Forex broker spreads

As we know, the spread size always depends on several parameters—the currency pair, the brokerage company, and the market situation. While we can't control the latter, we can certainly determine which broker offers the lowest commission and for which currency pair.

While we can't control the latter, we can certainly determine which broker offers the lowest commission and for which currency pair.

Below I will indicate the average spread depending on the specific broker, for the most popular currency pairs and the Bitcoin cryptocurrency.

To make it easier to compare indicators, I have highlighted brokerage companies with the smallest spreads.

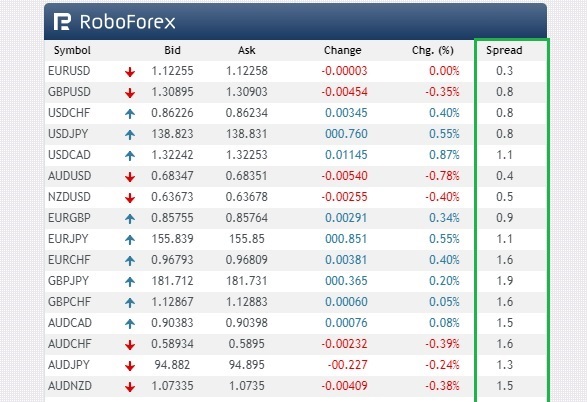

The table shows average spread sizes, as brokers usually indicate that their minimum spread size is 0 pips:

Important points to consider when comparing forex broker spreads

Before registering with a brokerage company, you can check the current spread yourself. To do this, simply visit the quotes section, which is available at any broker.

As a rule, quotes also have a column in which the parameter we need is indicated.

When choosing a broker with the lowest spread, remember that the commission also depends on the account type; professional ECN accounts typically charge much lower commissions. Furthermore, broker spreads widen significantly during periods of low liquidity, typically before holidays.

Cashback or rebate is also an important feature; it's not available at all companies, but it allows you to get back up to 50% of your commission.

As for currency pairs, the smallest size for instruments that include the US dollar or euro will help us navigate this issue; the difference between buying and selling will be the indicator we need.

Brokers often advertise zero-spread accounts, but fail to mention that such accounts may incur a commission based on turnover. This means you still pay a fee when you open a trade and don't win anything.

To avoid overpaying, we recommend installing a special script . This will allow you to check the accuracy of the data specified in the currency pair specifications and select a brokerage company with the most favorable trading conditions.

In conclusion, I would like to note that if you open no more than one or two trades per day, then you can completely ignore such an indicator as the fee for opening positions; the 3-4 dollars paid per 100,000 trade is unlikely to have a significant impact on your financial results.