What is an ETP in investments and on the stock exchange?

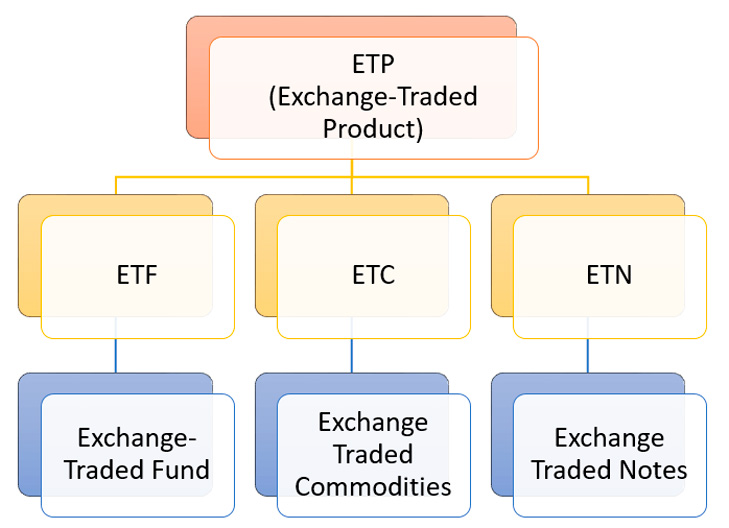

ETP — Exchange-Traded Product, which replicates the price of a specific asset: an index, gold, oil, an economic sector, or a basket of shares.

An investor doesn't buy the asset itself, but rather an instrument that moves with it. For example, one ETF reflects the dynamics of the entire US market, while an ETC tracks the price of gold. An ETN is another subtype of ETP.

To understand, it is enough to know only that ETPs come in different designs, although their purpose is the same - to provide easy access to the market.

The main value of ETPs is that they relieve investors of many complexities. To invest in gold physically, you need to purchase bullion and think about storage.

Trading oil requires studying futures and expirations. Assembling a diversified stock portfolio requires significant funds and time. ETPs solve all these problems with a single instrument that's as easy to purchase as a regular stock.

If you want to invest without in-depth analysis of individual companies or without mastering complex derivatives, ETPs are a convenient and transparent option. A single instrument provides access to an entire market or commodity, and the purchase process takes seconds.

A few illustrative examples will help form a general idea. The S&P 500 ETF tracks the movements of the largest US companies. The gold ETC tracks the price of the metal without requiring physical ownership of the bullion. These examples are sufficient to understand the logic behind the ETP's operation and its purpose.

Disadvantages of ETPs

Despite its convenience, ETPs have their weaknesses:

- management company fees gradually reduce the final profitability;

- the reliability of individual products may depend not only on the market, but also on the financial condition of the issuer;

- Some instruments have low liquidity , which makes it difficult to quickly buy or sell;

- The portfolio composition is fixed by the management company, so the investor accepts a ready-made structure rather than forming it independently.

CFDs can be considered an alternative for those who prefer active trading. These contracts allow you to trade on the price movements of an index, gold, oil, or stocks, offering the ability to open short positions and use leverage .

But CFDs are a short-term speculation tool, not an investment: there's no ownership of the asset, and the risks are higher. Therefore, ETPs are usually better suited for a long-term strategy.

Purchasing shares directly is also an alternative, but in this case, the investor must assemble and manage the portfolio themselves. Futures provide access to the same markets as ETPs, but require professional training and an understanding of margin requirements. Physical gold is suitable as a safe haven, but incurs storage costs and a wider spread .

Compared to these options, ETPs appear to be a practical solution for those looking to invest in a major market or commodity without unnecessary technical complexities. They offer a tool for secure long-term investments and structured capital growth. While they don't completely replace other forms of investment, they make them more accessible, simpler, and more understandable for a wider range of investors.