Momentum Trading Strategy

Momentum trading is a short-term trading strategy widely used for profiting in the stock market, and has recently found its way into Forex.

The principle used to open trades with this strategy is quite simple, based on unusual price behavior.

This type of trading is often referred to as momentum trading, as the investor needs to notice the emergence of momentum and open an order in its direction.

Positions are opened based not on fundamental factors, as is typically the case in the stock market, but on price action statistics and technical analysis.

The strategy is quite complex to use, so it was previously only used by experienced traders.

Reasons for opening trades in impulse trading.

There are many signs that a strong market trend has emerged and the price is ripe for profit.

1. Price acceleration – in this strategy, this is the primary entry signal. If you see the price moving at a rate of 10 pips per hour during the day, and 20 pips per hour in the last 10 minutes, this is the best signal to place an order.

To use this signal, you must first study or research the price movement statistics for the selected stock or currency pair.

2. Increasing volumes always confirm the emerging movement and, to some extent, can serve as an additional filter against false signals.

2. Increasing volumes always confirm the emerging movement and, to some extent, can serve as an additional filter against false signals.

3. Breaking through resistance or support levels—breaking through price channel boundaries—can also indicate a favorable moment to enter the market.

4. Fundamental factors—even though the strategy is based on technical analysis, it's never a bad idea to check the reasons for a sharp price jump. And if such reasons are present in the news feed, this will provide additional confirmation of the emerging movement.

To simplify the process a little, you can use the volume indicator and the channel indicator.

Automating the Momentum Trading Strategy

In addition to the above options, there's another, simpler way to catch the momentum: placing a pending order.

This order will only trigger if the price reaches the level we set within a certain time.

This means, according to calculations, the EUR/USD exchange rate should not exceed 1.1555 within four hours. If it reaches 1.1600, our Buy Stop once triggered, a buy trade will be opened.

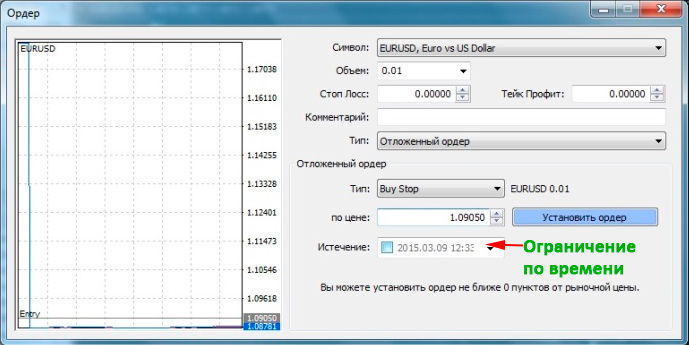

Technically, we set a time limit when activating a pending order, in which we check the "Expiration" box and set the time until which our order is valid.

Technically, we set a time limit when activating a pending order, in which we check the "Expiration" box and set the time until which our order is valid.

For example, if you set a two-hour period, then if the price doesn't reach the desired value within two hours, the order won't be triggered. This means the impulse hasn't occurred and the trend is moving at its usual speed.

Trades are closed after you notice a slowdown in price movement and a reduction in trading volume, both of which may indicate a potential reversal.

The Momentum Trading strategy allows for quite large profits, as the price moves a considerable distance in a short period of time. The key is to spot the onset of momentum in time and open a trade.

A description of another version of this strategy can be found at http://time-forex.com/strategy/strategiya-torgovli-na-impulsakh