What is a lot on Forex? A calculator for calculating the size

For the convenience of users, all transactions on the Forex currency market are concluded in standardized volumes, so-called lots.

Lot forex is a standard volume with a strictly defined size for a single transaction on the foreign exchange market. It is used to simplify calculations and round off the amounts of currency purchase or sale transactions.

One lot on Forex is 100,000 units of the base currency, which is listed first in the currency pair, i.e., the instrument for which the quotation is carried out.

For example, when buying euros for US dollars, the EURUSD quote is used, the base currency in this currency pair is the European currency, therefore 1 lot for this transaction will be equal to 100,000 Euros.

For example, when buying 1 lot of GBPUSD – British pound sterling for US dollars, you pay 150,000 US dollars, while if a transaction of a similar volume is carried out on the NZDUSD currency pair, then 83,000 US dollars will be enough to complete it.

For example, when buying 1 lot of GBPUSD – British pound sterling for US dollars, you pay 150,000 US dollars, while if a transaction of a similar volume is carried out on the NZDUSD currency pair, then 83,000 US dollars will be enough to complete it.

That is, the cost directly depends on which currency in the currency pair is the base currency; the higher the exchange rate of the base currency, the more expensive the lot will be.

Article on the calculation method - https://time-forex.com/info/stoimost-lota

In other words, the specific trade size directly depends on the currency used as the base currency for the trading instrument.

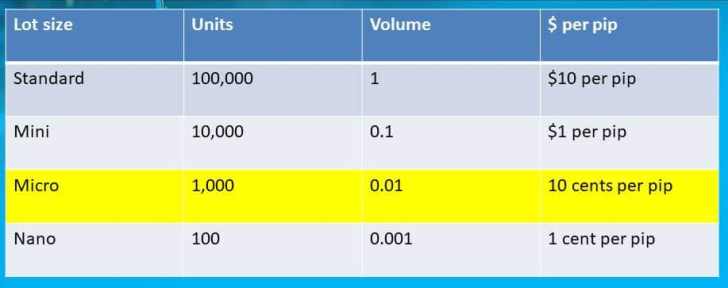

Trading isn't always done using whole values; sometimes brokers offer their clients the option of trading using fractional values of 0.1 or 0.01 of a whole forex lot. This approach allows for trading with smaller amounts without abusing leverage.

However, if even this option still doesn't suit a trader, they are forced to switch to micro-lot trading, which uses cent accounts.

What are the benefits of using micro lots in Forex?

When trading on a cent account, the trader's deposit is converted into cents, meaning the amount of available funds is multiplied by 100. For example, if the deposit was $5, the cent account would have 500 units.

The forex lot size then undergoes the reverse change: the trade amount is divided by the same 100 and reduced by a factor of 100.

The forex lot size then undergoes the reverse change: the trade amount is divided by the same 100 and reduced by a factor of 100.

This means that one micro forex lot will now be equal to just $1,000, but nothing will change in the "Volume" tab of the trader's terminal.

Calculating the optimal size

Traders often ask how to calculate the correct lot size in Forex. In reality, they mean the optimal trade size based on the deposit size.

The simplest option is to use a calculator - https://time-forex.com/skripty/raschet-lotov-forks which will calculate the optimal volume taking into account the acceptable risk.