Nahuatl Strategy

Any trader can choose between two paths: trend trading, which means following the crowd, or counter-trading, seeking a reversal point.

Both variations of this Forex strategy are quite common, and each has its own advantages and disadvantages.

For example, trading against the market requires nerves of steel and a large deposit.

Therefore, there's an unspoken rule among traders to always follow the trend, as this is the path to profitability with the least resistance.

However, trend trading isn't as simple as it might seem at first glance.

This is the strategy you'll learn about in this article.

The Nahuatl strategy is an indicator-based strategy aimed at identifying and capturing major price trends.

Nahuatl is a time-tested forex trading strategy with a decade of history of use in the financial markets.

A unique feature of this strategy is that it isn't universal like most trend-following strategies. Instead, it focuses on the specific movements of currency pairs such as the GBP/USD and GBP/JPY.

This tactic can only be used on higher timeframes, specifically from the hourly to the four-hour period, as these intervals have less market noise.

The strategy is easy to implement and can be used by virtually all traders, regardless of their experience.

Installation:

This is one of the top strategies used by traders since 2008. Dozens of modifications have been created based on it, all of which are more or less similar to the original.

Installing the strategy first involves downloading the indicator files and the template itself, which you can do by scrolling to the very end of this article.

The next step is to place these files in the appropriate folders in the MT4 root directory. This is very easy to do: in the running platform, go to the File menu and click "Open Data Folder."

Once you're in the data directory, find the "Indicators" folder and move the indicators there. Also, find the "Template" folder and move the strategy template there.

Once the installation is complete, be sure to restart your trading platform or update it, as the terminal will simply not display the dropped template and indicators.

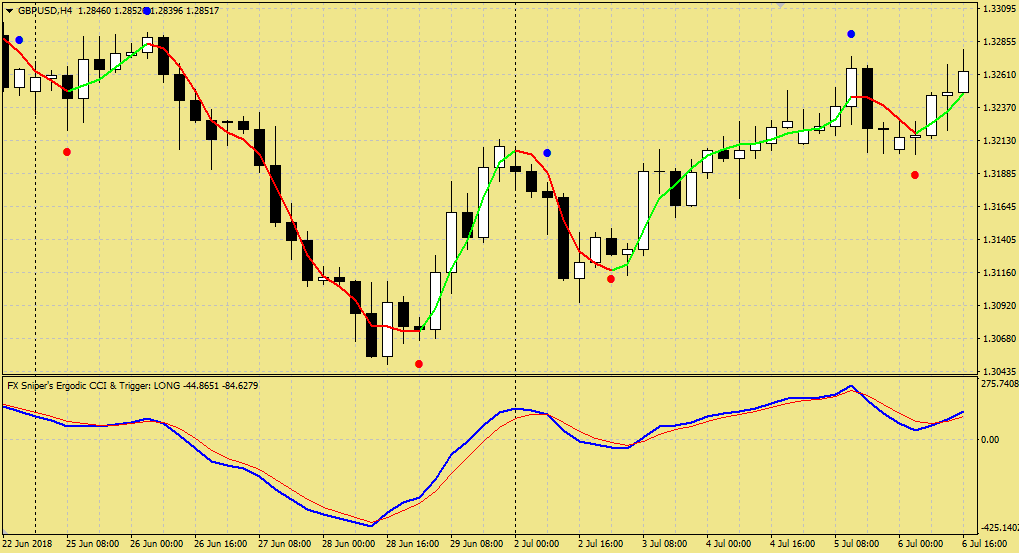

Open one of the two recommended currency pairs and run the template on it. This is what your chart should look like after running the strategy:

Nahuatl Strategy Signals

One of the most important features of using "Nahuatl" is that market conditions don't have to be met simultaneously, as is the case with other indicator strategies.

In our case, it's crucial that the conditions are met one after another within a few candlesticks.

The strategy itself is supported by three indicators: NonLagMA, FX Sniper's Ergodic CCI Trigger, and SHI SilverTrendSig.

The key indicator determining the entry point is FX Sniper's Ergodic CCI Trigger, while the other two indicators serve as filters. So, let's look at the strategy's rules.

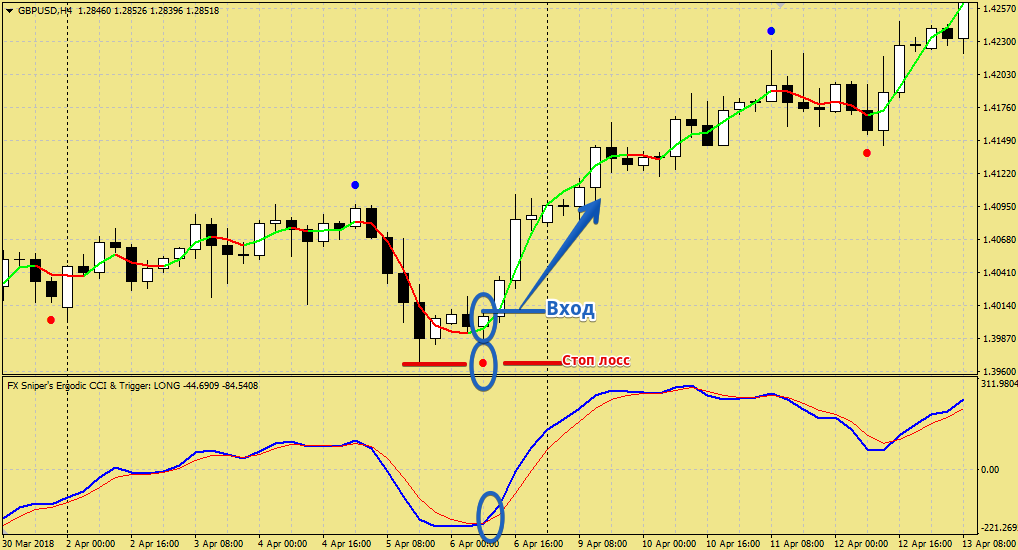

Buy signal:

1. The SHI SilverTrendSig indicator warned of a possible buy reversal with a red dot under the price.

2. The blue FX Sniper's Ergodic CCI Trigger line crosses the red line from below.

3. The NonLagMA is green, confirming the uptrend.

The Nahuatl strategy offers two Stop Loss options. The first, and primary, option is at the local minimum. The second option is only acceptable if the nearest extreme is very far away.

It can be set at the minimum of the previous candlestick. Exiting the market is recommended when the Take Profit , which should be no less than the Stop Loss you set.

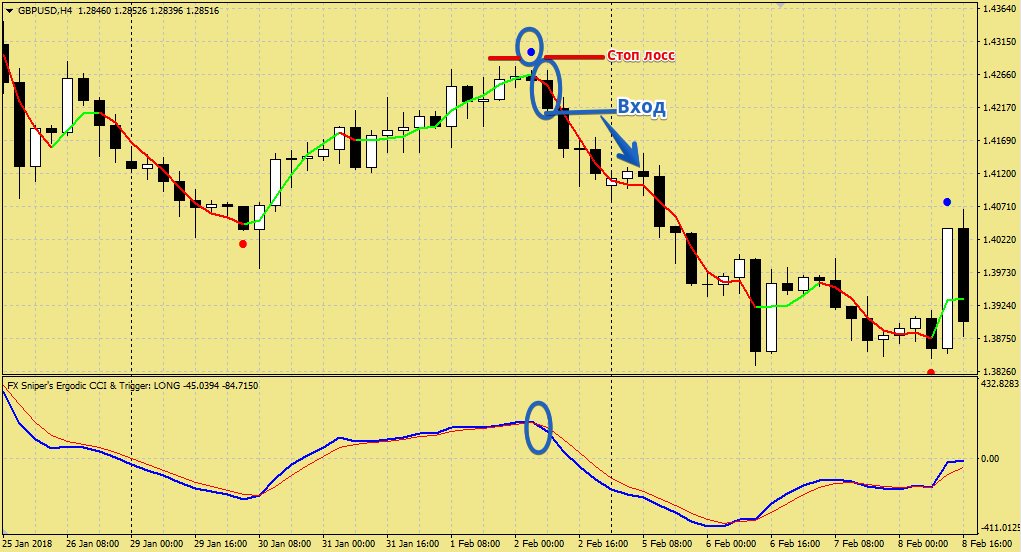

Sell signal:

1. The SHI SilverTrendSig indicator warned of a possible sell reversal with a blue dot above the price.

2. The blue FX Sniper's Ergodic CCI Trigger line crosses the red line downwards.

3. The NonLagMA is red, confirming the downtrend.

The principles for setting a Stop Loss for sell orders are slightly different: the order should be placed at the local high. If this method is not feasible due to a large stop order size, place a limit order at the high of the previous signal candle.

In summary, the SHI SilverTrendSig strategy can safely be called highly specialized. However, as for its drawbacks, it's worth noting that signals appear extremely rarely on the four-hour chart.

Download scripts for the Nahuatl Strategy

.