A Simple Correlation-Based Forex Strategy: What Have Brokers Been Hiding From Us?

In online trading terminology, the term "correlation" refers to the relationship in the pricing of financial instruments.

There's a well-known strategy for profiting from spread differences, based on correlation.

There's a well-known strategy for profiting from spread differences, based on correlation.

When working with reliable brokers who provide access to interbank liquidity, the difference between the asset's bid/ask prices (Bit/Ask) is always floating.

During periods of high liquidity (such as the publication of macroeconomic data), the spread widens, while during moderate liquidity, it stabilizes.

This variable liquidity is due to the predominance of demand over supply.

A well-known strategy for making money on correlations

There's a concept called the "correlation coefficient." This value ranges from 1 to -1, where 1 signifies a direct correlation between financial instruments (the charts move synchronously), and -1 signifies an inverse relationship (the asset prices move in the opposite direction).

A correlation coefficient of 0 indicates a lack of correlation between the assets. For example, the pricing of stock indices is virtually independent of the value EUR

futures A well-known correlation strategy involves opening two trades in the same direction on assets whose correlation coefficient tends toward -1. This is a form of hedging .

When the spread widens, both orders are closed, locking in a profit equal to the spread range. This trading tactic seems quite simple, and its description can be found on many information websites.

However, the authors of these reviews fail to mention that, in addition to correlation, it's important to consider the moderate market spread of these assets, which in total should not exceed 3 pips.

Furthermore, trades should be opened during a period when the spread is minimal. This can only be determined in advance by properly working with cluster charts, which are inaccessible to many beginning traders.

A more affordable alternative

In fact, there's a simpler way to profit from correlations, one that involves virtually no trading risks.

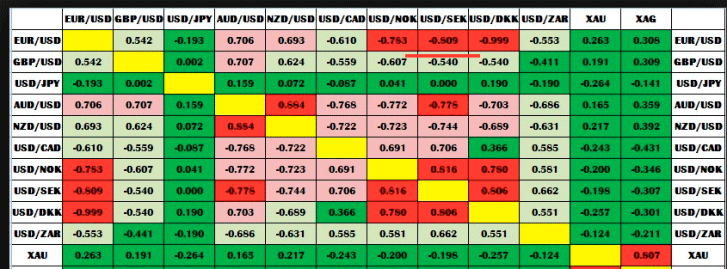

To understand the trading principle, first look at the correlation table:

As you can see, the correlation coefficient for the USD/SEK and EUR/USD currency pairs is negative, equal to -0.809.

As you can see, the correlation coefficient for the USD/SEK and EUR/USD currency pairs is negative, equal to -0.809.

This indicates that the price charts of these assets always move in opposite directions.

Now, let's use a little imagination and imagine what would happen if you simultaneously opened two trades in the same direction on these assets and held them for a month, with the swap being positive.

Unfortunately, every broker is aware of this potential for profit, so it's important to work only with companies that provide clients with direct access to interbank liquidity.

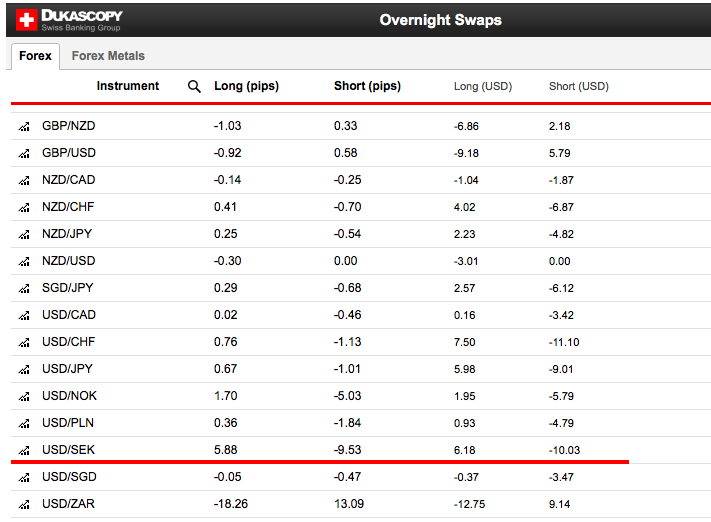

Let's consider the practical application of this strategy using Dukascopy Bank as an example:

The broker's official website has a "Contract Specifications" section. Please note that when rolling over an open Buy order to the next day, the swap is positive and amounts to 6.18 pips.

The broker's official website has a "Contract Specifications" section. Please note that when rolling over an open Buy order to the next day, the swap is positive and amounts to 6.18 pips.

Unfortunately, when opening a similar position on EUR/USD, the swap is negative and amounts to over 11 pips. Therefore, an alternative option should be considered.

The correlation coefficient for the USD/SEK and AUD/USD currency pairs is also negative and amounts to -0.778, which is slightly lower than the value discussed previously.

According to Dukascopy's trading conditions, the swap for rolling over a Buy order to the next day is -3.71:

This means that by simultaneously opening two Buy orders on the USD/SEK and AUD/USD pairs, the profit will be 2.47 pips daily.

This means that by simultaneously opening two Buy orders on the USD/SEK and AUD/USD pairs, the profit will be 2.47 pips daily.

The minimum deposit to start trading with Dukascopy is USD 1,000. The leverage level is 1:100. This is sufficient to open trades with a volume of 0.5 lots.

Thus, the daily profit will be approximately USD 15, or 45% per month. The optimal volume to minimize risks is 0.2 lots, which will allow you to earn approximately 15% per month on your starting deposit.

Keep in mind that swaps are tripled overnight from Thursday to Friday.

Conclusion

Earning on correlation is not only possible, but also accessible to everyone. The trading example presented in this article is not a panacea.

Contract specifications vary from broker to broker, so it is entirely possible to find alternative trading options based on a similar model.

When choosing a broker, it is important to carefully review the user agreement and ensure its reliability.

Dukascopy Bank was used as an example because its activities are regulated by FINMA and current Swiss law, ensuring the safety of user funds and the absence of conflicts of interest.