Simple strategies used in Forex

Exchange trading has always been portrayed as something complex, something only seasoned professionals with Harvard or Stanford degrees can do.

But in reality, the secret to success lies in the approach used to generate profit.

You can create complex and cumbersome trading systems that are daunting to even look at, let alone trade in practice.

Or you can use simple strategies that make Forex trading understandable and accessible even to those with a high school education.

In fact, there are quite a few such trading options, and all of them are increasingly popular among most traders.

Even a newbie to the stock exchange can use them effectively.

Choosing a simple Forex strategy

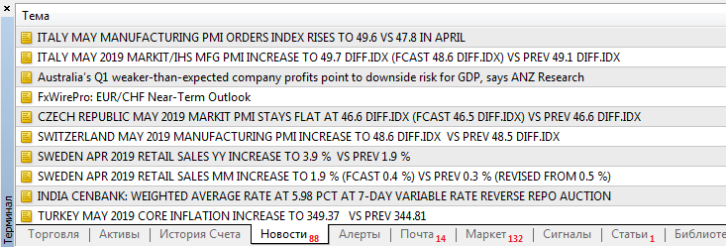

• Trading on the news – despite the fact that this option is tied to knowledge of some economic principles, it can also be considered simple.

You can view the schedule of planned events in the calendar, and record their release in the feed. Based on the news, you can draw conclusions about the price behavior of the currency pair.

If desired, you can use any other source as an alternative to the trading terminal's news feed.

If desired, you can use any other source as an alternative to the trading terminal's news feed.

This option is described in detail here - http://time-forex.com/strategy/torgovlya-na-novostyakh

• The strategy of pending orders x – in my opinion, this is also a fairly simple option for making money on Forex, since it almost completely eliminates the human factor.

There's nothing easier than drawing a price channel on a currency pair chart and placing a pending order, having previously set stop-loss and take-profit parameters.

Everything will then happen automatically: the order will be triggered and then closed with a profit or a planned loss.

Everything will then happen automatically: the order will be triggered and then closed with a profit or a planned loss.

The strategy is quite effective, as orders are opened only when the channel is broken, indicating a change in market trend.

A detailed description can be found at http://time-forex.com/strategy/strategiya-otluzhennykh-orderov

• Closing a price gap – in the forex market, there is a concept called a gap, when the price makes a sharp jump, creating a price gap on the chart.

This most often happens after weekends, so it's quite easy to spot a gap, and the strategy itself is quite simple and easily applicable to Forex.

Its essence is based on the principle that after a price gap forms, the price tends to fill it in the near future.

Its essence is based on the principle that after a price gap forms, the price tends to fill it in the near future.

That is, an upward price gap is filled by a downward trend, so there's nothing simpler than opening a sell trade and closing it after the gap is filled.

You can find the nuances of using it here - http://time-forex.com/strategy/strategiya-gep

In this article, you've learned about three interesting trading options, but these are far from all the simple Forex strategies out there. If you wish, you can choose another option you like in the section - http://time-forex.com/strategy