Fundamental analysis for Forex and the stock market: similarities and differences

In stock trading, two types of price analysis are used: technical, which analyzes the history of trends, and fundamental, which is based on the analysis of financial indicators and news.

While technical analysis is essentially a fairly universal method of market research, fundamental analysis is not so simple.

When using fundamental analysis, you should consider which market you are trading in and, depending on this, use methods appropriate to that market.

Today we'll compare fundamental analysis for the forex and stock markets, or more precisely, how the same research method is applied to different assets.

Forex currency trading

Due to the prevalence of speculative players, fundamental analysis in Forex has recently been reduced to news trading. The main tools used are:

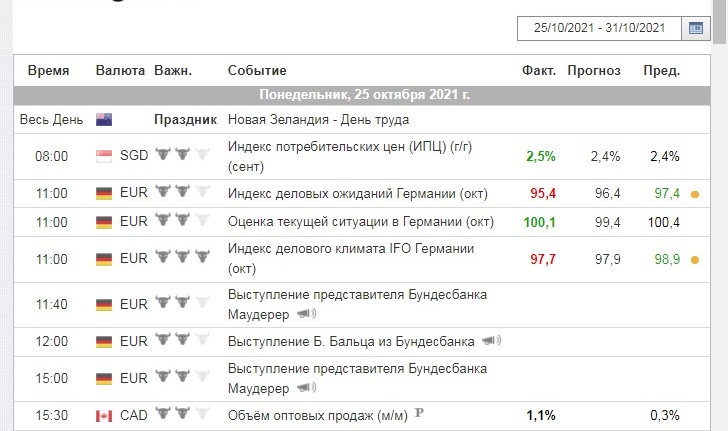

The Economic Calendar publishes information about the release times of news releases. These primarily cover economic indicators such as inflation, trade balance, business activity index, and interest rate levels .

News feeds display news that directly or indirectly relate to a specific currency. While the economic calendar publishes the news release time and forecast, the news itself displays information about an event that has already occurred.

Fundamental analysis in Forex is mainly used for short-term news trading, where trades are opened immediately after a specific news item is released.

In rare cases, medium-term trades may also be opened if forecasts in the economic calendar have already begun to influence the price, but the event has not yet occurred.

Trading shares on the stock exchange

Here, everything is a little more complicated; the sources of information for the stock market are:

Financial statements are reports on the activities of companies, showing profits and losses for the reporting period, sales volumes, information on profit distribution, and other important financial indicators:

News feeds – financial reports are published on companies' websites, which, to some extent, can also be considered news channels. In addition, stock prices are influenced by other events reflected in the news.

There are two ways to apply fundamental analysis when trading stocks on the stock exchange.

In the first case, the same news trading strategy the essence of which is that short-term transactions are opened after the news is released.

The second option involves long-term investment, which involves carefully studying the company's financial statements and the state of the industry it belongs to. Only then is a long-term deal initiated, typically a purchase.