A simple strategy using pending buy and sell limit orders

Trading with pending orders is one of the most common strategies.

Most traders use buy and sell stop orders in their trading because they allow them to open trades with the trend.

However, limit pending orders are not as popular due to their complexity.

In fact, most traders simply don't know when to use this tool.

Furthermore, calculating entry points in this case is quite complex and requires some effort before placing a limit order.

The first option is suitable for those who decide to trade on the news.

It often happens that you launch your trading platform and see that an asset has begun to rise sharply due to news.

But it's too late to enter the market, as the news that triggered the rise was released quite some time ago, and the price has already reacted to the event. In this case, one option is to wait for the correction to begin and place a buy limit :

This order will execute a buy after the price drops to the level you set. It's important that the market maintains an uptrend, and that the correction doesn't turn out to be a trend reversal.

This order will execute a buy after the price drops to the level you set. It's important that the market maintains an uptrend, and that the correction doesn't turn out to be a trend reversal.

The difficulty with this method lies in finding the entry point, as it's impossible to accurately predict the size of the correction, unless there's a nearby support line from which the price will bounce and rise again.

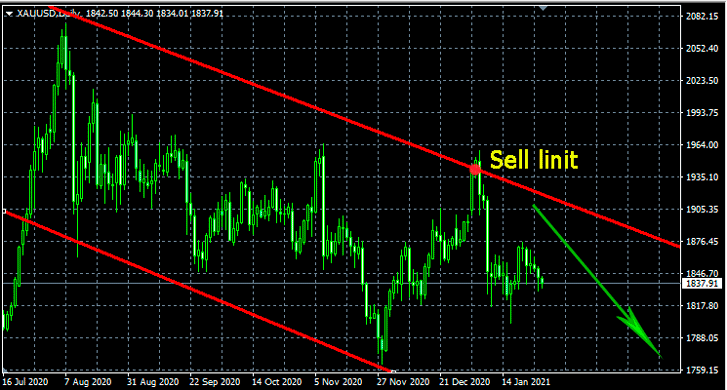

The second option is simpler and, to some extent, safer. When using it, limit pending orders are placed at the boundaries of the price channel:

The key is for the price to move within this price channel for some time:

It's better to use higher timeframes , ideally when a horizontal channel can be created.

It's better to use higher timeframes , ideally when a horizontal channel can be created.

It's even better to focus on strong levels when placing orders, near which the price most often reverses.

A strategy using limit pending orders is quite risky, so remember to set a stop loss immediately, as after the order is triggered, the price may move further against the already open position.

The stop loss size should be set to prevent false triggers, as it's difficult to accurately calculate the reversal point of the correction.

To be completely honest, I personally prefer to use pending orders such as buy stop sell stop; it's much easier.

A brief description of the stop order strategy can be found here: https://time-forex.com/strategy/strategiya-otlozhennykh-orderov