Stock brokers' commissions for opening trades on the exchange

When starting forex trading, you should know how much you'll have to pay and what you'll pay for it—that is, what brokerage commissions are available.

is, what brokerage commissions are available.

Surprisingly, many traders are simply unaware of the number of additional costs they may face.

Sometimes this information isn't always disclosed transparently, so be especially careful when reading trading terms and agreements.

A forex broker's commission can include the following: spread, lot fee, swap for rolling over positions, and SMS for withdrawing positions.

There may also be other fees that may apply depending on the company you are trading with.

What brokerage fees are available to individuals in the stock or forex market?

A Forex spread is the basic fee charged by a broker when trading currency; it is essentially the difference between buying and selling a currency pair.

So, you bought the euro at $1.1053, but you can immediately sell it for $1.1051, 2 pips cheaper. This difference is charged when you open the new position, meaning your financial result will be -2 pips immediately after opening the trade.

The spread can be floating or fixed, depending on trading conditions. Its value depends on the popularity of the currency pair and can range from 0.1 to 100 pips.

The spread can be floating or fixed, depending on trading conditions. Its value depends on the popularity of the currency pair and can range from 0.1 to 100 pips.

The minimum commission for stock brokers (spread) is listed here: https://time-forex.com/vsebrokery/spred-broker

Volume fees can sometimes be a trap for inexperienced traders. In addition to the standard spread, dealing centers also charge a percentage or fixed fee for each trade. For example, if the spread is 1 pip, the broker's commission is 0.02%.

As a result, opening a 1-lot order on EURUSD yields $10 + $20, meaning the actual opening fee is 3 pips. However, lot fees are typically found on accounts with floating spreads.

Brokerage companies often advertise that trading is spread-free, but they forget to indicate the amount of commission charged.

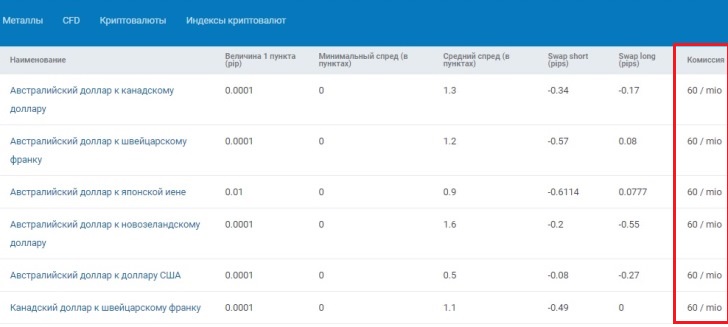

The figure shows that, in addition to the spread, the broker's commission is $60 per 1 million traded, meaning you'll have to pay about $6 per lot in this case. Or roughly an additional 0.6 pips on top of the floating spread.

In most cases, there is no significant difference between the commission and the spread. If you recalculate how much you will pay for one transaction of the same volume, then most likely these two indicators will be equal.

Commission-free exchange brokers, only spreads and swaps -

Alpari and RoboForex. Swap is the fee for moving an order overnight, which may include the difference between the interest rates on both currencies in the currency pair and an additional broker commission.

It should also be noted that the fee for carrying over positions is charged not only for currencies, but also when trading other assets, such as stocks, futures, and metals.

The swap amount is usually not large and cannot fundamentally change the financial result, while the swap can be either negative or positive.

You can learn about the importance of swaps when trading on the exchange at https://time-forex.com/praktika/svop-fx and how this payment method is calculated.

Withdrawals – many companies charge fees for withdrawing your hard-earned funds, typically around 0.5-2%. This is how the broker encourages clients to continue trading or use certain payment systems.

However, sometimes, for certain types of payment systems, stockbrokers' fees for withdrawals can reach 4%.

These are probably all the cases where you'll have to pay extra when using the services of forex dealing centers.