Swing Trading Strategy

As I expand my circle of contacts with traders, I come to the conclusion that, for some unknown reason, everyone likes to complicate their lives. Yes, life, and all because everyone is constantly creating complex indicator trading systems, staring at their monitors day and night, and their entire personal lives are transformed into a stock market game, leaving no time even for loved ones.

lives. Yes, life, and all because everyone is constantly creating complex indicator trading systems, staring at their monitors day and night, and their entire personal lives are transformed into a stock market game, leaving no time even for loved ones.

And everything would be fine, but success is also unlikely with this approach, because constantly chasing every point from the market, you will always be haunted by a series of mistakes, unexpected losses due to your emotional state, and strong psychological stress.

Swing trading is a specific trading tactic in which all work is conducted on daily and weekly charts, and its main goal is to take profits along the main trend and ignore intraday price fluctuations.

On average, a swing trader's trade lasts for at least three days, and the main rule of the strategy is to let profits grow, since the main trend is not as easy to change as it seems.

The vast majority chase trend reversals, but this tactic only ruins the deposit, because we simply don’t have enough information, and indicator lines will never tell us for sure whether the market is at its bottom or peak.

Main market conditions.

All classics of stock market literature distinguish three market states, namely accumulation, trend state and distribution.

The first stage is initiated by large players with huge capital and information that is unavailable to us, so swing trading is never carried out during this phase.

The trend's middle phase is an excellent moment for making money, as the price is purposefully moving upward and its direction is very difficult to break.

Finally, distribution is the phase where major players close their positions, and naive newcomers enter along with a clear trend and lose their money. Therefore, the main goal when using a swing trading strategy is to find trending markets and enter in the main direction.

Basic entry signals for the swing trading strategy.

A swing trading strategy is based on simple signals that may seem trivial at first glance, but often, thanks to these simple approaches, the world's most famous traders have achieved stunning success. The first thing you need to do is select a list of currency pairs , stocks, and futures that have a clear trend, specifically, a downward or upward movement. We need to see the big picture, namely, the global trend.

Once we've determined the trend direction, we know which way to trade. So, let's look at some signals used in swing trading strategies.

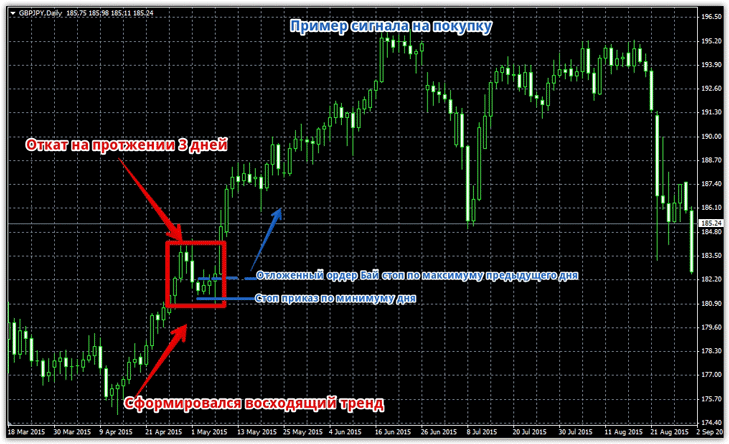

Buy signal.

A pullback has formed in the uptrend, lasting 3-5 days. A buy stop order at the high of the previous candlestick, and a stop order at the low. See the image below for an example:

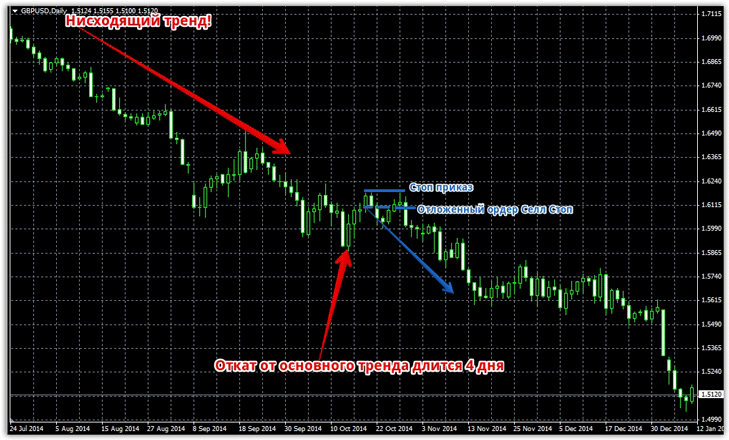

Sell signal.

A pullback has formed in the downtrend, lasting 3-5 days. A sell stop order should be placed at the low of the previous candlestick, and a stop order at the high. See the image below for an example:

What to do if the pullback continues and the pending order does not trigger?

It's very simple, you need to delete the old pending order and place it according to the rules on a new candle.

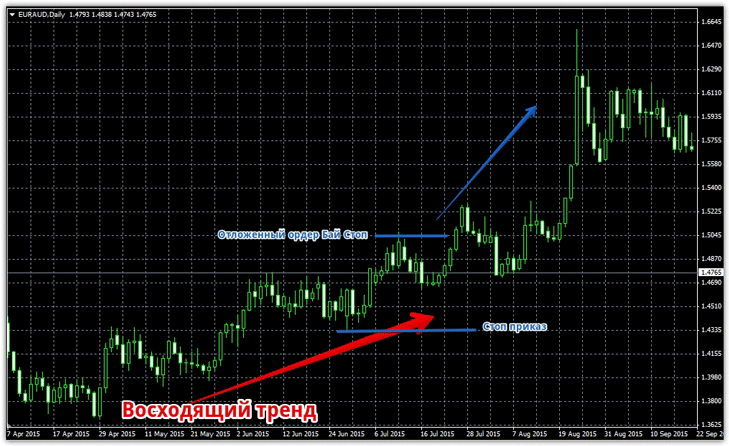

The second type of signal is based on a breakout of an extreme or so-called minor support level. This signal occurs when the price begins a pullback at a certain point, forming a low or high depending on the trend. This point becomes a type of support or resistance, and once broken, the price reaches a new high or low with renewed vigor.

So, for a buy signal to occur, the market must be in a global bullish trend, followed by a pullback in the opposite direction. At the point where the pullback begins, place a Buy Stop order, and at the local low, a stop order. See the example below:

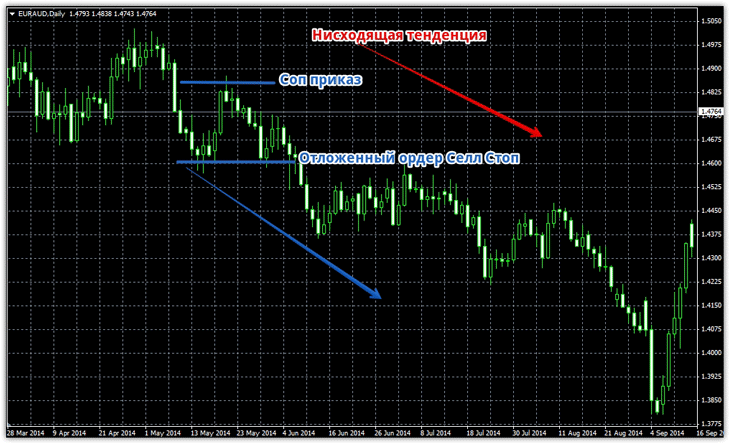

For a sell signal to occur, the market must maintain a global downtrend, with a 3-5-day pullback forming. At the point where the pullback began, place a pending Sell Stop order , with the stop loss at the local high. See the image below for an example:

For a sell signal to occur, the market must maintain a global downtrend, with a 3-5-day pullback forming. At the point where the pullback began, place a pending Sell Stop order , with the stop loss at the local high. See the image below for an example:

In general, the swing trading strategy relies on such simple signals. Among the advantages of this strategy, I'd like to highlight the lack of any psychological burden, as trades are made no more than 1-2 times a day, and they must be held for several days, on average about a week.

a swap for holding a position overnight , so before opening a long or short position, try to trade in the direction of a positive swap and choose a broker with a minimal commission.