Minute MAX MACD Strategy

Compared to other trading tactics, scalping strategies allow you to achieve increased profitability in a short period of time.

Moreover, with proper capital management, the risk per position in points is usually so minimal that if you were using a trend strategy and received one stop order of 60 points, then with scalping you would have to allow 4-6 losing trades in a row to incur the same losses.

This increased profitability is achieved by capturing any micro movements that can be observed on the minute chart.

The minute strategy, like no other, requires the trader's full presence and a very cold-blooded trading tactic.

Scalping without a clear strategy means chaotic trades that will never lead to anything good. That's why the MAX MACD one-minute strategy will allow you to make your trading systematic, without any unpredictable actions.

Based on the name, you've probably already guessed that the strategy is adapted for trading on a minute chart, and the choice of currency pair or metal is entirely up to the trader, as the strategy is universal.

The only requirement for working with the strategy is the availability of the MT4 trading terminal, since the special indicator included in the trading strategy is tailored strictly for this platform.

Setting up the components for the Minute Strategy

Before continuing, go to the end of the article and download the required indicator and template. Installing the strategy in MT4 is quite simple. To do this, open the terminal and go to the File menu and open the data directory.

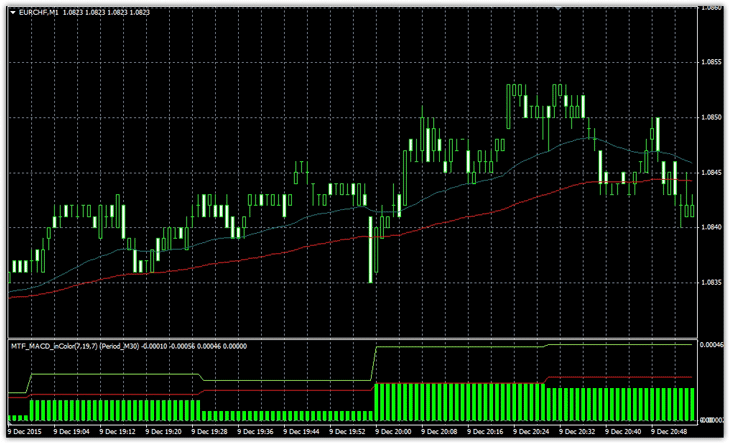

In the open directory, find the "Indicators" folder and place the indicator there. The template should be placed in the "Template" folder. Without restarting the terminal, click "Refresh" in the navigator panel where the indicators are located. After this procedure, simply go to your templates list and launch the "Minute MAX MACD Strategy." After launching the template, your strategy is ready to use, and the working chart will look like this:

Trading signals. Information on indicators

The foundation of this minute strategy is just three simple indicators, namely two trend moving averages with periods of 20 and 50, which you can see as a red and blue line on the chart, as well as a modified MAX MACD oscillator, which is based on the familiar MACD .

To ensure that all trades do not diverge from the main global trend, a higher time frame is set in the MAX MACD settings, namely m30, which allows filtering out most trades that diverge from the main global trend.

All indicator settings are transparent, so you can always adjust their performance in the event of significant market changes. So, let's get to the signals.

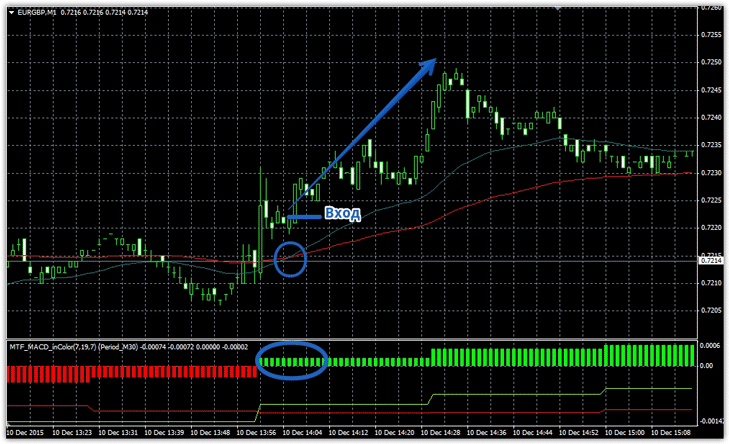

The buy signal is based on only two market conditions, namely:

1) The 20-period moving average (blue) must cross the 50-period moving average (red) from bottom to top.

2) The MAX MACD histogram bar should be above zero and colored green.

We enter the position only after the candle closes. See an example of a buy signal below:

The sell signal is based on only two market conditions, namely:

1) The 20-period moving average (blue) must cross the 50-period moving average (red) from top to bottom.

2) The MAX MACD histogram bar should be below zero and colored red.

Enter the position only after the candle closes. See an example of a sell signal below:

You're probably wondering why such a long period is needed for moving averages, considering that the trading is only done on a one-minute chart. The point is that using moving averages with such a long period emphasizes quality rather than quantity of signals, since it's precisely when working with a long period that you can detect significant price deviations from its average value, and the signals tend to be effective.

Setting stop orders. Capital management

Initially, the strategy recommends using a static stop order, specifically 10-15 pips, depending on market volatility . However, I personally find it easier to place stop orders at local highs and lows. Based on historical analysis, the average stop is 7-10 pips. Exiting the position uses a simple formula: multiply your stop order in pips by 1.5.

In terms of capital management, a one-minute strategy, due to the large number of trades per day, must be calculated so that if your stop order is triggered, the loss does not exceed 1% of the deposit. Remember, scalping without strict adherence to all rules can lead to the loss of your deposit.