What is a swap on Forex and how much does its size affect profits?

A relatively small number of traders delve into the trading conditions that the broker provides them in detail, and even more so on all sorts of commissions and costs that do not depend on the company itself.

Such a commission as a swap on Forex , which is charged to a trader for transferring a position to the next day, is identical for any company and does not depend on any regulations or preferences of brokers.

An additional minus or plus that a trader can observe in addition to the spread has an easy mathematical justification. It is worth noting that a swap can either be beneficial or negatively affect the profitability of your trade.

The concept of swap and its meaning in trading

Many traders mistakenly believe that the size of the fee for transferring a position depends only on the broker, and some companies manage to speculate against the backdrop of traders’ ignorance.

In reality, a forex swap is the difference in interest rates between the two countries that participate in the currency pair, which is charged for rolling over the position to the next day.

Based on the basics of what a Forex swap is, we can safely draw conclusions about the importance of this commission for certain categories of traders. So, if a trader trades intraday and uses a strategy in which all transactions will be closed by 24-00, he should not worry about charging a commission on his transaction.

But the category of traders who like to hold their positions for weeks and months, and their trading is dominated by long-term transactions, are very susceptible to the influence of the swap, both in positive and negative aspects.

Positive and negative swap on Forex. Calculation example

If you have ever held positions on currency pairs for more than one day, you might have noticed that the value of a swap on Forex can either be debited from your account and be negative, or credited to your account and be positive. This is directly related to the interest rate of Central Banks.

Let's imagine that you decide to buy the Pound/Dollar currency pair.

When buying this currency pair, you must clearly understand that you are buying pounds and at the same time selling dollars.

Since you do not have that much dollar, you are conditionally borrowing a dollar, and for such an operation you naturally have to pay a commission to the Central Bank. Since you do not close the transaction and hold the Pound, the bank has the right to use your funds and for such an operation you are credited to your account. Thus, the size of a swap on Forex is calculated by the difference between the funds accrued and written off.

So, let's imagine that the interest rate on the pound is 3 percent, and on the dollar 1. Thus, if we buy this currency pair, we will get a value of 3-1 = 2 percent of the sum. And now, if we translate this into real numbers, then under such conditions, from a sum of 10 thousand dollars you would be charged an additional 200 dollars. Where to get the value.

Real calculation for holding a transaction for 10 days In order not to look for interest rates for each country of a currency pair when opening a position, you can use two sources of information on the size of the swap on Forex, both for buying and selling.

The first source of information is located directly in the MT4 trading terminal.

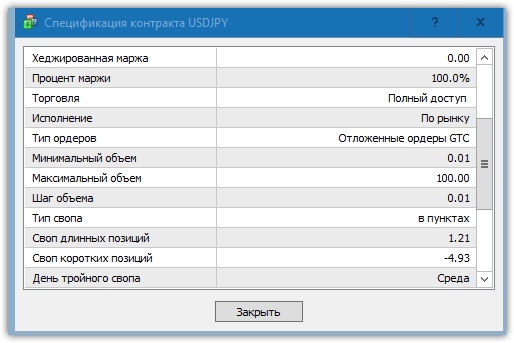

In order to find out the information you are interested in, call up an additional menu with the right mouse button directly on the currency pair symbol and select “Specification”. A sign will appear in front of you, in which you can get acquainted with the size of the required commission for both long and short:

The second source of information is your broker's , where you can find contract specifications.

It is also worth noting that the information in MT4 that is on the broker’s website is indicated in points, which makes the calculation much easier. For example, if you open a buy position on the USD/JPY currency pair, you will receive 1.21 points per day. So, if you opened with one lot, and the pip price is 1 dollar, then you will receive an increase of 1 dollar 21 cents per day. On Wednesday the triple swap is credited, so on this day you will be credited $3.63. Now let's sum it up if we held the position for 10 days from Monday to Wednesday inclusive: 1.21+1.21+3.63+1.21+1.21+1.21+1.21+3.63=$14.5. Agree, there is a good increase in the position if you hold the deal for only 10 days.

Swap size for currencies on Forex, stocks, futures - https://time-forex.com/info/razmer-swopa

In general, the swap indicator when trading on Forex is very important for traders who prefer long-term trading , since due to it you can get a good increase or, conversely, in the case of a negative value, you will lose a significant part of the profit. However, if you work intraday, then both positive and negative Forex swaps will not affect you in any way and should not be your attention.