Martingale trading

Fear of losing money and an uncomfortable sense of tension constantly haunt traders when trading systematically. For a normal trading strategy, five losing trades in a row is normal, but such a losing streak puts intense psychological pressure on a trader.

a normal trading strategy, five losing trades in a row is normal, but such a losing streak puts intense psychological pressure on a trader.

Therefore, traders are always looking for a kind of Holy Grail that would allow them to always come out unscathed, despite the wrong direction of the transaction.

To avoid losses and psychological stress, martingale capital management was adapted from gambling to stock markets.

Martingale trading was originally used exclusively in gambling games, such as heads or nuts and black/red roulette. The essence of money management boils down to doubling your bet if you lose.

For example, you bet $1 on black and lost it. Then, using the Martingale strategy, you bet $2 back on black, and if you win, you win back your previous loss and earn $1.

The whole idea is that you're hoping that black will eventually come up, according to probability, but you're doubling your bet until it does.

Eventually, a series of doubles can lead to you placing a huge bet, but only winning $1.

Forex trading using Martingale.

Martingale trading is generally applied in the Forex market in a similar manner, but there are several variations and subtleties to this strategy, which will be discussed in this article. The first method of martingale trading is often referred to as fixed-price.

For example, you receive a signal using an indicator strategy and set a stop loss of 15 pips, along with the same amount of profit. If your trade loses, you wait for the next signal, but enter with a doubled lot. This doubling continues until the trade closes in profit, and the total profit covers the series of losing orders.

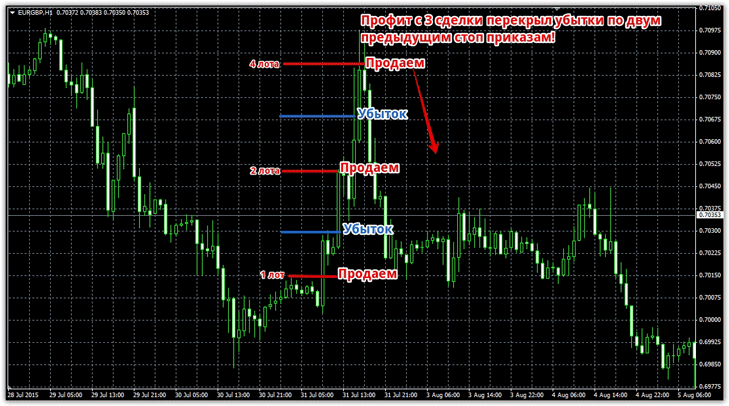

For example, look at the picture below:

One of the advantages of this approach is that you won't see a large drawdown in your account, which could wipe out your entire deposit overnight. However, with each increased lot , the size of the loss will dramatically increase, along with the psychological strain, which often leads to rash actions like repeatedly increasing the volume in the hopes that this time the trade will be profitable.

One of the advantages of this approach is that you won't see a large drawdown in your account, which could wipe out your entire deposit overnight. However, with each increased lot , the size of the loss will dramatically increase, along with the psychological strain, which often leads to rash actions like repeatedly increasing the volume in the hopes that this time the trade will be profitable.

This method requires strong discipline and strict adherence to the lot growth plan.

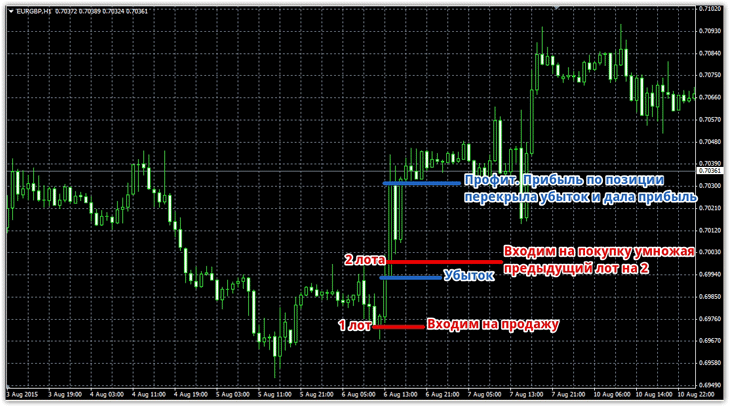

The second martingale trading method is called "Reversal." The tactic is very simple and straightforward. Let's say you enter a sell order with one lot and set a stop loss of 30 pips, but the price moves against you.

When a stop loss is triggered, you immediately open a position with a doubled buy lot, and if the profit is triggered, you resume trading with the original lot. Essentially, you're admitting you were wrong about the trend direction and reversing the trade, continuing this process until the profit is triggered and partially offsets the losses.

Unlike the previous option, profitable positions in trending areas emerge much earlier, and the series of losing orders is shorter. However, despite the obvious advantage of this method, there is one major drawback. This capital management model results in a very large series of losses if the market is moving sideways within a narrow range.

Unlike the previous option, profitable positions in trending areas emerge much earlier, and the series of losing orders is shorter. However, despite the obvious advantage of this method, there is one major drawback. This capital management model results in a very large series of losses if the market is moving sideways within a narrow range.

It gets to the point where you have to reverse a lot of times, and if the flat lasts for a couple of days, you simply may not have enough funds to open a position.

The third method is an improvement on the martingale system and involves position averaging. The idea is that if you miscalculate the direction, you don't close the order, but rather, at a certain distance from the previous one, open a new one in the same direction, but with a doubled lot size.

Essentially, you build a network of open orders at a certain distance in the hope that the price will sooner or later pull back and, based on the sum of the last few profitable positions, you will completely cover your losses and come out on top.

One of the advantages of using this method is that you never actually see a stop order, as it's never used, and all losses are averaged out. However, the drawdown on open orders is typically enormous, and even with any money management rules , you risk losing your entire deposit for a tiny profit. This model is most often used in various advisors, but due to the drawdown, the loss of your deposit becomes instantaneous.

One of the advantages of using this method is that you never actually see a stop order, as it's never used, and all losses are averaged out. However, the drawdown on open orders is typically enormous, and even with any money management rules , you risk losing your entire deposit for a tiny profit. This model is most often used in various advisors, but due to the drawdown, the loss of your deposit becomes instantaneous.

To reduce drawdowns, some traders average their positions not by doubling, but by multiplying them by a smaller coefficient. However, as the coefficient decreases, the pullback must be an order of magnitude larger to cover losses.

In general, martingale trading is a very common method, and it's used primarily by beginners. It's important to understand that there's no point in avoiding losing trades; stopping losses is part of the process.

If you can't handle this, you should be aware that by using martingale , you risk losing everything for a profit that doesn't justify your expectations. In the long run, a trader using martingale will eventually lose their account, especially during broad trend movements.