Strategy for trading at the European Forex session

The impact of trading sessions in the Forex market on the profitability and effectiveness of strategies simply cannot be underestimated.

Thus, many traders, and especially novice scalpers, make two fatal mistakes - they trade the wrong asset at the wrong time.

As a result, instead of observing an active market response to the received signal, the trader sees a very sluggish market.

Naturally, in conditions when the price practically does not move and enters a deep flat, it is simply impossible to trade effectively due to the fact that the probability of losses increases significantly.

At the same time, traders who pay attention to only one trading session, which marks the peak of market activity for the selected currency pair, receive simply phenomenal profitability, since they do not waste their time and effort on inactive parts of the market.

In fact, one of the most active trading sessions for major currency pairs is the European one, and in this article we will look at a very simple scalping strategy, which is designed specifically for this time period.

It is worth noting that it can only be used during the European trading session, on currency pairs with the euro or British pound, namely EURUSD, GBPUSD, EURGBP.

The working time frame of the tactic is a five-minute chart of the previously listed currency pairs.

Setting a strategy for trading in the European session

In order to apply a custom trading strategy based on technical indicators, you will need to download the strategy files at the end of the article, and then install the indicators and template into your MT4 trading terminal.

The procedure for installing a strategy, from a practical point of view, is no different from installing any other custom strategy, namely, you will need to place the downloaded indicators and template in the appropriate folders of the trading terminal data directory.

In order to enter the data directory, run your platform and go to the file in the file in the upper left corner. Then you will see a list of options, among which you find and run the line with the name “Open Data Catalog”.

After launching the directory, a list of platform system folders will be displayed on your monitor screen, among which find the folder called Indicators and drop the downloaded indicators into it, and also find the folder called Template and drop the template into it.

In order for the trading platform to be able to see the installed files, it must be updated in the navigator panel or restarted.

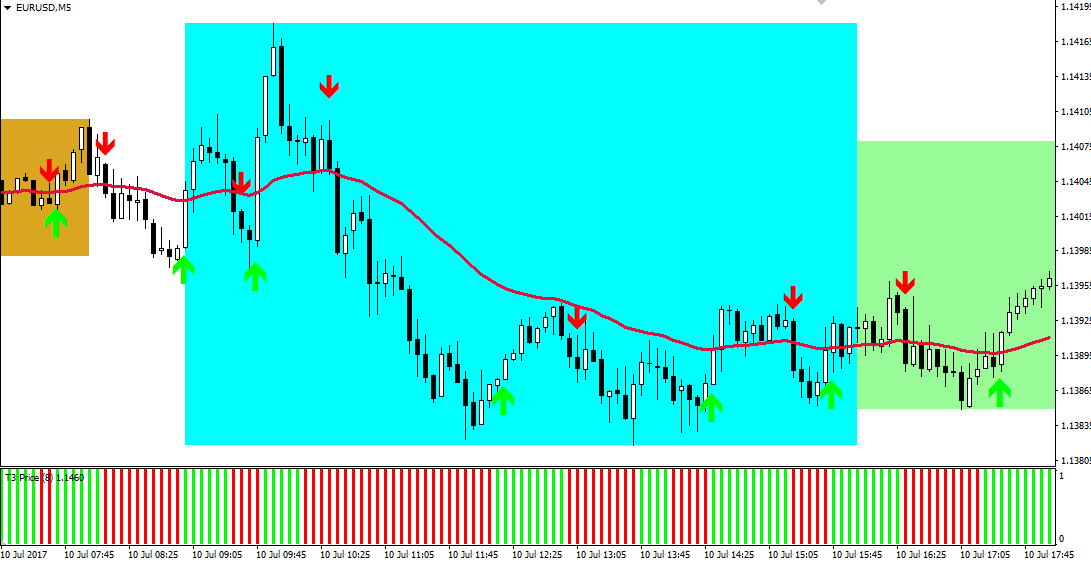

After updating the terminal, open a five-minute chart using one of the following currency pairs and run a template called “Euro Plus” on it. You will get this graph:

Brief information on the strategy. Signals

To determine trading sessions, the strategy uses the i-Session technical indicator, which paints areas on the chart in the appropriate color.

If we talk about the European session, then the indicator paints this area in blue. It is worth noting that the indicator for building areas of trading sessions uses the specified time in the settings and the time of your trading terminal, so before starting trade, it is very important to supervise the time so that the indicator displays the European session correctly.

When trading during the European trading session, it is worth clearly understanding that it is during this period that key statistics for European countries are published en masse.

There is no point in avoiding trading on news, since all the activity of this trading session is triggered by the publication of key statistics. So, let's move directly to trading signals.

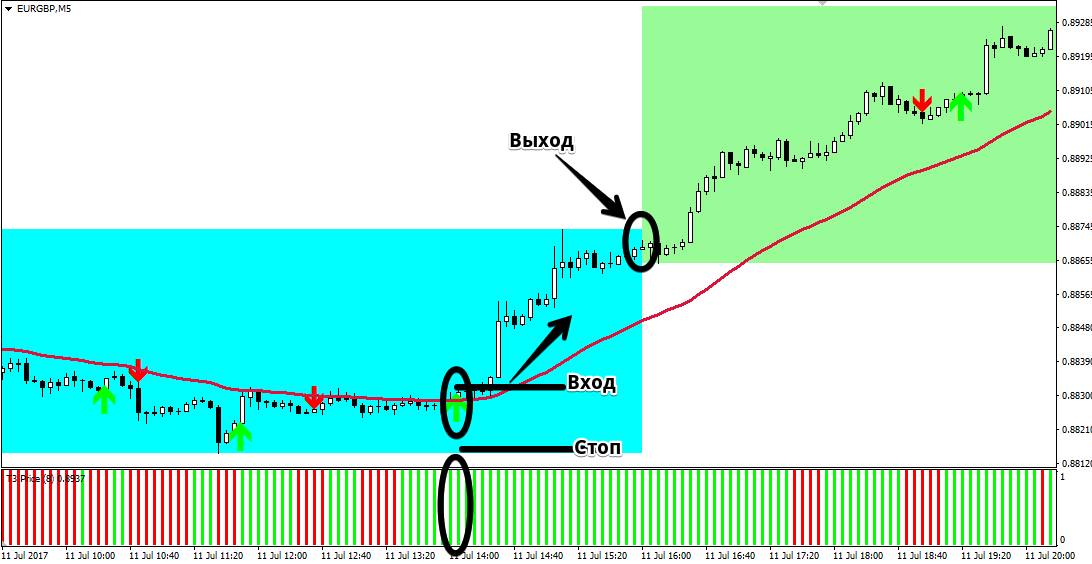

Buy signal:

1) The i-Session indicator paints the area blue.

2) The price is above the moving average with a period of 40.

3) The Trend Master indicator displays a green up arrow.

4) The T3 color Histo indicator bar is colored green.

After opening a position, the stop order should be set at the local minimum level, the profit should be 5-10 points more than the stop order.

If by the end of the European trading session the order is not fixed by profit or stop order, it must be closed manually and the result recorded. Example:

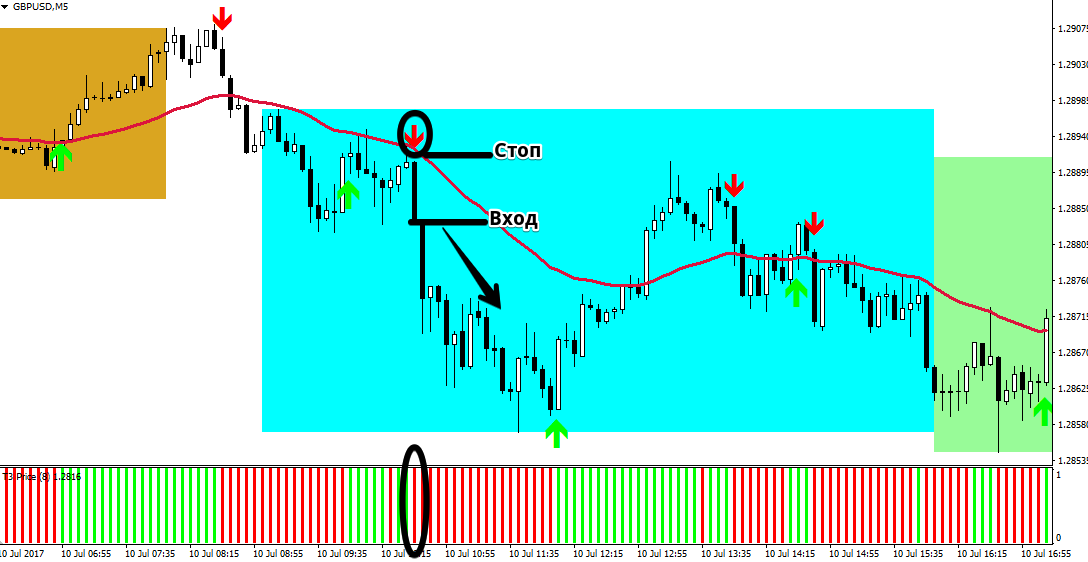

Sell signal:

1) The i-Session indicator paints the area blue.

2) The price is below the moving average with a period of 40.

3) The Trend Master indicator displays a red down arrow.

4) The T3 color Histo indicator bar is colored red.

After opening a sell position, the stop order should be set at the level of the local maximum, and the profit should be 5-10 points more than the stop.

If at the end of the European session the order has not reached the target, it must be closed manually.

In conclusion, it is worth noting that trading on European forex trading session has a number of features that are caused by high market activity for major currency pairs during this period.

However, this particular period is the most prosperous for all scalpers in the Forex market.

Download strategy template.