What are Stop Limit orders for?

If you trade in the MetaTrader 4 terminal, you've probably never heard of pending orders like Stop Limit.

We're more accustomed to using buy or sell stop orders, and buy or sell limit orders—they seem incredibly simple.

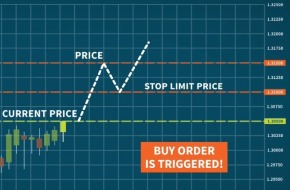

Stop orders are placed above the price during an uptrend or below the price during a downtrend, and are opened after the price has moved the required distance.

Limit orders assume a market correction and are placed against the trend, hoping the price will pull back and then move in the desired direction. Example of placing a Buy Limit.

This is all pretty clear, but why did MetaTrader 5 introduce buy and sell stop limit orders, which combine the names of familiar pending orders?

In fact, there is nothing complicated if you break this transaction down into two orders. The first is Buy Stop, after the price reaches its level, not the order itself is placed, but permission is given to place a Buy Limit order:

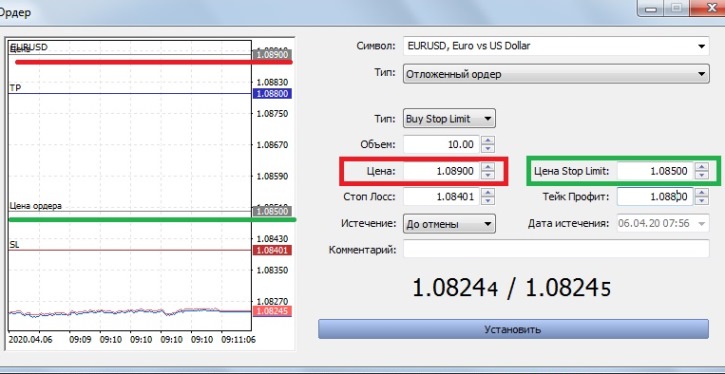

For example: the current price is $1.08245 per euro. We know that the support level is at 1.08900, where the price most often reverses and starts moving in the opposite direction. We set the "Price" value here.

We want our order to trigger after a correction, which is assumed to end at 1.08500 and then the price will move up again. We enter the "Stop Limit Price" value here. This will be the price at which the position will be opened:

It might seem pointless, but this type of order is primarily used when trading within a channel, with the Buy Stop Limit value set at the lower boundary of the channel.

It might seem pointless, but this type of order is primarily used when trading within a channel, with the Buy Stop Limit value set at the lower boundary of the channel.

The stop loss is set below the Buy Stop Limit value, and the take profit is correspondingly set above the position entry point.

As for setting the Sell Stop Limit, it is set in a downtrend using similar principles; the main rule is that the "Price" field value is below the Stop Limit Price value.