Forex correlation, currency pair correlation table, special indicators

It has long been noted that the movement of exchange rates on Forex for different pairs can be interconnected; this relationship is called correlation.

Forex correlation refers to a stable relationship between the exchange rates of various currencies on the foreign exchange market. In practice, this relationship between currency pairs is typically used, significantly simplifying the trading process.

The strategy is quite widespread and has earned the trust of more than one generation of traders on various global exchanges.

When trading on the foreign exchange market, you've probably noticed more than once that as soon as one currency rises, others follow suit, or, conversely, as soon as a trading instrument begins to fall in price, some other currencies only strengthen their positions.

It should be noted that currencies or currency pairs It won't necessarily move in only one direction. Correlation in Forex can be either direct or inverse.

If the trading instrument and the chosen benchmark move in the same direction, there is a direct correlation. If the rates move in the opposite direction, then this is usually referred to as an inverse forex correlation.

Coefficient

To organize online trading on multiple currency pairs, it's common to use the concept of the Forex correlation coefficient. It allows us to determine how closely currency pairs are related.

If a currency's price moves in the same direction consistently, the Forex instruments are assigned a coefficient value of +1, which corresponds to 100%. However, this doesn't mean that if EURUSD rises by 10 pips, EURGBP will also rise by 10 pips, even if they are 100% correlated. The coefficient doesn't characterize the magnitude of the change, but rather the length of time over which this correlation exists.

At the same time, the plus or minus sign indicates whether the interaction is direct or inverse. A plus sign indicates that the pairs are moving in the same direction, while a minus sign indicates the opposite direction.

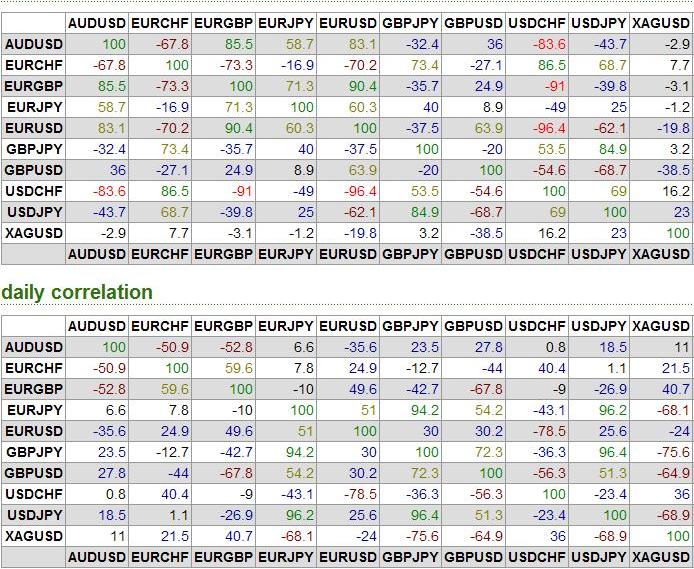

An example of currency pair correlation is shown in the table; the first table is for an hourly chart, the second for a daily chart.

Forex currency pair correlation - practical application.

There are two possible uses for this parameter. The first is for multi-currency trading. Knowing that certain two instruments generally move in opposite directions, there's no point in opening trades in the same direction. Perhaps a similar approach can be used for hedging on Forex .

When correlation helps reduce risks, assets that react very differently to news releases or events are often used for this purpose.

An entire strategy is built on the second option. Its essence lies in the fact that one currency pair usually reacts to an event slightly faster than the other. Therefore, by focusing on the first, trades can be opened on the second.

Forex correlation is not a constant parameter; special scripts exist for calculating this variable. Here are some examples:

The PRICE CHANNEL OSCILLATOR indicator - http://time-forex.com/indikators/price-channel-oscillator - displays correlation charts for two currency pairs, showing the strength of the coefficient.

The correlation indicator - http://time-forex.com/indikators/indikator-korrelycii - reveals patterns in the movement of currency pairs.