Futures Strategy

Forex traders have developed a number of myths surrounding futures trading, primarily due to a lack of understanding of the nature of this contract.

a lack of understanding of the nature of this contract.

For example, some argue that only fundamental analysis works when trading futures, others argue that only technical analysis works, and there is a category of traders for whom futures are something out of the realm of fantasy, and they don’t even know which instruments actually work here.

A futures contract is a contract that obligates a supplier to sell a product at a pre-agreed price at a specified time, and a buyer to buy the product at a specified time at a pre-agreed price.

Let's say you think the euro will go up in a month, so you decide to enter into a futures contract at the current price so that you can receive your euros in a month at the current price, not at what might happen.

Ultimately, if the euro exchange rate actually rises, you'll make a profit in a month, since the futures contract allows you to buy back the euro at the price you set when the contract was entered into. In real life, you could buy euros and hold them until the exchange rate rises, but if you think the price of oil will rise, you wouldn't buy a barrel with the intention of reselling it, would you?

Therefore, non-deliverable futures were invented to profit from price differences. Their main purpose is to profit from price movements both now and in the future at expiration. Essentially, you see a standard price chart, just like on a currency exchange, and can both buy and sell. You can close your position before the contract expires, but the position will close automatically upon expiration.

To summarize the above, all the methods and strategies that you used for trading on the Forex market can be easily applied to trading futures.

Main types of futures.

There are many different types of futures, or more precisely, assets that act as futures. For example, there are currency futures (with a price chart similar to Forex), futures on metals, commodities, energy, stocks, indices, securities, and anything else traded on various exchanges around the world.

Depending on the asset you choose, your futures trading strategy can vary, ranging from fundamental analysis to the usual technical approaches.

Currency futures remain subject to the same fundamental factors as regular forex currency pairs. These include indicators such as interest rates, national GDP, trade balance, business activity index, unemployment data, and all macroeconomic indicators of the currencies whose futures are traded.

In the forex market, you're accustomed to seeing the abbreviations for the currencies you trade (for example, EUR/USD buys euros with dollars). Futures contracts, however, have a completely different abbreviation, but the meaning remains the same. For example, an ED futures contract is equivalent to EUR/USD, and an AU futures contract is equivalent to AUD/USD. Therefore, when you open a currency futures contract and a currency pair on the forex market, you'll see the exact same chart.

Energy futures, such as various grades of crude oil, lend themselves well to both fundamental and technical analysis. To trade successfully, you need to analyze the production status of major exporting countries, such as Saudi Arabia and Canada, and monitor policy statements, as oil prices can be held down by production cuts or, conversely, depressed by the entry of new players into the global market and increased exports by major oil producers.

Basic principles of building strategies using futures.

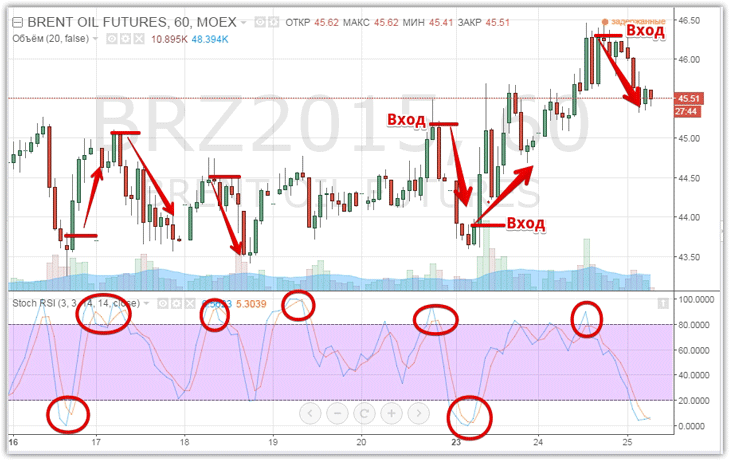

However, despite fundamental analysis, any futures contract lends itself to technical analysis, and all the usual support and resistance levels, chart patterns, and technical indicators still work just as well. For example, let's look at Brent crude oil futures and the signals from the Stochastic Oscillator.

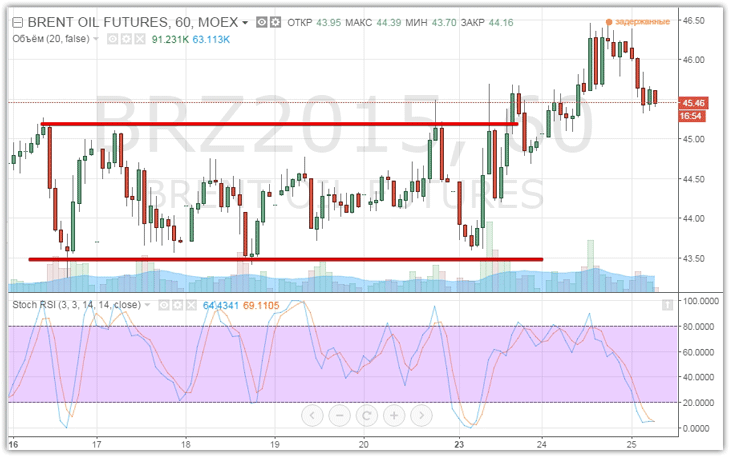

The image demonstrates how using just the Stochastic indicator, buying in oversold zones and selling in overbought zones, can lead to successful oil futures trades. Also, if you've noticed, standard support and resistance lines are no less effective. For example, let's look at the same chart, but draw these levels:

As you can see, the price repeatedly hits the support line and bounces back to the resistance line, and when the price breaks through the resistance line, it successfully goes up.

In summary, both fundamental and technical analysis can be used and form the basis of a trading strategy. While fundamental factors can help you identify potential trends and confirm underlying tendencies, technical analysis can always help you find excellent entry points.