Spot Gold Trading vs. CFDs: What Are the Similarities and Differences Between These Trading Options?

Gold is traditionally considered a safe haven asset, but in recent years it has increasingly been used for active trading.

High volatility, rapid price movements, and reactions to global events have made gold one of the most popular instruments among traders.

This is especially noticeable during periods of inflation, geopolitical instability and changing interest rates.

Gold trading on financial markets is most often conducted in two formats: spot and CFDs, and it is between these that traders have the primary choice.

It is important to understand right away: we are not talking about buying bars or coins, but about exchange and over-the-counter trading of gold prices.

What's the difference between spot and CFD gold?

Spot gold trading means trading with the current market price of gold—the same price we see in the XAU/USD quotes . Essentially, it's trading "as is," without deferred delivery or complex structures. The price is determined by supply and demand here and now, and transactions are as close as possible to the real gold market.

CFDs (contracts for difference) are a derivative instrument. When trading CFDs, a trader doesn't buy gold as an asset, but rather enters into an agreement with a broker for the difference between the opening and closing prices. This format allows one to profit from both rising and falling prices, use leverage, and open positions even with a small capital base.

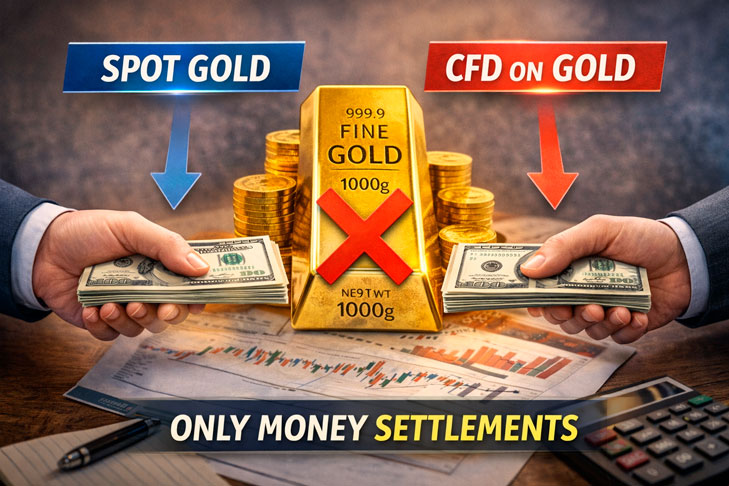

There's an important point worth emphasizing: in neither the spot nor the CFD option does the trader receive physical gold . In both cases, settlements are made exclusively in cash.

Even spot gold from a broker is a transactional instrument, not a purchase of a bar with the option to take it home. Physical gold is purchased through banks and dealers and is considered an investment, not a trading activity.

Similarities and differences worth knowing

From a real-world trading perspective, rather than a theoretical one, the difference between spot and CFDs is evident in several key areas:

- In both cases, you are trading the price of gold, not the metal itself

- Spot is closer to the classic market and is more often used for calm, medium-term trading

- CFDs are designed for active trading and short-term transactions

- With CFDs, there are additional costs for carrying a position over to the next day - swap on gold

- Spot is generally perceived as a more conservative instrument, CFDs as a riskier one

These factors directly influence the choice of a trading strategy and the success of its application in practice.

| Parameter | Spot gold | CFDs on gold |

|---|---|---|

| Physical gold | ✖ No | ✖ No |

| Type of instrument | ℹ Calculated, at the current price | ℹ Derivative contract |

| Leverage | ➖ Minimal / none | ✔ Used |

| Main costs | 💰 Spread | 💰 Spread + carry |

| Trading on the fall | ⚠ Limited | ✔ Full-fledged |

| Position holding period | ⏳ Medium and long | ⚡ Usually short |

| Risk level | 🟢 Below | 🔴 Above |

Spot and CFD trading on gold is available at most major online brokers. Typically, this involves trading the XAU/USD instrument through MetaTrader trading platforms or the broker's own terminals.

Gold CFDs are offered by forex and CFD brokers focused on active trading, scalping, and leveraged trading. Spot gold is also most often offered as a settlement instrument, but without aggressive leverage and with more relaxed terms.

For current broker examples, trading conditions, and spread comparisons for gold and silver, please refer to specialized reviews: Brokers for gold trading on the exchange

Spot or CFD Gold Trading

If you're looking at gold as a relatively low-stress trading instrument, want to hold positions longer, and don't plan to actively use leverage, then spot trading is a more suitable option. It's easier to understand, has more transparent costs, and offers a more comfortable trading experience.

If your goal is active trading, frequent trades, exposure to both rising and falling prices, and the use of leverage to increase potential profits, then gold CFDs offer more opportunities but require strict risk management.

In any case, it's important to remember: both spot and CFD trading involve trading the price of gold, not owning the metal itself. The choice between them doesn't depend on "which is better," but on how you plan to trade.