Long-Term Forex Trading: The Secret to Consistent Profits

Many traders, having gained enough experience and learned their lesson in day trading, sooner or later begin to think about long-term or medium-term trading.

In reality, scalping and day trading have become a huge myth about the profitability of this approach.

Most beginners mistakenly believe that by devoting more time to trading, they will somehow magically earn more.

Unfortunately, this approach is fundamentally flawed and has been ingrained in us since the Soviet era.

For example, in the past, people who exceeded their production quotas were heavily rewarded, rewarded, and featured in newspapers.

Unfortunately, the modern world is built in a completely different way, and perhaps your neighbor who goes to work twice a week earns tens of times more than you, working overtime at a machine.

The world of trading, and specifically trading as a process or work, is no exception, and the banal idea that the longer you are in the market and the more trades you make, the more you will earn, is fundamentally wrong.

To understand why long-term trading is popular among long-term investors and renowned traders, let's take a closer look at this concept.

Long-Term Forex Trading: Pros and Cons

To begin, it's worth reminding our readers that long-term trading is a trading process in which holding a position is measured in months, and market entry is calculated for global price changes.

Long-term trading occurs on weekly or monthly charts, and the number of positions per instrument may not exceed five. So, let's explore the appeal of long-term trading.

Advantages of long-term trading:

1) Market predictability.

Whatever anyone says, market noise is a problem inherent to day trading. When trading on short timeframes, their main problem is market noise, which often leads to stop orders.

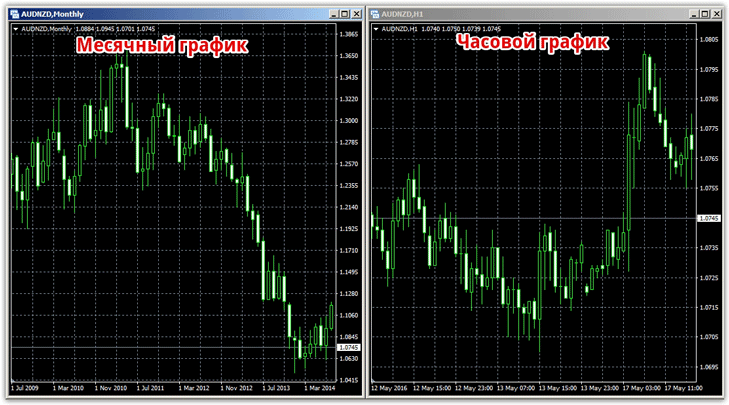

Looking at the chart of the same instrument on both short and long timeframes, it becomes clear that the trend is more clearly visible and has a better outline on the longer timeframe. For example, I suggest looking at the monthly and hourly charts to get a clearer understanding of the real market situation:

2) Saving on Spreads:

A day trader can't even imagine how easily a broker profits from them, averaging three pips per trade. Three pips seems ridiculous to you? Well, let's do some simple math.

On average, a trader makes five to ten trades per day, but we'll take the minimum. So, if you do the math, a day trader loses 15 pips daily. This amounts to 450 pips per month, or 5,400 pips per year.

Now let's imagine you have a small deposit and trade with the smallest lot, where a pip is worth 10 cents. As a result, by trading with the minimum lot, you lose at least $540 per year, which at today's exchange rate is almost twice the average salary.

the Forex spread only once , when they open a trade, and doesn't lose anything extra.

3) Less time investment and emotional strain.

Unfortunately, many beginners are deluded into thinking that making money on the exchange is easy, especially scalpers and day traders. Honestly, I've encountered many traders who scalp daily, and believe me, you simply won't find anyone more irritated, angry, or unhappy than this category of traders.

Just imagine the emotional state of someone who spends the entire day making and losing a penny, potentially ending up in the red at the end of the day.

Long-term traders can spend just a couple of hours analyzing the market, open an order with a stop loss and take-profit, and then forget about their trade for months, checking their terminal once a week to move their position to breakeven, and so on.

Flaws:

1) A large deposit is required.

Unfortunately, to achieve a profit of 2,000 pips, a stop loss of at least 500 pips is required, which requires a fairly substantial deposit to maintain a sound risk management approach.

2) Swap commission.

It's no secret that brokers charge a swap commission for holding a position overnight. For a day trader, a Forex swap is nothing more than a formality, but if your position is open for a couple of months or a year, it significantly impacts your trading.

The secret to stable profits

The future success of a long-term trader depends primarily on the strategy they choose, as well as timely monitoring of the fundamental background, namely global macroeconomic indicators.

It's worth noting that to increase profitability, it's essential to open trades only in the direction of positive swaps and remember to hedge by creating complex positions reminiscent of Caritrade-based tactics. Remember, however, that the high correlation of forex instruments with high positive swaps is an excellent long-term investment.