Pairs trading strategy in stock trading

Pairs trading is a fairly simple strategy that involves making a profit through the correlation of several assets.

That is, in stock trading, the principle is used: if the price of one asset rises, then another asset that has a direct correlation will also necessarily rise in price.

The concept of pairs trading originated in the 1980s thanks to mathematicians and quants at investment bank Morgan Stanley.

Since then, the strategy has undergone significant changes and development, becoming accessible and attractive to a wide range of investors.

Today, pairs trading is one of the most popular strategies in stock markets due to its unique ability to minimize risks and stabilize returns in any market conditions.

Typically, these are stocks of companies in the same industry or other assets whose prices move in sync. Traders use specialized software and algorithms to track correlations and identify suitable asset pairs.

Pairs trading has a number of advantages, the most important of which are stability and the ability to profit even in a falling market. However, like any other strategy, it has its drawbacks.

The main drawbacks are the difficulty in selecting assets and the need for constant market monitoring. Furthermore, this strategy may require significant investment to achieve significant returns.

Therefore, let's try to figure out which assets can be used with a pair trading strategy.

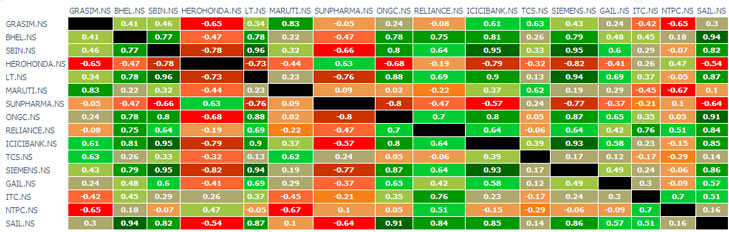

Pairs trading on company stocks

The simplest example of making money on stocks using pairs trading is given in Wikipedia . This approach involves the relationship between the price of commodities and the stock prices of companies involved in the production of those commodities.

Photo 2

For example, it is natural that when the price of oil rises, the shares of oil producing companies also begin to rise in price.

When pair trading stocks, assets from the same industry are often selected. Let's say we find that Apple and Microsoft stocks are highly correlated. As soon as the price of one company's shares begins to rise, we buy the other.

Pair trading Bitcoin and gold

Surprisingly, these two assets also have a direct and stable correlation, so when gold rises, you can open a long position on Bitcoin.

The relationship between the price of gold and the price of Bitcoin is described in detail in the article - https://time-forex.com/interes/korrelacya-zoloto-bitcoin

As you can see, these two assets move almost in tandem and are ideal for pairs trading, a fact that has been proven time and again. Currently, gold has risen to $1,990 per ounce, and Bitcoin has risen above $29,000 per coin.

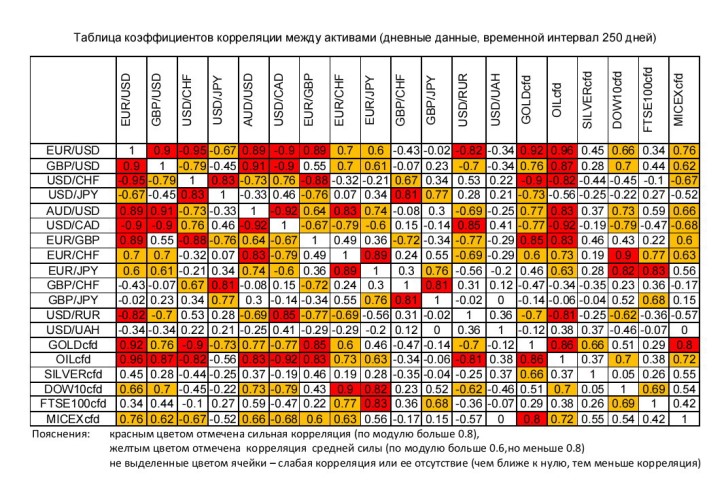

Pairs trading on currency pairs

This strategy requires selecting currency pairs that have a direct correlation and then moving on to the direct application of the strategy itself.

In this case, the most effective solution is to use a correlation indicator , which will show up-to-date information on the relationship between currency pairs.

It's important to note that successfully applying a pairs trading strategy requires certain skills and knowledge. Here are some tips and recommendations for traders using this strategy:

- First of all, it is necessary to carefully analyze the two selected assets to ensure that they are related.

- It is necessary to constantly monitor the price dynamics of selected assets in order to respond to changes in a timely manner.

- Don't forget about risk management: when opening a trade, you need to determine stop-loss and take-profit levels in advance.

- Pairs trading should not be relied upon alone - it should be just one part of an overall trading strategy.

Of course, correlation isn't always perfect. Sometimes highly correlated assets can move in opposite directions. This is called negative correlation. In this case, we can lose money if we don't take this possibility into account.