Price Channel Oscillator: A Tool to Facilitate Pairs Trading

The goal of any trader and investor is to minimize risks as much as possible while still achieving acceptable returns.

Large hedge funds achieve this goal through smart hedging risks, creating the most market-neutral portfolios of stocks and other assets, as well as by searching for a direct relationship between assets, their correlation and, most importantly, spread or swap.

However, in pairs trading, everything is far from as simple as it seems at first glance, because knowing the direct relationship between assets is necessary to catch the very moment of profit due to the spread that occurs when the charts diverge significantly.

To simplify pair trading and find expansion zones for different assets, traders overwhelmingly use specialized assistants. We'll learn about one such assistant in this article.

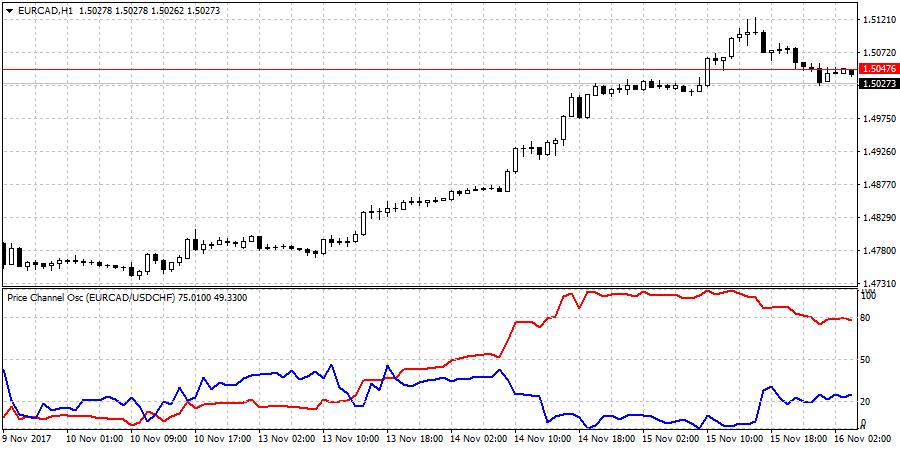

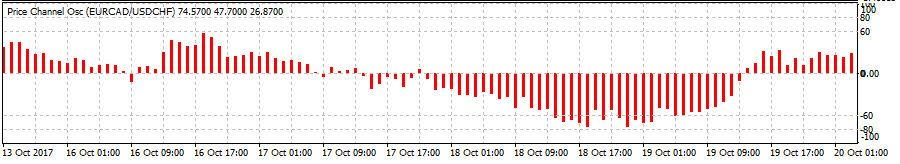

The Price Channel Oscillator indicator is an auxiliary technical analysis tool whose main task is to build a price oscillator based on two currency pairs.

The Price Channel Oscillator is used by traders to identify price divergences, so it can be used on any trading asset and time frame where such patterns need to be monitored.

Installing the Price Channel Oscillator indicator

The Price Channel Oscillator indicator is somewhat of a novelty in pairs trading, as the tool was developed at the end of 2017.

Therefore, in order to use it, you will need to download the indicator file at the end of the article, and then install it directly into your MT4 trading terminal.

Installing the Price Channel Oscillator is practically no different from installing any other custom indicator.

The installation process itself follows a standard procedure, namely, you will need to transfer the indicator file previously downloaded at the end of the article to the appropriate folder in the terminal data directory.

You can find more detailed instructions on installing indicators by following the link http://time-forex.com/praktika/ustanovka-indikatora-ili-sovetnika.

After restarting the platform, Price Channel Oscillator will appear in the list of custom indicators, and to start using it, simply drag the name onto the screen.

However, it is important to understand that for the Price Channel Oscillator to work correctly, it must have access to historical data on the currency pairs that are included in the oscillator.

Therefore, before applying it to the chart, open the necessary ones for the calculation in parallel currency pairs in separate windows.

The Basics of Pairs Trading: Using the Price Channel Oscillator

Pairs trading is based on profiting from the spread. It's crucial to understand that the spread in pairs trading has nothing to do with the commission, which is also charged by the broker.

In fact, the spread in pairs trading is the profit that is generated by opening opposite orders on two currency pairs, with the goal of making a profit on a future narrowing.

Pairs trading involves trading two currency pairs with a high correlation, which should be 75 percent or higher. Simply put, the assets should move almost identically most of the time.

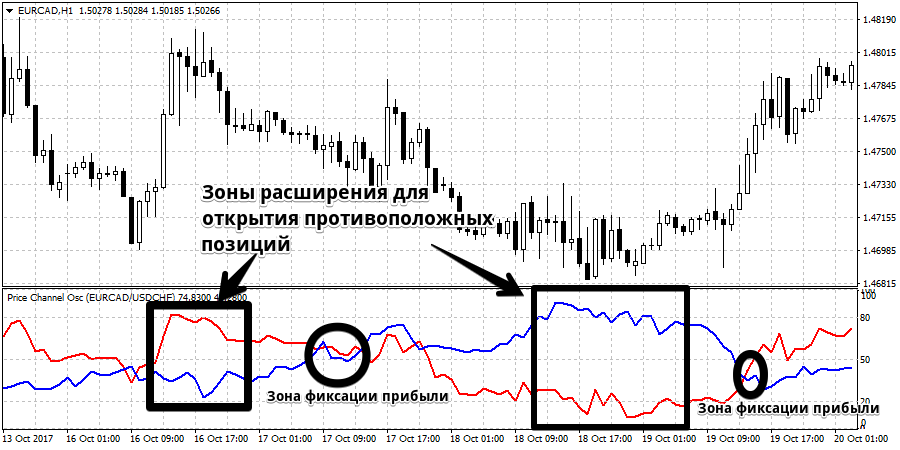

The spread, or rather the profit, is formed due to the fact that at a certain point the prices begin to move in the opposite direction (move apart relative to each other).

At such moments, the trader opens opposite orders on two instruments with the aim of ensuring that the assets come into balance and continue to move in their usual direction.

In terms of practical application, the Price Channel Oscillator significantly simplifies the process of finding such situations and clearly visualizes them.

So, if the selected currency pairs have a direct correlation (they move identically in the same direction), but their values have diverged significantly (the lines have moved away from each other), it is necessary to open a sell order for the currency pair that has moved upward, and a buy order for the pair that has moved downward.

Profit is recorded at the moment when the profit from one position covers the loss from another.

In conclusion, it's worth noting that the Price Channel Oscillator is an excellent tool for pairs trading, allowing you to trade the divergence of correlated instruments and profit from the spread.

However, it's important to understand that this tool only visually highlights asset behavior, and traders must select highly correlated instruments themselves. You can view currency pair correlation coefficients here - http://time-forex.com/terminy/korrelysyy-forex

Download the Price Channel Oscillator.