Scalping in a price channel

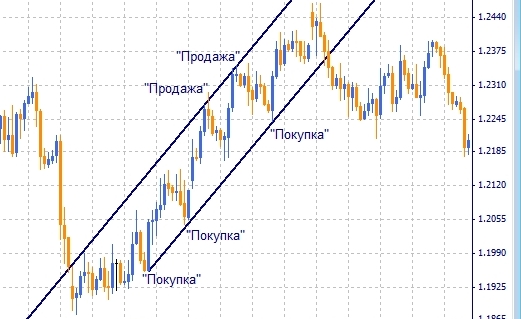

The basis of this forex strategy is price fluctuations within a price channel; it is the range of trend movement that will serve as a guideline for opening trades.

Looking at any currency pair chart, you'll immediately notice that the one-minute timeframe clearly shows the underlying trend and price pullbacks.

Looking at any currency pair chart, you'll immediately notice that the one-minute timeframe clearly shows the underlying trend and price pullbacks.

If the correction value is greater than 10 points, you can try trading in both directions, thereby earning more in the same period of time.

The work begins with constructing a price channel. The easiest way to do this is by installing one of the channel indicators of your choice in the trader's trading terminal.

The main thing is that it independently builds support and resistance lines on a minute time frame.

You will find a selection of channel indicators here - http://time-forex.com/tehanaliz/in-kanalov

Scalping in a price channel involves the following steps:

1. Analyzing the width of the price channel - after the price channel has been built, you can analyze its width and if it is less than 8-10 points, then it is best to switch to a higher time frame.

2. Choosing the direction of trades – if the pullback value exceeds 10-15 pips, you can trade either with or against the trend. The key is to enter the market just as the price begins to reverse.

3. Currency pair – selected solely based on the spread size. The smaller the spread, the greater your profit and the lower your risk, as the trade closes faster. A good solution would be to use a floating spread, sometimes as low as 0.1 pips.

4. Dealing center - be sure to work only with brokers for scalping , and there are no restrictions on short-term transactions.

5. Order execution is absolutely instantaneous, or as it is also called precise. When trading using the scalping strategy in a price channel, deviations that exist with the market version of order execution are not allowed.

6. Lot - the bigger the better, as mentioned in other articles, you can trade to the maximum using the highest leverage.

Scalping trading

After the preparatory procedures, you can proceed directly to trading itself; everything here is quite simple.

Buying at the support line of our price channel after the price has gone up, closing the trade after receiving a few points of profit.

Selling at the upper channel line when the price moves downwards, we close the deal as soon as we make a profit.

An important aspect is closing trades when the position is unprofitable. Everyone sets their own loss level here. I close with a loss of thirty points. You can change this level depending on the dynamics of the trend and the width of the channel in which you are trading.

An excellent time for trading is during a flat period, as it is during horizontal movement that the price often forms a stable and predictable channel.

Read all about scalping in the section - http://time-forex.com/skalping