Forex Eyes Divegence Strategy

Following the global trend allows a trader to always stay afloat and be content with little, since, as a rule, it is only possible to determine the trend at the very end of the trend.

Millions of traders have made money simply by following the crowd, but the only ones who truly became rich were those who anticipated a reversal and entered a trade first.

Finding reversal points on Forex is the most dangerous and at the same time the most profitable business, because by opening a position before the start of a new trend, you cannot always guess the entry time.

The Forex Eyes Divegence strategy is a special indicator strategy that has absorbed two reversal indicators

Namely, the predictive forex eye and the divergence of the MACD indicator.

Installing Forex Eyes Divegence Strategy Indicators

The Forex Eyes Divegence strategy contains two indicators and if MACD indicator While the Forex Eyes indicator is a custom tool and is installed in MT4 by default, it is a custom development that should be downloaded at the end of the article and installed.

The strategy installation process follows a standard procedure, namely, you will need to reset the indicator and template to the appropriate folders in the terminal data directory.

To access the catalog, launch your platform and open the File menu in the upper left corner. A menu with a list of options will appear. Find the "Data Catalog" line and open it.

After launching the catalog, you will be able to see a number of system folders on the monitor screen. Among them, find a folder called indicators and drop the Forex Eyes indicator into it. Also, find a folder called Template and drop the template into it.

For the terminal to see the installed files, simply restart the platform. To launch the strategy, open the additional menu on the chart and find the "Forex Eyes Divegence" strategy in the template list. After launching the template, you'll see a chart like this:

Brief overview of the Forex Eyes strategy. Signals

The Forex Eyes Divegence strategy is based on the most popular market predictor – divergence.

It is worth remembering that divergence is the difference between the indicator readings and the price, and in our case, between the peaks of the MACD histogram and the price.

This is expressed as follows: the histogram peak may be lower than the previous one, while the price has updated the maximum and vice versa.

There is a concept of bullish divergence, which appears on a downtrend and predicts a reversal towards a bullish market, as well as bearish divergence, which predicts a reversal of an uptrend towards a bearish one.

So, having become familiar with the concept of divergence, you can proceed directly to the signals.

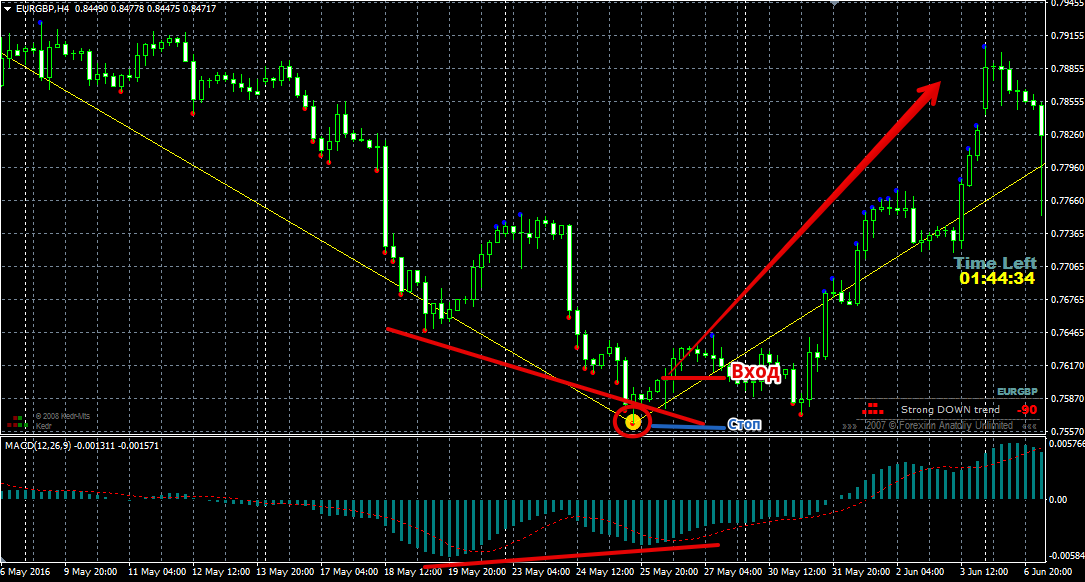

Buy signal:

1) The beam of the Forex Eyes indicator is directed downwards.

2) Forex Eyes indicator draws a yellow dot.

3) There is a bullish MACD divergence on the chart.

A stop order should be placed either at the local minimum or at the minimum of the signal candle. The profit should be 2-3 times the stop order in points. Example:

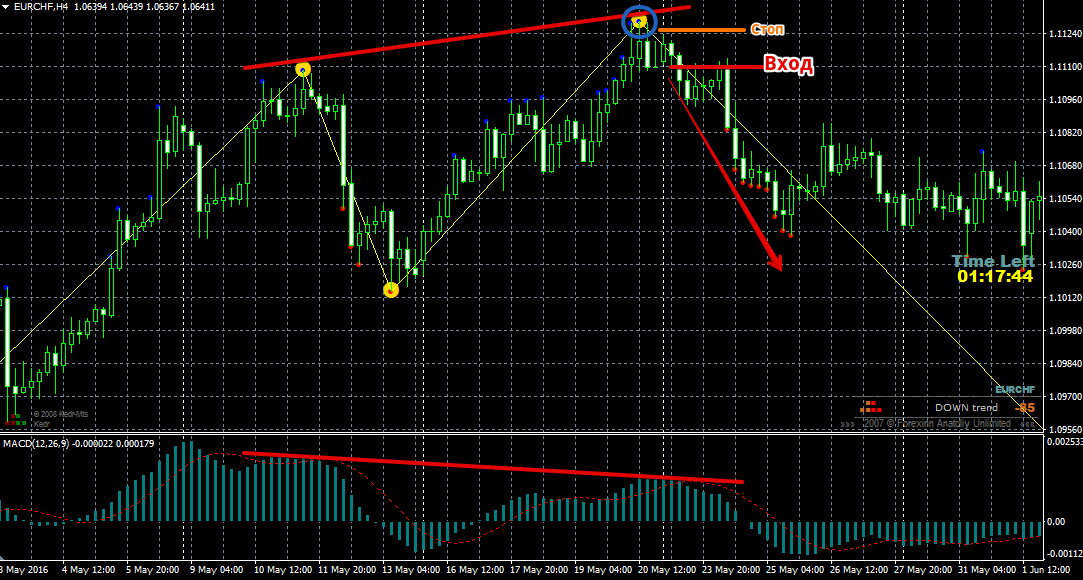

Sell signal:

1) The beam of the Forex Eyes indicator is directed upwards.

2) Forex Eyes indicator draws a yellow dot.

3) There is a bearish MACD divergence on the chart.

A stop order should be placed either at a local high or at the high of the signal candle. The profit should be 2-3 times the stop order in points. Example:

In conclusion, it is worth noting that the Forex Eyes Divegence strategy is primarily designed for more experienced market participants who are already familiar with the concept of divergence and have little experience in applying it in practice.

It is also worth adding that signals appear extremely rarely, so this strategy is suitable for busy people who cannot devote all their time to the market.

Download the Forex Eyes indicator for the strategy