Impulse trading strategy.

The impulse trading strategy is the simplest and at the same time one of the most effective approaches for trading in financial markets.

Trading on market momentum boils down to buying rising assets and simultaneously selling falling ones.

Incidentally, a trader using a momentum strategy never delves into the underlying logic of what's happening, as they simply ride the tide, chasing the market's undulating movements.

Reasons why momentum strategies are profitable

To understand which direction a purchase or sale is taking, statistics are analyzed, specifically, a specific historical period is analyzed to determine the percentage deviation and the asset's current trend.

In fact, this strategy is based on the psychological behavior of the crowd. If a major player or crowd begins to push the price toward a certain point, more and more players are drawn into this movement, and the price, in turn, gains more points than it should, as if by inertia. Therefore, due to the unchanging nature of crowd behavior, this approach remains relevant to this day.

Impulse trading is superior to the so-called optimizing trading on Forex, however, it is characterized by rather large drawdowns, which can be reduced by introducing a filter into the strategy in the form of fundamental analysis or, more simply, news.

Period of statistical analysis and selection of currency pair

Three months is considered the most popular period for analyzing and selecting a statistical sample for momentum trading. However, this period is based on literature and has virtually no evidence to support it, so if you're skeptical of this assertion and would prefer to track the sample over a longer period, you'd be right.

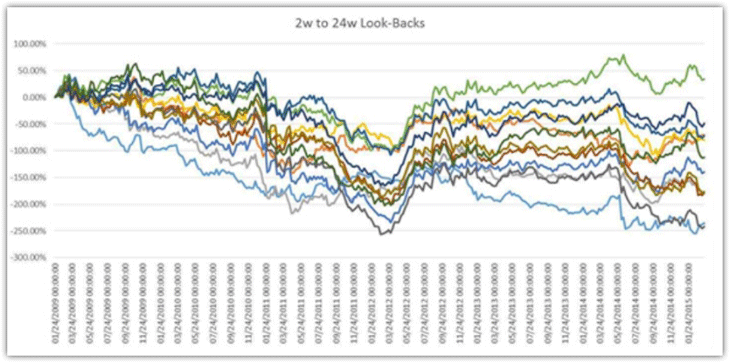

However, to prove the effectiveness of this sample, traders conducted testing using different samples with periods ranging from two weeks to six months. The results of this test can be seen below:

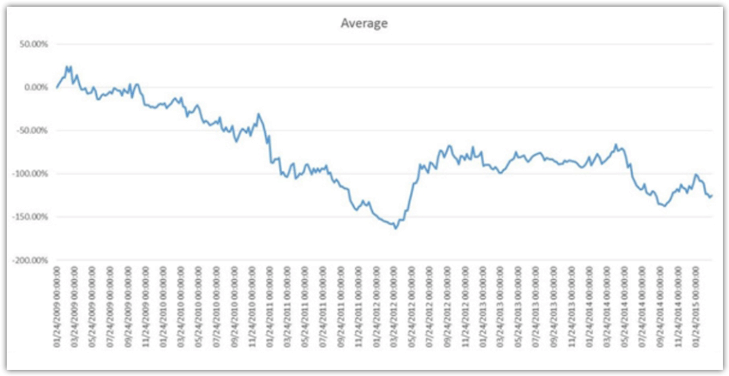

After examining the test results, we can see that out of 12 samples with different time periods, only one three-month sample was profitable, making this the most optimal option. The average performance across the different samples can be seen below:

Time Series Momentum.

Time series momentum strategies are considered the simplest price following trading tactics. The essence of this approach is that we open a short position if the price is below a certain level, which we set some time ago during testing.

We also open a long position at the beginning of each week if the price is above its previous level.

We create a statistical sample, and if the price at the beginning of the week is above a certain average, we buy, and if it is below, we sell.

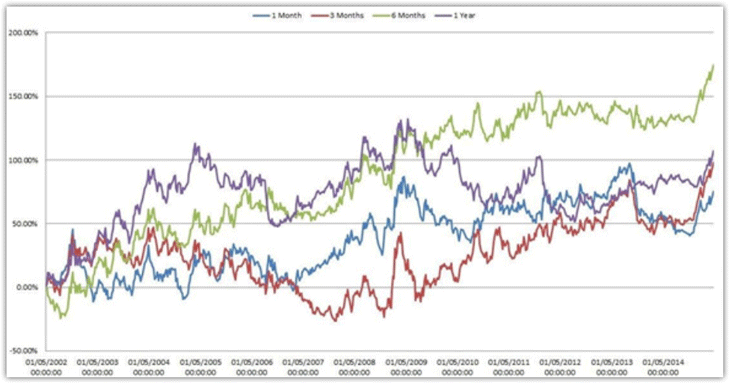

Any practicing Forex trader will naturally ask: which currency pairs are best to use? Initially, we conducted a massive thirteen-year test on four currency pairs: EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

The principle was as follows: a position was opened sideways at the beginning of the month, depending on the price's position relative to the statistical sample, and held for exactly one month, at the end of which the trade was closed. The test result is below:

The strategy's testing results were quite impressive, with profitability exceeding 100 percent of the deposit for all variants. If you look closely at the diagram, you'll notice that historical data for 1, 6, 3, and 12 months was used to determine momentum, and the strategy delivered excellent results in all variants.

In conclusion, it's worth noting that momentum trading, which is based on analyzing historical data and searching for momentum over a long period, is more akin to investing than active trading. However, this approach allows people with limited employment to profit from the market, making it very attractive.