Basic settings of Forex advisors

The concept of automated trading has long been common among traders. To implement it, you don't need to conduct a detailed market analysis; you simply need to install a suitable Forex advisor.

to conduct a detailed market analysis; you simply need to install a suitable Forex advisor.

However, in order for the program to work correctly, you should first install the advisor itself and study its settings.

The final step will determine the outcome of automated trading. An incorrectly configured robot can easily wipe out your deposit in just a couple of trades, so you should take it very seriously.

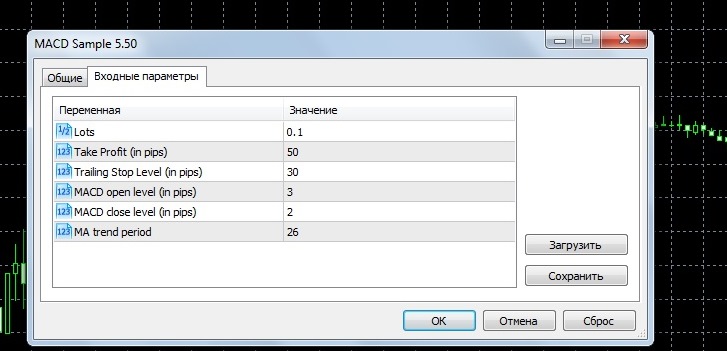

Advisor settings have a number of standard parameters, the installation of which is carried out according to general principles.

Before launching and configuring the program, you should first install it on your trader's terminal. To do this, simply copy the downloaded script to the folder where your trader's terminal was installed.

Pre-configuration of the automatic advisor.

Each trading robot has its own individual settings, but the basic operating parameters are still similar:

Long/short - choosing the direction of transactions to avoid unnecessary losses. During an upward trend, we select only long transactions; during a downward trend, we select short ones.

Manual confirmation – for full control over order opening, it's recommended to check the box at first. This will allow you to monitor each trade and promptly change the trading direction if the trend reverses.

Take profit – set a realistic value, otherwise our order won't close within 24 hours. For starters, you can set it to 200 pips on five decimal places. Better yet, focus on the current trend and the strategy the EA is using.

Stop-loss should be less than the previous order; you can also find the correct value empirically by adjusting the size based on the frequency of trades. However, you're unlikely to be able to set this value lower than the broker's specified level, which is typically 50 pips.

Lots – the volume of trades executed. It is recommended that no more than 30% of the total trade amount be held as collateral, so be careful when choosing trading volumes. For example, if your deposit is only $100, the volume of open orders should not exceed 0.1 standard lot.

Risk – this parameter is also quite common when setting up Forex advisors. It characterizes the risk level at which trading occurs. An excessively high value can lead to a large number of losing trades, while an underestimated risk level will result in the advisor barely trading. The golden mean is found through trial and error during testing.

Number of orders - this refers to the ability to open multiple trading positions simultaneously, thereby increasing trading volumes. This parameter should not be set to more than 3 simultaneously placed orders.

It is important to remember that some trading robots also have a setting for the number of simultaneously open orders, so sum up the volume of open trades.

Other settings - in addition to everything listed above, each advisor has individual settings, depending on the strategy and indicators on which it operates.

In addition, not all robots have the ability to set stop order parameters, so in some cases you will have to trust the script author.

It should also be noted that when installing an advisor, it usually already has standard settings, and if you do not understand what and in what direction should be adjusted, it is better not to change the set parameters.

We conduct all experiments with the advisor on a demo account, and only after achieving profit do we transfer it to a real one.