Forex strategies based on interest rates

It's just that over the past 10 years of familiarity with the forex market, I've almost completely abandoned the use of overly complex trading methods.

Experience has shown that the more components you need to consider when formulating a strategy, the greater the likelihood that something will go wrong.

Furthermore, if you don't fully understand the essence of someone else's forex trading strategy, it doesn't make your trading more effective.

The process of preparation, setup, and testing itself can sometimes completely discourage trading, at least for me.

Therefore, to achieve profit, I almost always try to use the simplest forex strategies , ones that don't require extensive preparation or in-depth knowledge.

The discount rate, or interest rate, is set by the central banks of the country issuing the currency. It is this rate that is used when providing loans to commercial banks and influences the exchange rate.

This means that you can always use changes in this indicator as a signal when opening new transactions in Forex trading.

Influence on trend direction:

- An increase in the key rate leads to an increase in the value of the currency, and therefore causes an increase in its exchange rate.

- An increase in the key interest rate makes the national currency cheaper, creating a downward trend on the forex market.

That is, if the key interest rate has increased, we open trades to buy that currency; if the rate has decreased, we sell that currency. It's important to pay attention to whether the base or quoted currency in the currency pair.

Often, exchange rate changes can begin even before the National Bank's decision is announced. The market reacts to analysts' forecasts, and therefore, if these forecasts are confirmed, there may not be a noticeable exchange rate movement.

Practical application:

You can view current interest rates for the most popular global currencies on the page - http://time-forex.com/uchetnye-stavki

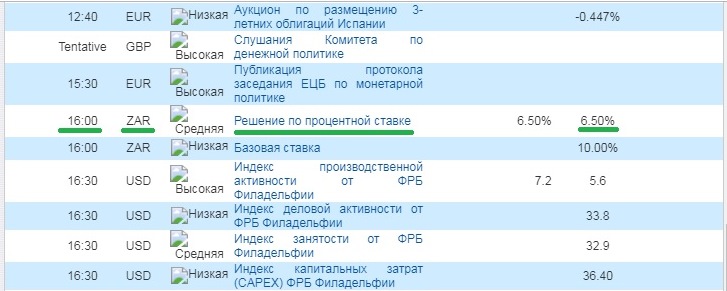

But we are interested not in the values themselves, but in their changes. Therefore, you need to monitor news in the economic calendar - http://time-forex.com/kalendar :

In the calendar we find:

In the calendar we find:

• Interest rate decision

• Time of news publication

• Determine the currency it will affect, in our case it is the South African Rand

• And the probable forecast, if there is one.

If the forecast differs from the previous indicator, there is a high probability that this will already affect the trend.

In our example, both indicators are the same, which means that if a change in the key rate does occur, it will lead to the beginning of a new trend for the USDZAR currency pair.

your broker's terminal .