How to Use Pending Orders to Make a Profit

Exchange trading allows you to open not only urgent trades but also pending ones, which will open after a certain period of time and only if certain conditions are met.

after a certain period of time and only if certain conditions are met.

This means you can order to buy a currency if its rate drops below a specified level, thereby executing the transaction on the most favorable terms possible without even having to be present at the trading terminal.

Such orders are executed using pending orders, which, thanks to their functionality, significantly expand your trading capabilities.

For example, you want to buy US dollars if the price of this currency starts to rise, and you place a pending buy-stop order to buy US dollars for Russian rubles as soon as the price reaches 60 rubles per US dollar.

Types of pending orders in the trading platform

Currently, several types of such orders are available in the trader's trading terminal:

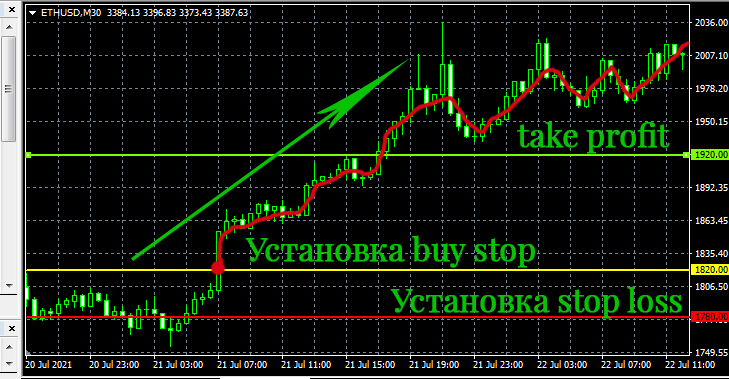

Buy Stop - allows you to open a buy transaction if the price continues to rise and reaches a higher level than it currently does, i.e., during an uptrend:

Placing this order implies continuation of the upward trend and closing the trade at a higher price.

When placing a buy-stop, the stop-loss is set below the planned order opening price. It will be triggered if the price first rises to the opening price and then begins to fall, causing losses. The take-profit is set higher; it will bring profit after the price rises.

Sell Stop - allows you to open a sell trade at a specified price if the exchange rate declines and ends up below the current level. In this case, you again plan to follow the trend:

Setting a pending Sell stop order assumes that the price will reach a certain level and then continue to decline.

As with other sell orders, the stop loss is placed above the opening price, and the take profit is correspondingly lower, since closing the trade with a profit implies closing it at a lower price.

Placing pending orders against the trend

A buy limit is a pending order to buy at a lower price, placed during a downtrend. Its purpose is that the trader expects the price to not decline continuously, but to reach a certain level and reverse. At this point, the purchase will occur, and the trade will begin to generate profit:

The logic behind this operation is quite easy to understand with a simple example: you want to buy US dollars for Russian rubles, the price is currently 64 rubles per dollar and is falling, you decide to buy dollars as soon as the price drops to 60 rubles per dollar.

In the case of buy limit, a similar situation is observed, only the process is automated due to the capabilities of the trading platform.

Since you're buying, stops will be set accordingly: the take profit is higher than the purchase price, and the stop loss is lower.

A sell limit is an order to open a sell trade at a higher price than the current one, with the expectation that the trend will reverse and the price will fall, allowing you to close the position profitably.

This tactic is used in anticipation of a scenario where the price will first rise and then begin to fall. In this case, the plan is that you will open a sell trade at a more favorable price.

Stop loss and take profit for these pending orders are set as for regular sell trades - stop loss is above the opening point, take profit is below.

The MT5 trading platform also offers the ability to set Buy Stop Limit and Sell Stop Limit. For more information on using these options, please follow the link.

Pending orders are placed quite simply. To do this, click the "New Order" tab in the trader's terminal. In the window that appears, change the "Type" to pending order. This will cause the window itself to change slightly.

Select the order type—Buy Stop, Sell Stop, Buy Limit, or Sell Limit—depending on your objectives.

You can also set the order's lifetime, for example, 24 hours. This means that if the price doesn't reach the desired level within 24 hours, the order is canceled.

Trading with pending orders effectively automates the trading process. You can place multiple orders simultaneously, each with different entry parameters, significantly increasing the likelihood of a successful trade.

,

see the articles: Pending Order Tactics and Placing Pending Orders .