Folding Rule Strategy

Greetings, dear visitors. Many of you sooner or later come to the conclusion that finding a trend reversal point is one of the best ways to make money on the stock market.

a trend reversal point is one of the best ways to make money on the stock market.

Another important fact is that identifying a reversal point in a timely manner will help you always exit a position promptly, without losing your profit.

Various indicators are available on various resources whose primary purpose is to identify such points.

But, unfortunately, as a rule, all these indicators give losing signals that are in no way connected with a price reversal.

Today I would like to introduce you to a well-known pattern called the “Folding Ruler”, which is based on technical analysis .

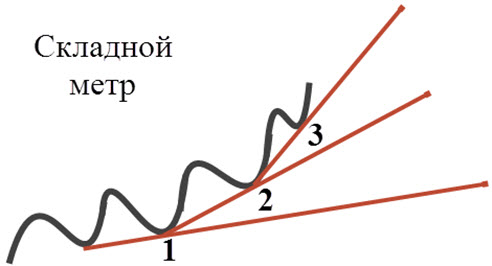

The author of this pattern argues that for each trend phase listed above, you should draw its own trend lines. By drawing three lines, you'll create a pattern whose breakout will guide your trading. To begin, take any currency pair and draw a trend line along the two extremes.

If the trend is upward, the trend line is drawn along two lows, and if the price is bearish, the line is drawn along two highs. This way, you can identify the first phase of the trend. Next, from the second extreme, along which the trend line was drawn for the first phase, draw another trend line with the new extreme.

This will highlight the second phase of the trend. You should draw a third trend line from the extreme point of the previous trend line (which marked the second phase of the trend) to the new extreme. Thus, using three trend lines, you've outlined all three phases of the trend. You can see an example of how this should look in the image below:

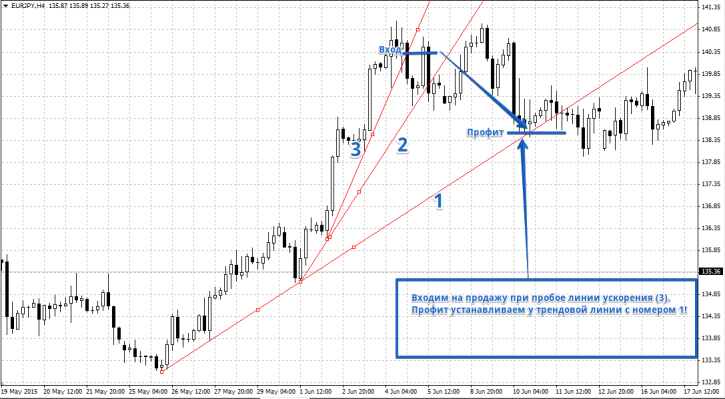

Now, let's move from constructing the pattern itself to trading signals , which we'll use to enter a position. Let's consider a bullish trend. After you've marked all the lines on the chart, a price reversal signal is a breakout of the third line, or, as we've called it, "trend acceleration." When the price breaks the third line during a bullish trend, we enter a sell trade. You should place your profit at the level of the first trend line. You can see an example of entering a sell trade in the image below:

Now, let's move from constructing the pattern itself to trading signals , which we'll use to enter a position. Let's consider a bullish trend. After you've marked all the lines on the chart, a price reversal signal is a breakout of the third line, or, as we've called it, "trend acceleration." When the price breaks the third line during a bullish trend, we enter a sell trade. You should place your profit at the level of the first trend line. You can see an example of entering a sell trade in the image below:

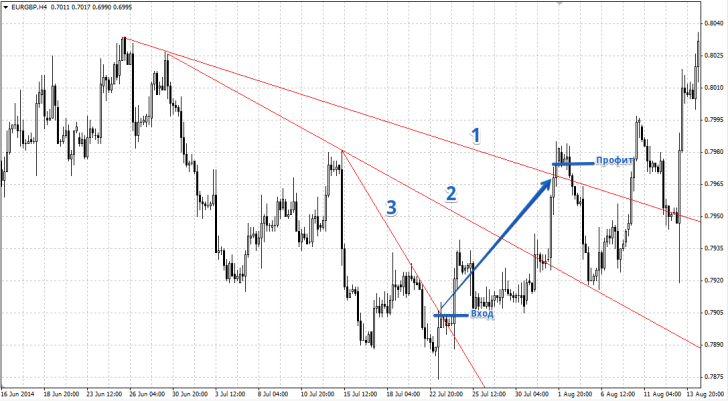

The conditions for entering a buy trade are the same. Specifically, draw a "Folding Rule" pattern in a bearish market and enter the position if the price crosses the third trend line. You should take profit at the first trend line. You can see an example of a position entry in the image below:

Stop orders should be placed near support or resistance levels, local highs and lows. You may also encounter some difficulties when searching for extremes, which can be easily resolved by adding a fractal indicator.

Despite the difficulties that arise when constructing this model, it almost always pays off. However, I would like to point out that this tool shouldn't be used as a primary trading strategy, as you'll be out of the market most of the time, missing out on the most important and profitable trend movements, profiting only on pullbacks. Therefore, this pattern makes a good addition to your primary trading strategy. Thank you for your attention, and good luck!