Shorting Stocks: How to Make Money on Uncovered Trades

We are all accustomed to the fact that traditionally, earning money on securities involves buying them and then selling them at a higher price.

But after the advent of contracts for difference (CFD Contract For Difference), it became possible to enter into unsecured sales transactions, including on securities.

Exchange trades to sell are often referred to as short trades, which allows one to immediately indicate the direction of the open position.

Shorting stocks is when you sell securities without having them in hand, so to speak, borrowing shares of a particular company from a broker, and an amount equal to the current value of the security is debited from your account as collateral.

In reality, CFDs are much more complex, but there's no point in going into a long explanation. What are CFDs? - https://time-forex.com/interes/cfd-kontrakt

Why open short trades on stocks?

It might seem pointless to short stocks, as buying them is much more appealing. It's nice to invest in a security hoping for growth, and the dividends you receive when you buy are a welcome bonus.

But in reality, today you can earn much more by shorting than by investing in securities. Gone are the days when a company's stock would increase several times in value in a year.

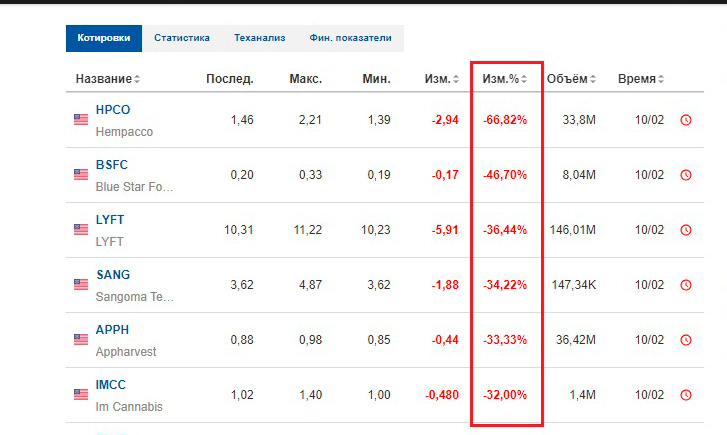

Currently, price collapses are more common than price increases, and the size of the decline is usually greater than the price increase:

For example, some companies on the US stock market have fallen in price by more than 66%, meaning that a well-timed short trade could have yielded a profit of around 60%.

The second argument in favor of opening short trades is that it is much easier to track an event that will cause a market collapse than to predict the rise in the price of a certain asset.

Shorting stocks should begin when negative financial results are published, scandals arise, sanctions are imposed on a company, tariffs are raised, and other news has a negative connotation.

Remember how a few years ago, shares of the Volkswagen automobile concern literally plummeted by 17% in a single day as a result of a scandal related to manipulation of environmental testing.

Therefore, the more negative the news, the stronger the downtrend and the better the prospects for a short trade.

A Simple Strategy for Shorting Stocks

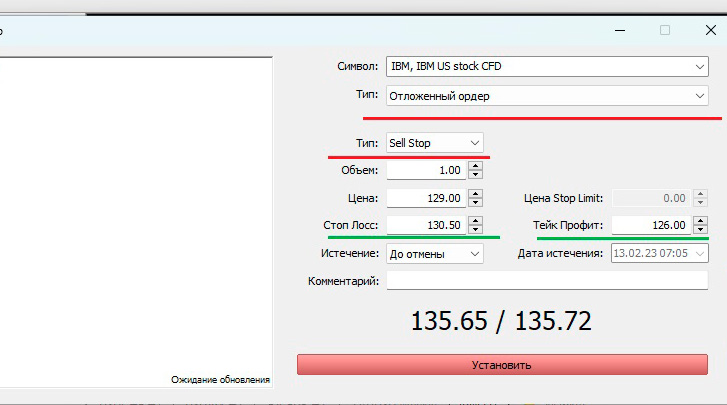

One of the simplest strategies when opening sell trades on securities is to use pending orders:

To implement it, you just need to determine the minimum price on the selected time frame for the desired asset and place a pending order below this minimum.

In this case, it's best to choose stocks that haven't experienced major price declines over the past year and that are close to support levels. This will increase the chances of a pending order being triggered.

When placing an order, remember to consider the stop loss and take profit , as there is always a chance the upward trend will resume after the order is triggered.

An alternative to placing pending orders when shorting stocks is to set up a signal indicator that will send you a message if the price breaks a significant low or a support line.

Download the signal indicator – https://time-forex.com/indikators/price-alert

After that, you will check what is causing the downtrend and if the news is strong enough, you will open a sell trade.

Brokers for CFD trading - https://time-forex.com/spisok-brokerov