Inside Bar indicator-free strategy: my opinion

The use of candlestick patterns, price action, and a complete rejection of indicator-based Forex strategies are considered the pinnacle of professionalism among novice traders.

Of course, abandoning the so-called crutches allows us to significantly overcome the situation regarding signal delays.

After all, the entire trading process centers on price patterns, not secondary indicator tools, which in most cases have a lagging nature.

However, a single entry point is often far from sufficient, as sometimes what matters isn't the entry point itself, but how effectively the trader exits the position, whether they can reap the full profit from the price movement or close the trade immediately.

Therefore, the effectiveness of price action is greatly exaggerated.

You will also be able to understand how to turn the weaknesses of indicator-free strategies into strengths using simple tools.

The Inside Bar strategy, which uses no indicators, is a simple price action strategy that uses the frequently encountered Inside Bar pattern as a signal.

The strategy itself doesn't have any specific requirements for a currency pair or asset, so it can be considered multi-currency.

It's also worth understanding that the Inside Bar strategy can be used on all time frames; however, as experience with candlestick patterns and strategies based on them shows, maximum effectiveness is achieved on higher time frames, such as H4 and D1.

Introduction to the Inside Bar pattern. Strategy signals:

Stages of uncertainty, equilibrium, and parity, often referred to as a kind of truce between bulls and bears, are a common basis for developing breakout strategies.

Exiting consolidation zones, breaking out of flats, and breaking out of trading session ranges—all these strategies are built on a sharp change in the strength of participants who were recently in equilibrium.

The Inside Bar pattern is a pattern of uncertainty and equilibrium, indicating a relative balance of power between bulls and bears.

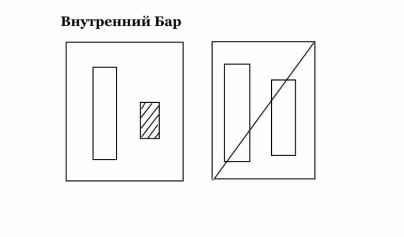

The pattern itself consists of two candlesticks: a large first candlestick in the same direction as the price movement, followed by a smaller second candlestick, which lies between the low and high of the first candlestick.

This combination indicates a certain balance between the two sides, as the large movement has been halted, but the price remains within the candlestick's boundaries. It's important to understand that the second candlestick must be significantly smaller than the first, otherwise it's a false pattern.

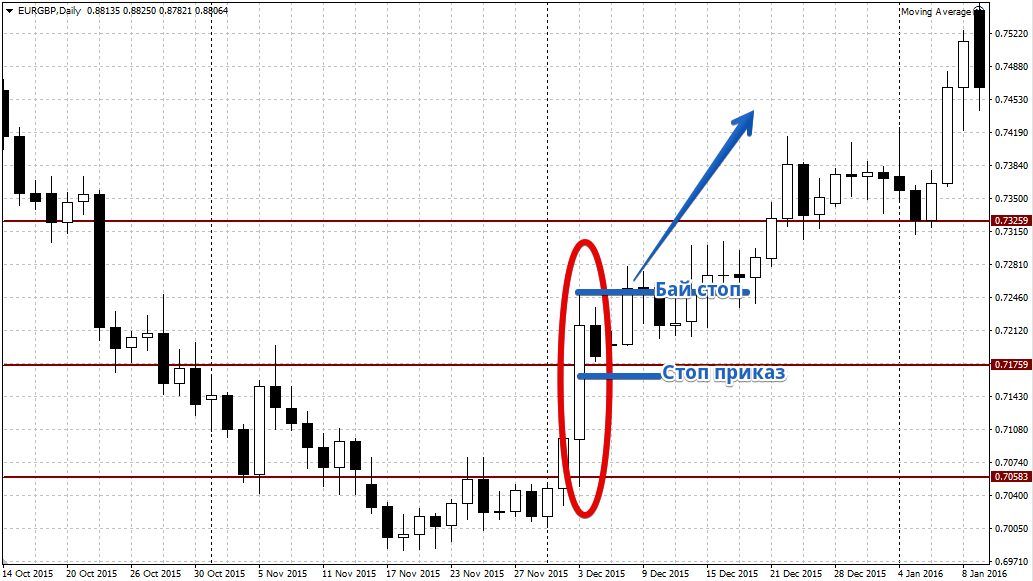

When trading this strategy, it's important to pay attention to support and resistance levels.

Any pattern, especially the Inside Bar, works effectively when supported by a certain support level, and this can be either the first or second candlestick. If there's no nearby support level, it's best to ignore the pattern.

The strategy is implemented using pending buy-stop and sell-stop orders. So, if a large bullish candlestick appears in an uptrend, followed by a bearish one that doesn't move beyond the low and high of the previous candlestick, place a pending buy-stop order at the high of the bullish candlestick.

If a large bearish candlestick appears in a downtrend, followed by a small bullish one that doesn't move beyond the low and high of the first candlestick, place a pending sell-stop order at the low of the first candlestick.

The trader places the stop order either behind the opposite tail of the signal candlestick or immediately behind the nearest level. Example:

A stone in the garden without indicator strategies:

Using the same strategy without indicators can lead to completely different results.

The fact is that it is very difficult to discuss the accuracy of graphical analysis, price action, and the Inside Bar strategy itself, as this type of analysis is directly related to the trader's imagination and attention to detail.

Therefore, the subjectivity of traders' market views is a key factor that can influence the strategy's profitability.

A second open question for Inside Bar strategists is trend determination, since each trader can interpret a particular wave as either a pullback from the trend or the beginning of a new trend.

The only way to solve this problem is to eliminate the subjectivity of trend perception, and any trend-following technical indicator can help with this!

In conclusion, it is worth noting that using the Inside Bar strategy without additional filters can lead to very unpredictable consequences, as the strategy's effectiveness largely depends on the trader's subjective perception.

However, if you deviate from your own principles and supplement the strategy with at least one trend indicator that allows you to clearly see the trend direction, the strategy's profitability will immediately increase significantly!