Session Close or Day Close Strategy

To trade successfully on the Forex market, it's important to understand that once a position has been opened, the trader has virtually no control over anything, as the decision has already been made and all that remains is to wait for the outcome.

The reality is that we don't control the market, we can only follow it and not succumb to its provocations by controlling our emotional state!

However, in practice, traders do not realize this and, instead of starting to fight with themselves, they begin to trade intraday, scalp, and use strictly small time frames.

Such preferences of beginners are caused primarily by the desire to control the market, because by constantly opening positions and immediately closing them, that very feeling of control appears.

In practice, a higher number of bars has nothing to do with the quality of the signals, since the vast majority of them are nothing more than price noise that distracts your attention from the real signals.

Daily Close. Strategy Ideology

The frequency of trades, as well as the number of candles viewed per day, is not a factor that affects a trader's efficiency.

In fact, a trader must develop tolerance and be able to wait for his own profit.

Almost all professional players wait for their own profit for weeks, if not months, and their positions are held in the market for about a month.

What's most surprising is that they spend no more than twenty minutes a day analyzing the market. However, if a position is open, they can freely go about their business and not worry about the transaction, since there can only be two outcomes: either profit or a stop order.

Why this happens is that they use the principle of trading on the “Day Close” or “Close of the Trading Session”.

What's the point of this miracle method, you ask? There's no Holy Grail, really, as trading based on the daily close principle involves using signals exclusively on daily charts after the candle closes, or a few minutes before it.

The author of this approach is Neil Fuller, a well-known developer of trading strategies based on indicator-free methods of market analysis.

The strategy can be used on any type of asset, and while on Forex the analysis itself begins after 24:00, on stocks it begins after 17:00 (at the close of the trading session).

Signals. Three popular models

The Session Close or Day Close strategy is based on three of the most popular Price Action patterns, namely the pin bar, inside bar, and pin bar confirmed false breakout.

Trading only takes place a few minutes before the daily candle closes or after a new candle opens after a pattern is identified. So, let's move on to descriptions and examples.

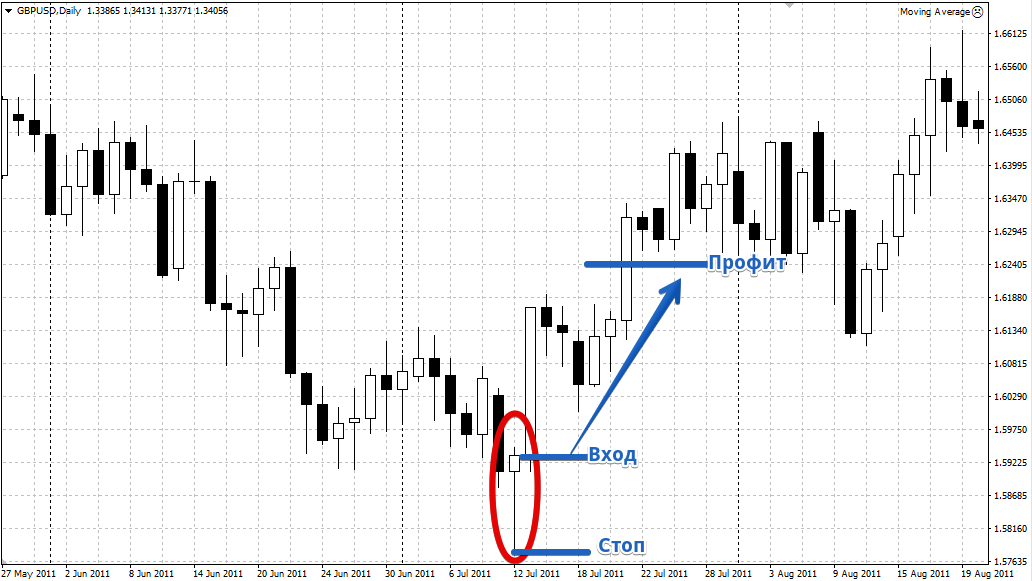

Pin bar model

The pin bar is the most common candlestick pattern Price Action, which consists of just one candle. It's important to understand that this pattern is a reversal pattern and indicates a sharp loss of strength on the part of either the bulls or the bears, depending on the trend direction.

The lack of strength itself is demonstrated by the large shadow in the direction of the trend, while the second shadow is practically absent, and the candle body itself is small in size.

If a pin bar appears in an uptrend, open a sell trade, placing a stop at the candle's high, and a profit 2-3 times greater than the stop.

When a pin bar appears on a downtrend, open a buy position, placing the stop at the candle's low and the profit 2-3 pips greater than the stop. Example:

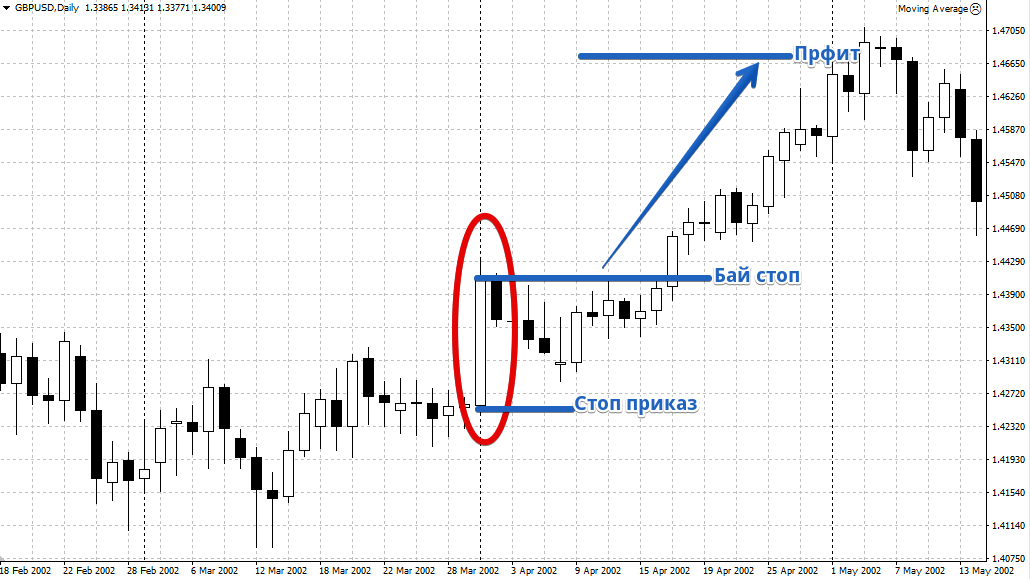

Model Internal bar

An inside bar allows you to trade what's known as market uncertainty, or consolidation as it's also known. It consists of two candlesticks: the first, a large parent candlestick, and a second, smaller candlestick whose body is contained within the first.

The pattern is implemented through pending orders Bye stop And sell stop, which are placed in the direction of the large first candlestick. A stop order is placed at the minimum or maximum of the parent candlestick, with the profit being 203 times the risk. Example:

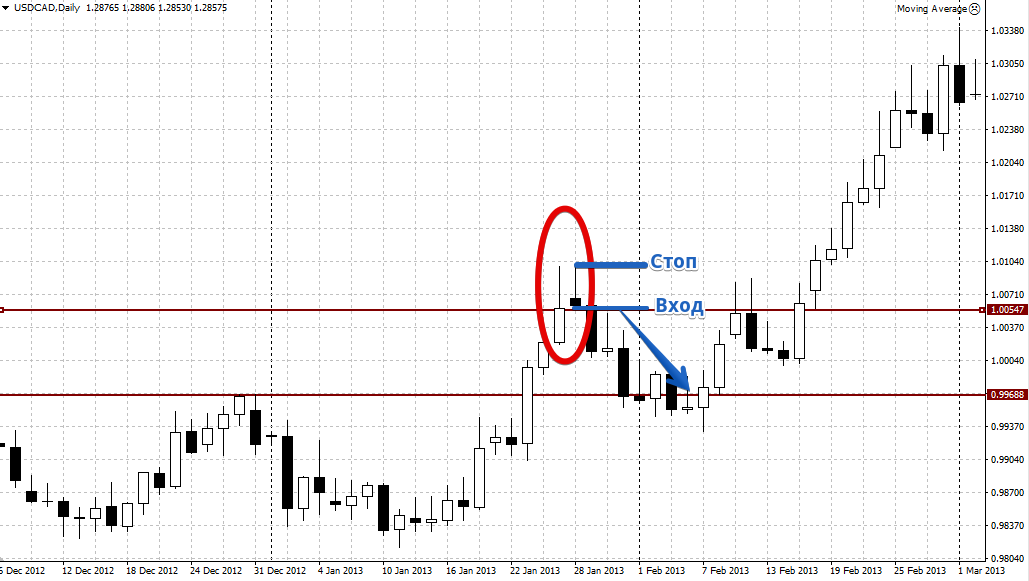

False Breakout with Pin Bar Confirmation Pattern

The essence of the model is to open a position against a breakout of a price level, but on the condition that immediately after the breakout of resistance or support, the next bar that appears will be a “Pin Bar”.

So, if in an uptrend the price hits resistance from below and a pin bar appears, we open a sell position. If in a downtrend the level is broken from above and a pin bar appears, we open a buy position. Example:

If you look at all three models of the "Session Close" or "Day Close" strategy, you can see that the profit always exceeded the expected risks, but in order to achieve this, on average, a trader would have to hold a position for 7-10 days.

However, if you manage to make such deals, with minimal work (20 minutes a day) you could make a profit an order of magnitude higher than any trader trading intraday and spending enormous effort in front of the monitor.