Trendline Strategy

When trading Forex, you can discover a variety of patterns. Simply observing a currency pair's chart is enough. Once you notice recurring patterns, you can then develop your own trading strategy.

Many Forex strategies are built on this principle, and the trend line strategy is no exception.

It is suitable for any currency pair and can also be used in trading with other trading instruments available in the MetaTrader 4 trading terminal.

Trading takes place on a five-minute M5 time frame, and to identify market entry points, a one-hour H1 time frame will be used. This approach will allow us to work only in the direction of the main trend, without paying attention to price rollbacks.

The trend line strategy is one of the most versatile and can be applied to various timeframes and any instruments. To get started, you only need to draw one trend line.

Constructing a trend line is quite simple using standard tools in the MetaTrader trading platform. You can find them under the "Insert" - "Lines" - "Trend Line" menu tab. You can also use specialized indicators for this purpose - http://time-forex.com/indikators

Trade.

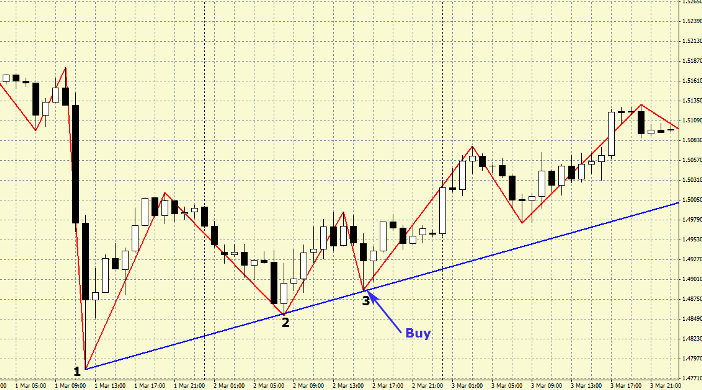

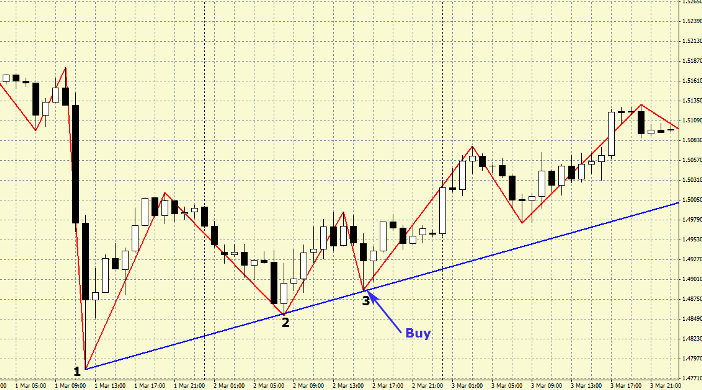

2. Depending on the direction of price movement, we find significant minimums or maximums; in an upward trend, we use minimums; in a downward trend, we use maximums.

To construct a trend line, we will need two points through which we will draw the line. It can also be called a support line, since this is where the last two corrections .

3. The resulting line will serve as a guide for opening a trade. Once it's drawn, all that's left to do is wait for the next trend reversal to occur.

The reversal doesn't necessarily have to occur exactly on this line; a divergence of several points is acceptable.

To open a deal, you can use either instant or pending orders, it's up to you.

4. After completing the transaction, switch to the M5 and begin monitoring the price movement. If it begins to move against our position, close the order after 10 points. If the price moves in the desired direction, wait for the first signs of a reversal on the M5 and close the order with a profit.

5. For insurance, it is recommended to set a stop-loss at 100 points from the current price immediately after opening an order.

The trend line strategy works in most cases; the main condition for it to work is the presence of clearly defined price pullbacks (corrections) in Forex. If desired, you can adjust this trading approach to your liking and achieve even greater profitability.