Installing an indicator or advisor in a Forex terminal

This is the simplest step, as scripts don't need to be installed like standard programs. They're already part of the trader's terminal, and installing them simply requires copying them to the appropriate folder. It's worth noting that the advisor and indicator are installed in exactly the same way, just in different folders.

part of the trader's terminal, and installing them simply requires copying them to the appropriate folder. It's worth noting that the advisor and indicator are installed in exactly the same way, just in different folders.

The installation of an indicator or advisor is complete only when you have copied all additional program elements to the appropriate locations.

Therefore, after downloading, carefully check what is in the received archive along with the main file of the advisor or indicator.

For easier understanding, let's break the entire process down into several stages:

1. Download the program itself or its archive to your desktop using the link in the article. In some cases, the download may automatically go to your browser's "Downloads" folder. You'll then need to move the downloaded archive to your desktop.

One-click trading.

One-click trading – this feature allows you to open and close trades with just one click, saving precious seconds on opening unnecessary windows and clicking confirmations.

saving precious seconds on opening unnecessary windows and clicking confirmations.

One-click trading was recently added to the trader's terminal and has become a standard feature of MetaTrader 4.

If your trading terminal doesn't have it, simply update the platform to a newer version or download the new terminal from your broker's website.

Optimal leverage for a beginner in forex or stock trading

One of the key features of Forex trading is the use of leverage, which allows for relatively high profits even with the slightest exchange rate fluctuations.

allows for relatively high profits even with the slightest exchange rate fluctuations.

Currently, most brokers offer leverage ranging from 1:1 to 1:500, while some companies offer leverage as high as 1:3000.

This can sometimes attract a large number of beginners who are unaware of the dangers of trading with high leverage. The high risks are further confirmed by the fact that in the US, providing leverage greater than 1:50 is prohibited.

Calculating profits from Forex trading

Many beginning traders are interested in the question "How to correctly calculate the profit received," because, as we know, money loves an account.

The obtained data can be used to analyze trading performance statistics.

When making calculations, you need to take into account many different nuances that play an important role, and to get a net result, it is advisable to subtract all overhead costs that are present in your work from the amount received.

To carry out calculations, you should use data such as the total amount of funds deposited, profit from successful transactions and losses incurred from trading, as well as interest accrued on available funds in the trader's account.

For greater objectivity, one should also not forget about the additional costs that will be mandatory - payment for the Internet, a virtual server, the purchase of advisors or auxiliary scripts.

How to work in MetaTrader 4.

One of the main tasks for a trader is choosing a trading terminal. The most popular option is MetaTrader 4. This trading platform allows you to not only trade, but also make your trading professional.

This trading platform allows you to not only trade, but also make your trading professional.

Newcomers to Forex often ask: "How to use MetaTrader 4?" The easiest way is to download the MetaTrader 4 manual .

It covers everything you need step-by-step, from the terminal's design to working with advisors and indicators. But if you're bored by the long read, I'll try to summarize the most important aspects in a few words.

You can download the trading terminal itself at the end of this article, which will allow you to test its capabilities without registering with a broker.

A new Demo account is opened in the Accounts tab; this is described in more detail in the program instructions.

Strength of the trend.

When trading Forex, you often hear the phrase "The trend has weakened, the likelihood of a reversal has increased." This makes it clear that to make money, you should only open trades during a strong trend.

make money, you should only open trades during a strong trend.

The strength of a Forex trend is the price movement of a currency pair, combined with its liquidity and the volume of all trades.

These indicators should be analyzed to determine the sustainability of an existing trend and the likelihood of its reversal.

If you trade on the interbank exchange, all the necessary indicators for trend analysis are publicly available; with Forex, it's becoming increasingly difficult, requiring some effort to obtain the information.

Working on a demo account.

One of the key components of trading training is working on a demo account. Without this step, it is not advisable to begin real trading, as it can lead to a rapid loss of existing capital.

it is not advisable to begin real trading, as it can lead to a rapid loss of existing capital.

Working on a demo account allows you to explore the capabilities of the trader's trading terminal, learn how to open trades and manage open positions, test new strategies, and check the performance of indicators and advisors.

A demo account is a free testing ground where you can test any of your assumptions and guesses, and do so under conditions as close as possible to real trading.

Stop orders.

The key to trading on any exchange is capital management and hedging risks for existing positions. In the latter case, it is common to use stop orders.

risks for existing positions. In the latter case, it is common to use stop orders.

A stop order is an order that forces a position to be closed, triggered when pre-specified parameters are reached.

These parameters can include the price of the asset being traded or the time (duration of the trade). There are several types of such orders, each with its own specific function.

Testing advisors.

Many beginning traders are drawn to automated Forex trading. It seems simple enough: download your favorite advisor and start trading. However, to be confident of success and protect your deposit, you need to test your chosen advisors.

Advisor testing can be carried out in three variants, each of which has its own strengths and weaknesses.

Forex capital management.

There are only a few key aspects in trading that govern the entire exchange trading process. One of these aspects is capital management.

these aspects is capital management.

Capital management in Forex is a smart approach to distributing funds and taking timely measures to preserve them. In financial matters, most money management recommendations apply to long-term trading, but with the right approach, they can also be applied to day trading .

Any capital management strategy is highly individualized, and its development should take into account both the amount of funds at the trader's disposal and the specific situation in the Forex market.

However, two universal options can be developed: the first is designed for traders with a modest deposit of up to $500, and the second is for more affluent investors.

The best trading terminal

Forex trading requires the use of specialized software, and the choice of software will determine the trader's comfort, so choosing the right trading terminal is crucial.

determine the trader's comfort, so choosing the right trading terminal is crucial.

In this case, you should be guided by the following principle: the trading platform must operate stably and be fully compatible with all possible Forex tools (automated advisors and technical analysis indicators ).

The trader's terminal is not just a program for issuing orders to open positions; it can also be used to perform a variety of other actions:

- conduct technical analysis,

- organize automated trading,

- receive news promptly,

- test different strategies,

- write additional scripts yourself.

In this article, we'll look at the different types of trading platforms, their advantages and disadvantages, and some practical considerations when making a choice.

Long and short positions on Forex

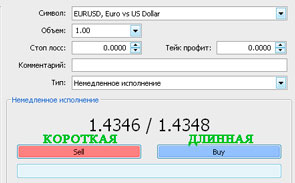

Currency trading can be conducted in two directions, opening buy or sell transactions, depending on the current market situation and the direction of the forex trend.

Depending on which direction a new position is opened, it has its own name.

A long position is a transaction to buy currency, carried out by pressing the buy button in the new order opening window.

In this case, the base currency of the currency pair is purchased for the quoted currency at the price indicated in the forex quote.

This type of operation is the easiest for a trader to understand; after its implementation, profit is made if the price of the currency pair rises.

Forex technical risks

In addition to the well-known risk of exchange rate fluctuations, there are also a number of other dangers in the Forex market, which, if they arise, can lead to the complete loss of your deposit.

which, if they arise, can lead to the complete loss of your deposit.

However, while exchange rate risk is taken into account first and foremost, other potential risks are not always considered by beginning traders.

Technical risks in Forex arise for a number of reasons beyond the trader's control, and to prevent them, a number of preliminary actions must be taken in advance.

By spending just a few minutes, you can save your deposit from being completely lost.

These could be due to equipment malfunctions on the trader's end, or problems arising in the work of the broker providing forex trading services.

Basic settings of Forex advisors

The concept of automated trading has long been common among traders. To implement it, you don't need to conduct a detailed market analysis; you simply need to install a suitable Forex advisor.

to conduct a detailed market analysis; you simply need to install a suitable Forex advisor.

However, in order for the program to work correctly, you should first install the advisor itself and study its settings.

The final step will determine the outcome of automated trading. An incorrectly configured robot can easily wipe out your deposit in just a couple of trades, so you should take it very seriously.

Advisor settings have a number of standard parameters, the installation of which is carried out according to general principles.

Before launching and configuring the program, you should first install it on your trader's terminal. To do this, simply copy the downloaded script to the folder where your trader's terminal was installed.

Page 2 of 2

- To the beginning

- Back

- 1

- 2

- Forward

- To the end