Elder's Three Screen Strategy - detailed description, indicators, books

This trading method is used by most Forex traders, who don't even realize that their work is based on the "Elder's Three Screen Strategy.".

This trading option is so simple that almost any novice trader can use it.

It's also worth noting its complete versatility; the three-screen strategy can be applied to virtually any trading instrument, both on the Forex market and on other financial markets.

Elder's Three Screens can be used as a standalone trading option or as a complement to other forex trading options.

It's true that there are quite a few different opinions about the effectiveness of this strategy; everything depends on the market situation, your attentiveness, and your experience.

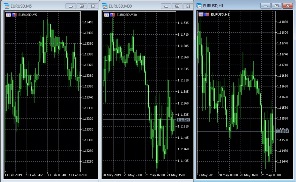

As the name suggests, trading is based on the analysis of three screens, or time intervals, of the trading terminal.

The following timeframes are best for working:

1. M30 – medium-term time interval of 30 minutes.

2. M5 – short-term time interval of 5 minutes.

3. H1 – long-term timeframe.

If you wish, you can move the screens in one direction or another depending on your preferences, the only condition is that they must all relate to intraday trading.

We will conduct trading according to the following scheme:

1. First, we analyze H1 and determine the direction of the main trend, find the starting point of the existing trend and the middle.

2. On M30, we check for rollbacks against the main trend; this will serve as an additional guide when opening positions.

3. On the M5, find the entry point into the market.

The signal to open a position in the Elder Three Screen strategy will be the start of a movement in the direction of the main trend on M5, while the direction of the transaction must coincide with the start of the movement on M30.

The charts show that the Forex market is currently experiencing an uptrend, with prices rising simultaneously on three screens. For greater effectiveness in this situation, I would wait for a pullback on the M5 before entering the market.

For greater clarity, it is recommended to use the stochastic indicator ; in this case, a buy transaction is made if the stochastic line leaves the oversold zone and begins to move upward on two lower time intervals.

Alternatively, other trend indicators ; they will make the work easier and facilitate the search for entry points into the market.

Using stop orders in Elder's Three Screen Strategy.

a stop loss based on the minimum or maximum points on the M30, depending on the direction of the transaction; its value is usually in the region of several dozen points.

Take profit – similar to the order, but in the same direction as the trade opening. The main goal of this order is to ensure that the trade is closed before the trend starts to reverse.

Elder's Triple Screen Strategy allows you to find the most favorable entry points and thereby profit. It's a trading classic, so to speak, and can be used even without additional technical analysis indicators on virtually any time frame. It's no wonder that it's been used in stock trading for over 50 years by successive generations of traders.

Setting up three screens for the Elder strategy - https://time-forex.com/sovet/ustanovka-tri-ekrana

Book by the author - https://time-forex.com/knigi/silny-signal-elder