US trade balance and EUR/USD

Unlike trading based on technical analysis, almost all position entries with a news robot have an economic justification.

have an economic justification.

However, not all news has the same impact on the market, and many often mistakenly link the degree of importance of the news and the possible reaction of the trend to its release.

By reviewing the fundamental analysis section of our website, you can see that sometimes an obvious news item like GDP may not have as strong an impact as many write and claim.

Thus, understanding the market's real reaction to key macroeconomic indicators can be an eye-opener for many beginners who have embarked on the path of studying fundamental analysis.

The trade balance is a macroeconomic indicator that allows traders and investors to assess a country's economic performance on the international stage. More specifically, the trade balance is the difference between a country's exports and imports of goods and services over a given period of time.

Thus, by comparing imports and exports of goods, traders and investors can form a general opinion about a country's economy. A negative balance indicates that the amount of goods imported exceeds exports, which often indicates an uncompetitive economy and its industry.

A positive balance, on the other hand, indicates a country with a strong economy and competitive industry, enabling it to fully cover domestic needs and export to other countries. You can find a rough description of this on almost any forex resource, but there are a number of subtleties that no one talks about.

For example, the US trade balance is always negative, and based on the logic of stock trading textbooks, one might assume that the US is a backward country. However, few people point out that the US is actively outsourcing labor-intensive production to other countries where wages are very low, allowing the US to earn large sums of money at lower costs.

News releases almost always have an impact on dollar currency pairs traded on Forex, but before taking this indicator into account when trading, let's consider the actual trend reaction to data releases over the past four months and draw some conclusions about the potential profitability of trading on this indicator on the EUR/USD currency pair.

On July 7, 2015, almost everyone expected a reduction in exports and an increase in imports of goods, and if in the previous month the trade balance was -40.70B, then in fact the data obtained was -41.87B.

A decline in exports indicates a weakening sector of the economy, so it's safe to assume the EUR/USD pair will rise due to the USD's weakness. The crowd's behavior can be seen in the image below:

The crowd's reaction to the data release was entirely predictable, as we can see a strong 120-point rise in the chart. The news had a significant impact on traders, as the chart rapidly climbed over the course of seven hours. The news ended as abruptly as its beginning.

The crowd's reaction to the data release was entirely predictable, as we can see a strong 120-point rise in the chart. The news had a significant impact on traders, as the chart rapidly climbed over the course of seven hours. The news ended as abruptly as its beginning.

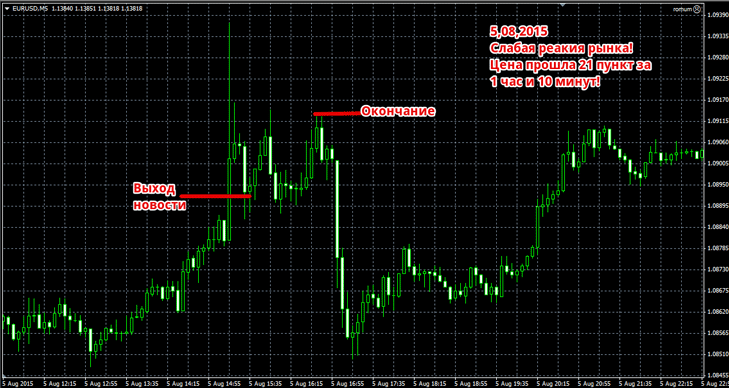

On August 5, 2015, extremely negative data was released, indicating a decline in the trade balance, or, more simply, in goods exports.

If the previous month's value was -40.94B, then we now have -43.84B. Such a significant deterioration should immediately result in a strong upward movement in the EUR/USD currency pair. The crowd's reaction can be seen in the image below:

The image shows that the market barely reacted to such strong news and moved only 21 points in one hour, after which there was a strong reversal towards positive news for the dollar or negative news for the euro.

On September 3, 2015, all market participants witnessed a significant increase in the US trade balance, which reached -41.86B compared to the previous month's -45.21B. Such a strong positive change indicates a strong increase in US goods exports and a strengthening USD, which should lead to a sharp decline in the EUR/USD currency pair. The implications of this data release are shown below:

Traders reacted aggressively to the release of positive dollar data, leading the chart to show a 140-point drop in 2 hours and 30 minutes. The news ended with a sideways trend.

Traders reacted aggressively to the release of positive dollar data, leading the chart to show a 140-point drop in 2 hours and 30 minutes. The news ended with a sideways trend.

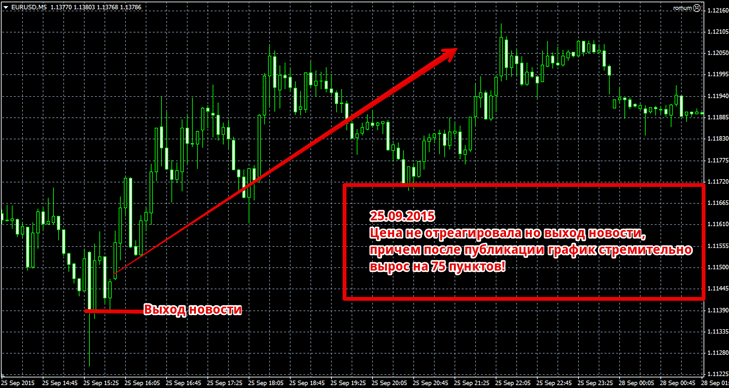

On October 6, 2015, disappointing data was released at -48.33B, indicating a strong increase in imports and a sharp decline in exports.

The market should react strongly to such a difference between last month and the current one, pushing the EUR/USD chart higher. The chart's movement at the time of the indicator's release is shown in the image below:

The chart shows that the market initially simply ignored the news and moved against it, but 15 minutes later, it surged upward with renewed vigor, 57 points. The news's impact lasted for seven hours, after which the market began to slide into a narrow flat.

Having analyzed all four scenarios, a bold conclusion emerges: the news is indeed effective and is influencing the EUR/USD pair. However, it's worth noting that in each scenario, the price moved significantly different distances, from 20 to 140 pips, making it difficult to say exactly how far the price moves after the announcement. However, a pattern is certain.

A significant factor in using this indicator in Forex trading is that the news plays out over a fairly long period of time, rather than being released in a single candle, as is often the case with weak economic indicators.