Choosing the direction of a trade during a gap in Forex.

gaps in stock trading. Most perceive them as punishment for not closing trades in a timely manner , and only a small percentage of traders regularly profit from gaps.

, and only a small percentage of traders regularly profit from gaps.

A gap is a price break that occurs when, for whatever reason, the market fails to reflect price movement in a quote.

The size of a price gap can range from a few points to several hundred points, depending on the strength of the factors that caused the gap.

Which direction should trades be opened when a price gap occurs?

It all depends on the situation in which the price gap occurred and its direction relative to the existing trend.

• A trend gap is a rather complex situation in which the price gap occurs in the direction of the existing trend.

It would seem appropriate to open a trade in the direction of the price gap, but this type of gap is often followed by a prolonged correction , sometimes until the price gap is completely closed.

It would seem appropriate to open a trade in the direction of the price gap, but this type of gap is often followed by a prolonged correction , sometimes until the price gap is completely closed.

This correction can trigger a stop-loss order and, consequently, result in losses. Therefore, with a trend gap, short-term trades are most often opened in the direction opposite to the price gap.

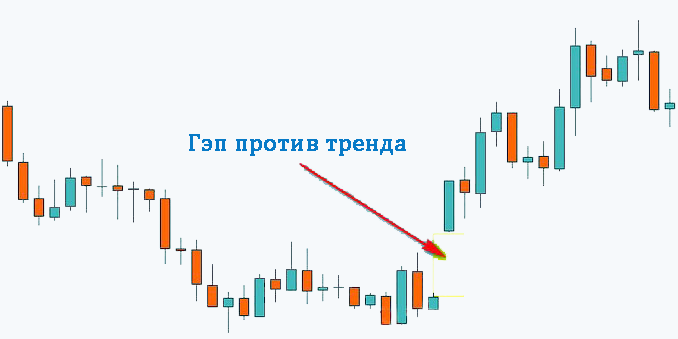

• A gap against the trend is a more attractive option, since this situation most likely indicates a reversal has occurred, meaning the new price movement will persist for some time.

Moreover, trades are opened not immediately after a gap occurs, but after the first correction in the direction of the newly formed trend has completed.

Moreover, trades are opened not immediately after a gap occurs, but after the first correction in the direction of the newly formed trend has completed.

Gap trading is one of the most common Forex strategies , but despite its apparent simplicity, there are many peculiarities to consider when opening trades. For example, it's a good idea to inquire about the event that caused the price gap.