4H Box Breakout Trading Strategy

Trading success largely depends on the chosen trading strategy. However, as experience shows, most require traders to be at their computer 24/7, monitoring indicator readings, and reacting flexibly and quickly to any economic developments.

most require traders to be at their computer 24/7, monitoring indicator readings, and reacting flexibly and quickly to any economic developments.

But what about the average person with a family, a job, or a business? Not everyone makes a living from trading, and the stability of such a source of income is a matter of debate.

Unfortunately, there are many myths surrounding stock trading, including that the money is easy, you're not dependent on an employer, and you're left to your own devices and have complete independence.

While this is true in theory, the reality is that a successful trader spends more time at their desk than most of us would ever spend in an office. Not to mention the psychological strain and insomnia that can plague you at night due to the possibility of losing money.

In reality, a pro doesn't look like the ads; he wears big glasses and has wide-open eyes.

The 4H Box Breakout strategy is an indicator-free strategy designed for people with limited time and trading opportunities. Not everyone is chasing millions, but most of us want to grow and preserve our savings while minimizing our involvement in the world of trading.

The idea is to wake up at 4:00 AM once a week on Monday and place a couple of pending orders. The strategy is designed for trading the GBP/JPY pair . The trading strategy is based on constructing a box on a four-hour candlestick that closes at 4:00 AM.

Simply put, we'll trade the first four-hour candlestick to close on Monday. Since the strategy is based on a range constructed using a Japanese candlestick, you can easily apply it to any currency pair.

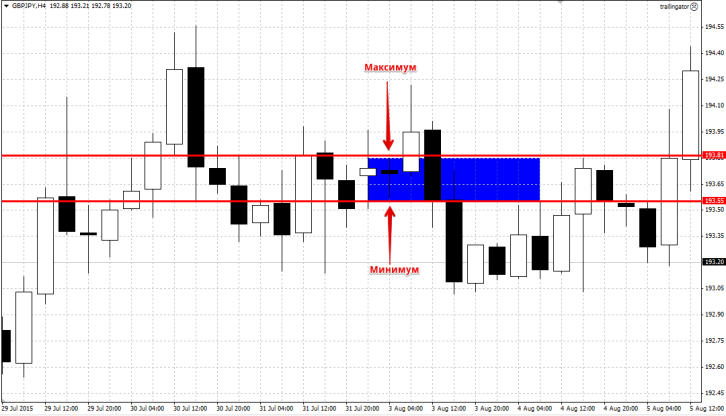

So, let's move from superficial words to practice. To begin, open the GBP/JPY currency pair and switch it to a four-hour chart. To draw a box (range), use the first four-hour candlestick that closes on Monday.

Draw two horizontal lines at the candlestick's high and low, resembling a box. You can also simply use the rectangle shape tool to highlight this area. If the price is very close to the candlestick's high or low, it's acceptable to indent 5-10 points from the candlestick's high and low. After marking, you should have a box that looks something like this:

Once you've formed a box, you should trade on a breakout of the upper or lower border. If you're constantly at your computer, open a buy order if the price breaks the upper border, and a sell order if the price breaks the lower border.

Once you've formed a box, you should trade on a breakout of the upper or lower border. If you're constantly at your computer, open a buy order if the price breaks the upper border, and a sell order if the price breaks the lower border.

A stop order should be placed beyond the opposite border of the box. The profit is usually set equal to the box size in points.

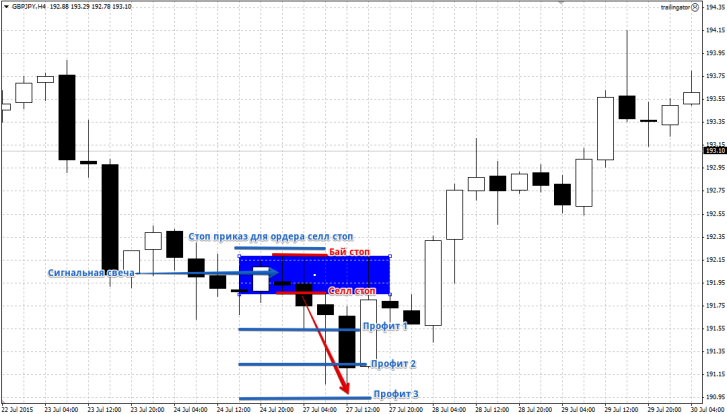

Now let's consider applying the 4H Box Breakout trading strategy if you're unable to be at your desk. To implement this trading strategy, we'll use two pending orders: buy stop and sell stop .

Place a buy stop at the high of the four-hour candlestick and a sell stop at the low of the candlestick. It's also worth setting a profit equal to the box size in points. The stop order should be placed 5-10 points from the opposite border of the box. Simply put, for a buy stop order, place it 5-10 points away from the sell stop order. For a sell stop order, do the opposite.

Often, after a pending order is triggered, the price moves more points than the box size. Therefore, many traders practice closing positions upon reaching three targets. The first profit is placed at the box size, the second at two boxes, and the third at three boxes from the price.

In simple terms, profit 1 is 20 points, profit 2 is 40 points, and profit 3 is 60 points from the entry point. This way, you can maximize profits from the market with minimal risk. An example of placing orders with targets is shown in the image below:

If we consider the strategy in its original form, when one pending order is triggered, the second is not deleted. However, as many traders have shown, if a buy stop order is triggered, the opposite pending order should be removed, as if the price starts to jump sharply, there's a high chance the second order will also be triggered.

If we consider the strategy in its original form, when one pending order is triggered, the second is not deleted. However, as many traders have shown, if a buy stop order is triggered, the opposite pending order should be removed, as if the price starts to jump sharply, there's a high chance the second order will also be triggered.

As a result, you could simply end up with a regular stop loss or, even worse, two stop orders. Therefore, when one order is triggered, the second should be deleted immediately. Thank you for your attention, and happy trading with the 4H Box Breakout strategy!