What is the NFP employment indicator and how does it affect the US dollar exchange rate?

One of the most important indicators of fundamental analysis is the unemployment rate, but in addition to this indicator, there are also indirect indicators that characterize the level of employment.

Non-Farm Payrolls (NFP) is a key indicator of the economic health of the United States.

This measure reflects the total number of jobs created in the economy excluding the agricultural sector and is a significant component of the monthly employment report published by the U.S. Bureau of Labor Statistics.

Job growth indicates a strengthening economy and a potential increase in consumer spending, which in turn could lead to higher inflation and, consequently, a tightening of monetary policy by the Federal Reserve.

How the NFP report affects the US dollar

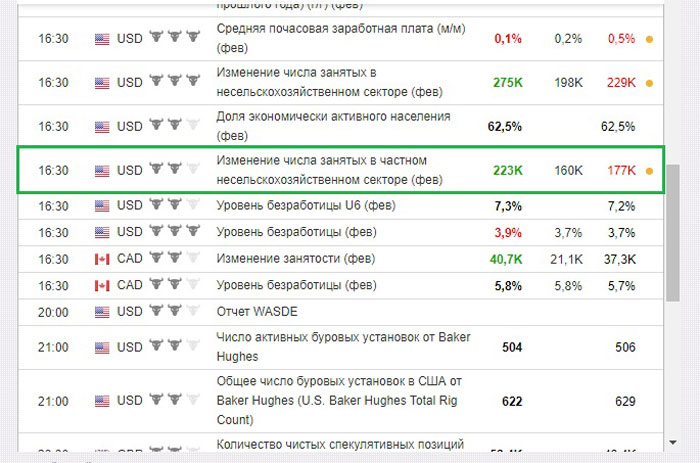

The release date of the report can be found in the economic calendar , and the US dollar exchange rate can react to the upcoming news even before its release based on forecasts:

Our economic calendar indicates three values:

- Current – NFP at the moment

- Forecast: plus or minus thousands of people

- Past – NFP value last month

Employment data has a significant impact on the US dollar exchange rate and financial markets overall. Positive NFP data can lead to a strengthening of the dollar, as this signals a possible increase in interest rates to curb inflation.

Investors and traders closely monitor this indicator, as it can cause increased volatility in the market .

On the other hand, if the data comes in worse than expected, the dollar could weaken on concerns about slowing economic growth and the Federal Reserve delaying rate hikes.

Furthermore, NFP affects not only the currency market but also the stock and bond markets, as changes in economic activity and employment can affect corporate profits and investment decisions.

Strong employment data tends to have a positive impact on the stock market, increasing investor confidence in the country's stability and economic growth.

At the same time, rising employment can lead to higher bond yields as investors anticipate higher rates, making new bond issues more attractive than existing ones.

When using NFP as a signal to open a trade, pay attention to how much the number of new jobs has changed; the greater the change, the stronger the influence of Nonfarm Payrolls on the market trend.

In conclusion, the NFP indicator is a powerful tool of fundamental analysis that shows the current state of the economy and warns of future changes in monetary policy.

This makes it an integral part of fundamental analysis for financial market participants seeking to make informed investment decisions and predict currency movements, particularly the US dollar.