Moving Average Strategy "Fan"

Moving averages, or the correct name, are the very first technical indicator that was created specifically for the objective assessment of price movements by averaging its value over a certain period in order to cut out market noise.

Thanks to the simple averaging Traders were able to achieve better trend identification and, as a result, trend reversals.

It is this simple indicator that has become the basis for many other technical analysis tools, not to mention trend strategies, of which there are hundreds, and all of them have a right to exist.

However, for many, it remains a mystery to this day which Moving Average periods are optimal for trading, since each period has its own unique information content, taking into account a particular level of market noise.

In fact, there is no clear answer to this question, but at the same time, the practice of using several moving averages with different periods simultaneously is very widespread.

The Moving Average Fan Strategy is a trend trading strategy that uses only the Moving Average but also uses different timeframes to assess short-term, medium-term, and long-term asset movement trends.

The strategy received its name "Fan" based on the key signal of the strategy, when during periods of major trends, moving averages line up one after another at a certain distance and resemble an unfolded fan.

The strategy is very sensitive to time frames, as experience shows that the higher the chart period, the fewer false moves it sees. Therefore, the strategy can be applied on hourly charts and higher.

Also, the Moving Average strategy can be applied to all currency pairs simultaneously, the only thing you need to pay attention to is spread size at brokers.

Building a Strategy on a Moving Average

Moving averages are notable because they are built into all trading platforms today.To recreate the Fan strategy, you'll need to plot five exponential moving averages with periods of 7, 20, 30, 60, and 90 on a chart. Be sure to assign different colors to the lines to avoid confusion.

A special strategy template has been prepared for traders using the MT4 trading terminal. You can download it at the end of this article, after which you'll need to install it. To do this, simply copy the downloaded template file to the appropriate folder in the data directory, and then to Template.

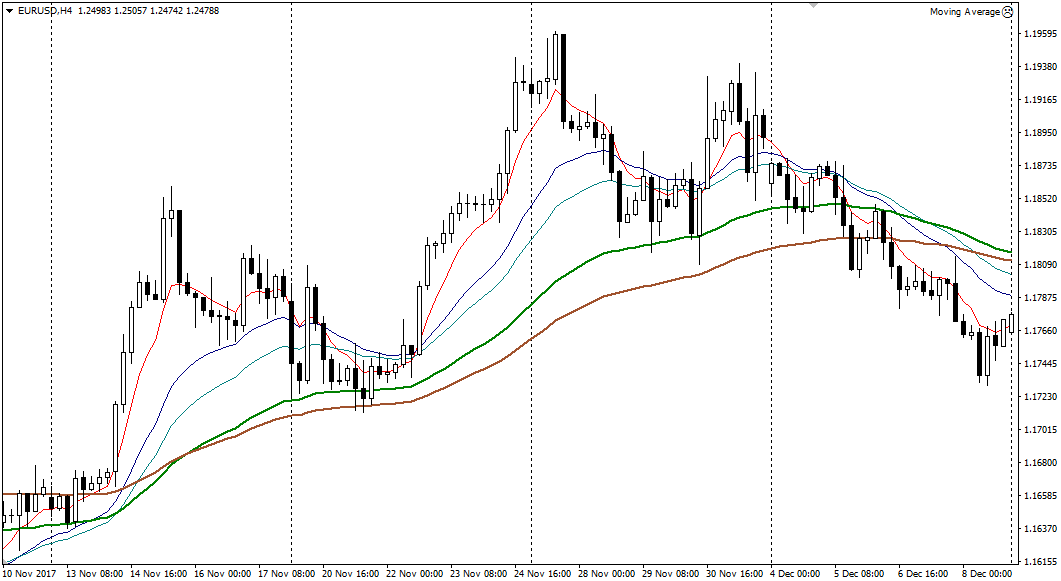

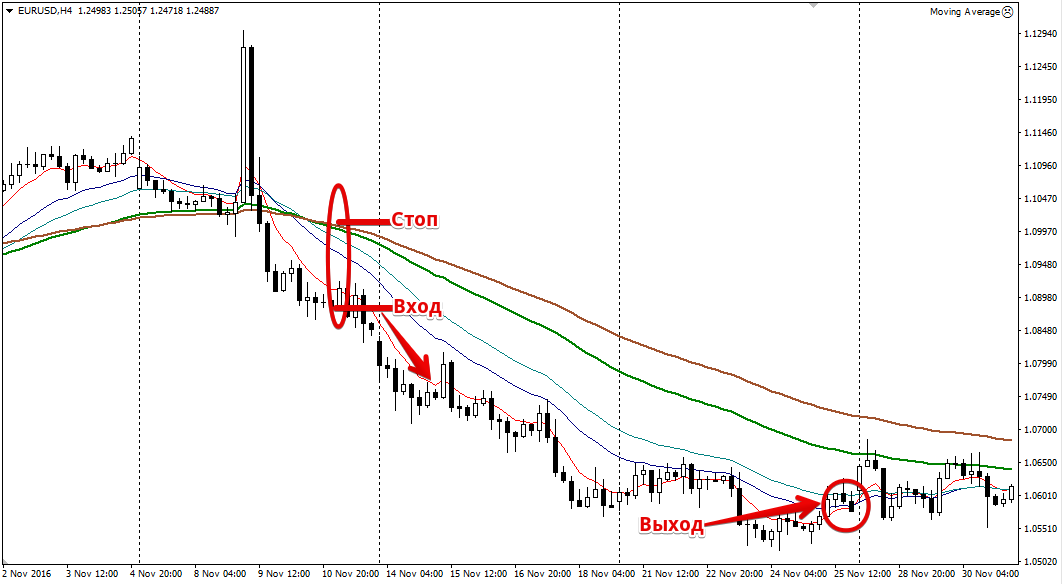

Then, after you restart the trading terminal or refresh it in the navigator panel, open a four-hour chart of any currency pair and run the "Fan" strategy template on it. You'll see the following:

Practice of application

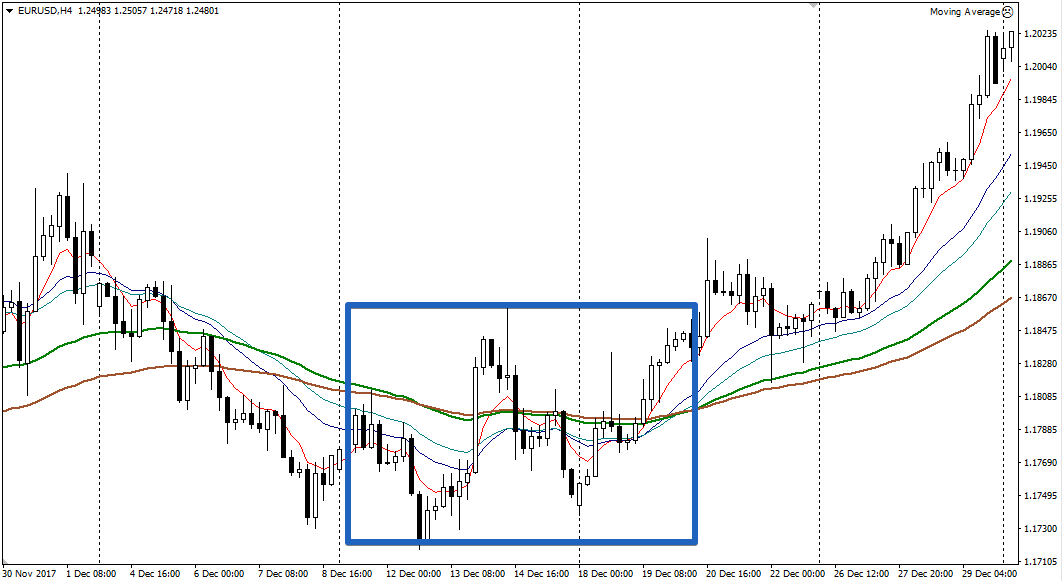

Most trend strategies become helpless when a trend appears flat in the market, since in most cases they are all aimed at capturing short-term trends or impulses.

With the Fan strategy, its key signal is focused only on strong trends, while weak trends and sideways movements are immediately eliminated. Incidentally, sideways movements and unfavorable trading moments appear on the chart as follows:

When starting trading, it's crucial to assess the long-term trend. To do this, pay attention to 60- and 90-period moving averages.

If the 60-period moving average is above the 90-period moving average, we consider only buy signals, and if it is below it, we consider only sell positions.

When trading, all moving averages should be placed one after another, ascending for purchases and descending for sales, which should resemble a fan.

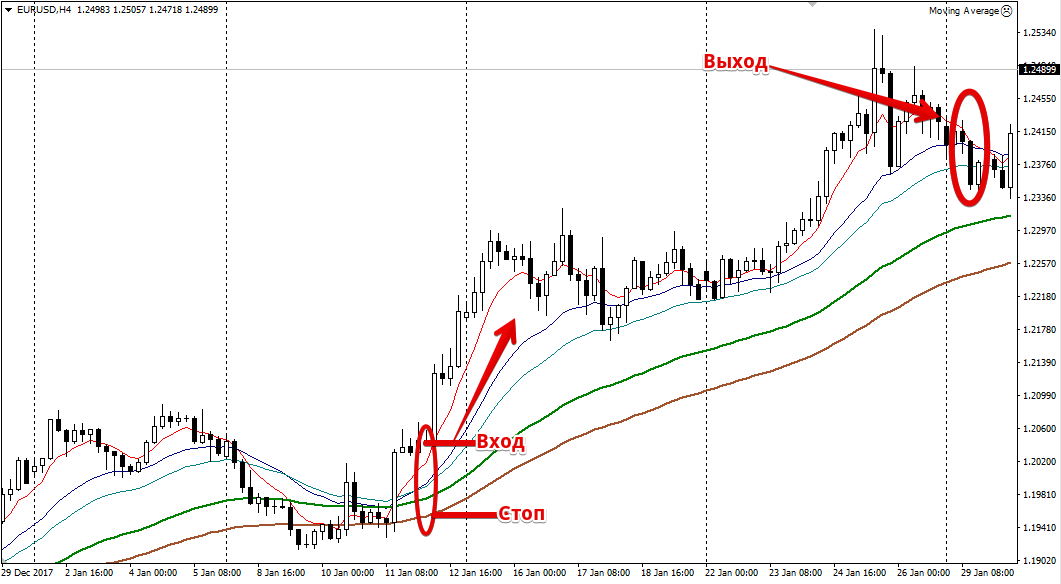

Buy signal:

1) MA 60 is located above MA90.

2)MA 30 is located above MA60.

3) MA 20 is located above MA 30.

4) MA 7 is located above MA 20;

At the moment when all the moving averages line up one after another, opening like a fan, a buy position is opened.

A stop order should be placed below or at the level of the 90-period Moving Average. To close a position, you can use the reverse intersection of the 7- and 20-period Moving Averages.

Sell signal:

1) MA 60 is located under MA90.

2)MA 30 is located under MA60.

3) MA 20 is located along MA 30.

4) MA 7 is located under MA 20;

When all the moving averages line up one after another, opening like a fan, a sell position is opened. A stop order should be placed above or at the 90-period Moving Average.

To close a position, you can use the reverse intersection of moving averages with periods of 7 and 20, namely, if the moving average with a period of 7 crosses the moving average with a period of 20 from top to bottom.

In conclusion, it's worth noting that the Fan strategy generates signals quite infrequently, but since the profit is almost always many times greater than the stop order, its effectiveness is very high.

Also pay attention to the removal swap, since positions can be held in the market for several days!

Download the Moving Average strategy template “Fan”