Nonfarm Payrolls Strategy

Fundamental analysis, which is extremely popular among traders trading stocks and other securities on the stock exchange, has come under justified criticism from traders in the foreign exchange market.

This is primarily due to the fact that the impact of financial statements on the price of one individual share simply cannot be compared with the impact of certain news on the exchange rate of the national currency of an entire country.

Unfortunately, fundamental analysis in the forex market has proven less effective, as exchange rate stability depends largely not only on economic indicators, but also on sound central bank policies and political leadership.

However, there is no need to be strictly tied to a specific scenario to trade successfully, as the very fact of a price impulse occurring at a certain time, as well as a sharp increase in liquidity, can become an excellent opportunity to implement any momentum trading strategy.

In this article, you'll learn about one such impulse strategy that allows you to profit from news such as Nonfarm Payrolls.

The Nonfarm Payrolls Strategy is a momentum trading strategy based on fundamental analysis, namely, based on such a key macroeconomic indicator of the US economy as Nonfarm Payrolls.

It is also worth noting that since the main goal of the Nonfarm Payrolls strategy is to capture price momentum, it can be applied on absolutely any trading time frame.

Nonfarm Payrolls: Predictable Unpredictability

Nonfarm Payrolls is a key piece of news for all speculative traders, as it can show us how much the US economy has strengthened, and consequently the dollar.

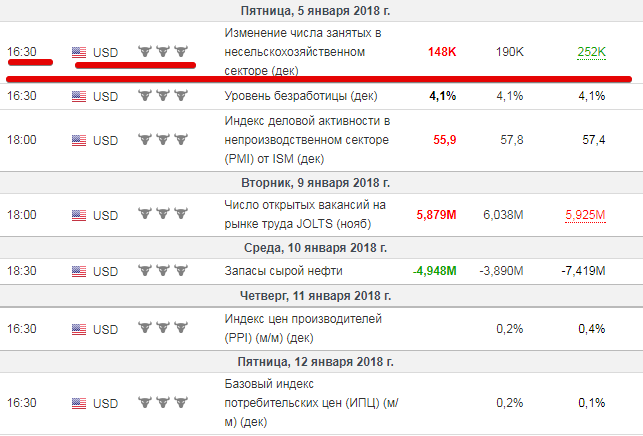

The thing is that Nonfarm Payrolls shows the number of people employed in the non-farm sector, and in our Russian economic calendar it looks like “Change in the number of people employed in the US non-farm sector.”.

The reason why this news is so important is that the non-agricultural sector of the economy, the lion's share of which falls to industry, is responsible for filling 80 percent of the country's GDP.

Thus, by monitoring employment, it is possible to predict the dollar exchange rate and draw conclusions about the country's changing economy.

Typically, when Nonfarm Payrolls are published, the market experiences the highest volatilityThe price can move 100-200 points in a very short period of time, but we're talking about the post-news effect.

The news itself is published every first Friday of the month, but interpreting it is far from straightforward. The fact is that unemployment statistics are released simultaneously with Nonfarm Payrolls.

Since the data can contradict each other, the market becomes virtually unpredictable, and only in rare cases, when the news moves in unison, does the price move in a more targeted direction.

However, despite the fact that it is almost impossible to predict the price behavior after the news is published, it is safe to say that it will cause a strong price impulse, which is captured by the strategy.

Nonfarm Payrolls Strategy Rules and Signals

To work with the Nonfarm Payrolls strategy, we will need an economic calendar, which will help you track news releases.

It's crucial to understand that data release delays are completely normal for a strategy, so it's crucial to track such changes promptly. Our economic calendar can help you with this http://time-forex.com/kalendar.

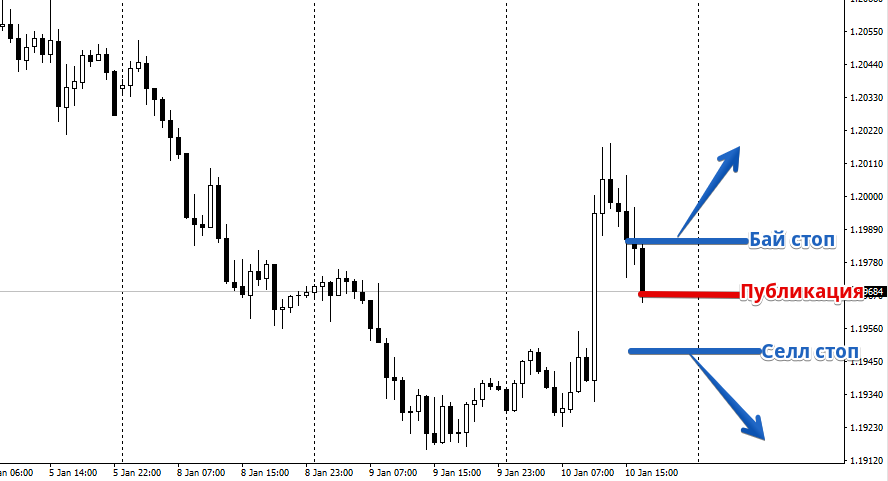

Once you know the news release date and time, you need to place two pending orders, Buy Stop and Sell Stop, a couple of minutes before the publication.

The pending orders themselves are placed at a distance of 25-30 points from the current price, which allows you to avoid the simultaneous triggering of two orders, which can occur due to a sharp increase in volatility.

After the price reacts with a price impulse and one of the two pending orders is triggered, the second must be deleted as an unworked scenario.

You must place a stop either on the opposite order, or you can not place one at all, provided that you do not delete the second pending order, which will block your loss.

Profit is fixed with the help of trailing stop, which should be moved as long as possible following the price in order to squeeze out the maximum price momentum.

In conclusion, it is worth noting that Nonfarm Payrolls is one of the most highly volatile news items, causing price movements in all dollar-denominated currency pairs.

The described rules of the impulse strategy can be applied to absolutely any strong news that can move the market.