Quoted and base currencies and their role in the quote

When trading Forex, you encounter a host of different concepts that are tied to the calculation of various important trading parameters.

One such concept is the quote and everything related to it, as this knowledge is used to calculate the lot price, the pip value, and the swap.

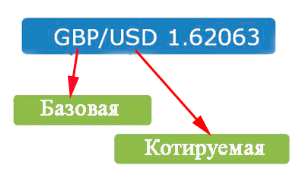

The quote is formed by two currencies, the first of which is the base currency and the second the quote currency. It would seem that nothing could be simpler, but...

Base currency

This is the currency in which transactions are conducted; it is the currency in which the transaction volume is calculated, which is why it is called the base currency.

For example, in the GBPUSD currency pair (British pound/US dollar), the British pound is the base currency, and volumes are calculated in it.

That is, if it is said that one lot of the GBPUSD currency pair was purchased, this means that 100,000 British pounds were purchased for American dollars.

In exchange transactions, it is simply stated which currency was bought or sold without mentioning the currency of the pair; in this case, it is assumed that the payment was made in the national currency.

For example, we hear: “I bought 100 US dollars today,” which means that a transaction was made today to buy American currency for Russian rubles.

The question often arises as to why a particular currency is listed first.

The question often arises as to why a particular currency is listed first.

There's no specific preference, but typically it's the more popular currency, most often the euro or the US dollar, though other options are possible.

Quoted currency

This is the second currency in the quote, also known as the settlement currency, since it is used to settle the transaction.

So, returning to our example, buying one lot of GBPUSD would cost 125,371 US dollars.

The quote currency is used to calculate the pip value, which is equal to the value of one unit of the last digit in the quote.

To put it more clearly, a GBPUSD price of 1.25371 would equal one dollar.

For more information on calculating the value of a pip, see the article at http://time-forex.com/terminy/punkt-forex

For more information on calculating the value of a pip, see the article at http://time-forex.com/terminy/punkt-forex

The swap size, calculated as the difference between the interest rates of the currencies forming the pair, also depends on whether the base or quote currency is used.

When selling, you sell the base currency, which you don't own, and therefore borrow it at the interest rate, and receive the quote currency, on which you accrue interest.

If the interest rate is less than the borrowed interest rate, you pay a negative swap for rolling the trade over; if it's less, you receive additional profit.

For more information on swap calculation, see http://time-forex.com/praktika/svop-fx

Therefore, it's important to determine which currency is the base and which is the quote currency, as this aspect affects both trade volumes and potential profits.