more the state can fill its coffers from taxes and reduce spending on unemployment benefits.

The ADP Nonfarm Payrolls Index is a leading indicator derived from an anonymous survey of a large number of US businesses, with approximately 400,000 respondents. Why do I claim this news has a leading effect?

That's because this indicator is published two days before the official data on non-farm payrolls is released. This allows us to be prepared for the official data and assess the overall situation before such important data arrives.

An increase in the employed population always bodes well for the US economy, meaning that positive data releases typically lead to a rise in the dollar's value. A decrease in the employed population, however, signals a deterioration in the labor market, leading to a weakening dollar.

While we all understand that the release of such important data has a strong impact on the movement of dollar currency pair charts, we need more specific information to trade successfully.

This information may include data on the number of points the price takes after the news is released, its behavior, the smoothness of the end of the news and, oddly enough, the approximate time of the news's impact on the market.

The number of currency pairs involving the dollar is enormous, so to analyze this news, we'll look at the price action of the most frequently traded currency pair, the EUR/USD. The ADP Nonfarm Payrolls data is released monthly, so for a more detailed analysis, we'll look at the market reaction to these news releases over the past four months.

On July 1, 2015, positive data was published, and while the previous figure was 203K, and experts were inclined to believe that the growth of the employed population would not exceed 218K, in fact, we saw a significant increase to 237K.

This scenario suggests that the dollar will strengthen, while the euro will weaken in the face of it, so we should see a decline EUR/USD currency pair

If you analyze the chart, you'll notice that the price reacted almost immediately to the news release, moving 63 points. It's worth noting that after the chart surpassed 40 points, there was a strong pullback to the starting point.

However, after the news ended, the price confidently continued its downward trend. The news's impact lasted for seven hours, and it ended with a smooth transition into a narrow flat .

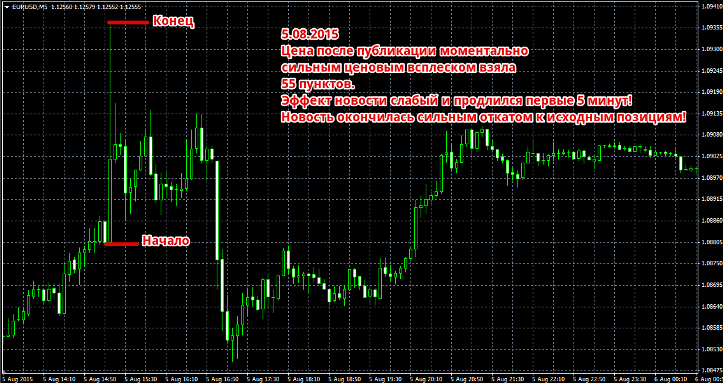

On August 5, 2015, the non-farm payrolls figure was 185K, which was negative data as most traders were betting that the figure would not fall below 215K.

Against the backdrop of a sharp weakening dollar, the euro should strengthen its position, so we should see a rise in the EUR/USD currency pair. The market reaction can be seen in the example below:

Unlike the previous example, we can observe a strong price spike in a single candlestick. The market reacted extremely strongly to the news, and within five minutes, the currency pair's chart rose by 55 pips.

The end of the news was as strong as its beginning, so we can see further strong price movement that covered the initial entry point.

On September 2, 2015, most traders reacted negatively to the employment data, as the actual figure was 190K, compared to the projected 201K. However, when compared to the previous month's 177K, the significant increase is immediately apparent.

Therefore, we can expect the dollar to strengthen, and we could see a decline in the EUR/USD currency pair. The market's reaction can be seen in the image below:

The market reacted more than adequately to the news release and successfully covered a distance of 46 points. The impact of the news release lasted approximately 10 hours.

The market reacted more than adequately to the news release and successfully covered a distance of 46 points. The impact of the news release lasted approximately 10 hours.

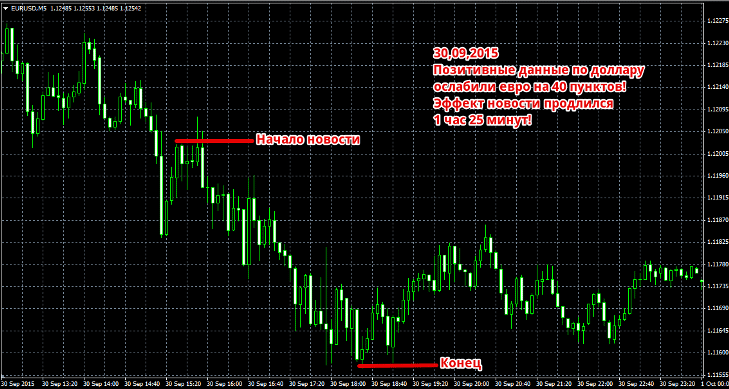

On September 30, 2015, the number of employed people rapidly increased to 200,000, compared to the previous figure of 186,000.

This suggests an improving labor market situation, which should lead to a stronger dollar. The EUR/USD chart should show a sharp decline. The market reaction to the data release is shown in the image below:

The market responded well to the data release and successfully moved 40 pips in the expected direction. The news's impact lasted for 1 hour and 25 minutes, and if you look at the end, you can see the price gradually shifting sideways.

Now let's summarize the profitability of trading on this news. If we analyze all the distances the price traveled after the news release and select the minimum value, which was 40 pips, and set a take profit and stop order equal to it, we get the following figures: 40 + 40 + 40 + 40 = 160 pips profit for four trades.