How to set a take profit

Placing stop orders is one of the key aspects of Forex trading. Besides allowing you to significantly reduce losses, they also allow you to plan your profit in advance.

to significantly reduce losses, they also allow you to plan your profit in advance.

To do this, you should immediately set the take profit size when opening a new order, which will allow you to close the position when a certain profit level is reached.

How to set a take profit is a question that comes up quite often, so let's look at it in more detail. In addition to purely technical aspects, the correct calculation of the value of this order also plays a role.

After all, any trader hopes to get the maximum profit from a single transaction, but at the same time, the price can reverse without reaching the desired value, and then the transaction will most likely close with a loss.

In this case, you simply use a floating stop loss, gradually moving it to the breakeven area.

Technical issues.

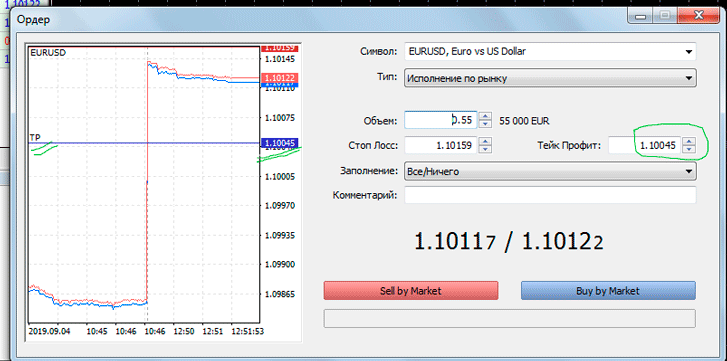

Take profit should be set simultaneously with opening an order. To do this, simply set the desired value in the new order window on the take profit tab.

When opening a buy trade, it is greater than the current price value, you add the planned number of profit points to the current price; if you open a sell trade, it is less.

Take profit order size

Here, everything is strictly individual: the longer the transaction, the larger the size of this indicator, although it should be taken into account that some dealing centers may regulate the minimum take-profit value.

Everything depends on the trading timeframe and the trend dynamics. For example, if the price moves about 20 pips in an hour, that's the order size. However, this doesn't mean you can't close the position early; you can take a 15 pip profit if you want.

When determining the size, I personally focus on the market situation, obtaining data from analyzing the historical trend.

For example, if the price rose to 1.2580 during the current session and is now at 1.2530 and rising, then there is no point in setting the value above 1.2570, but each trader has their own assessment of the situation and desire to make money.

Another positive aspect of take profit is that it relieves psychological pressure on the trader. By setting the price level at which the order will be closed, the trader no longer has to constantly ask themselves whether to close the position or not

Alternatively, you can use special scripts or indicators to calculate the required size:

- Take profit for pending orders - http://time-forex.com/skripty/teyk-prfit-otlog-ordera

- EasyTakeProfit script - http://time-forex.com/skripty/easy-takeprofit