Effectiveness of news trading

There's a lot of discussion and speculation surrounding the effectiveness of news trading, but I haven't really come across any compelling arguments for the effectiveness or unprofitability of this approach.

I haven't really come across any compelling arguments for the effectiveness or unprofitability of this approach.

Typically, newbies point to examples of how news didn't work out, more experienced participants argue that it shouldn't have affected the market, and others are completely adamant about trading on the news and profess only technical analysis.

Therefore, if you choose to apply fundamental analysis to your trading, no one will give you a definitive answer as to whether macroeconomic news influences the Forex market, much less whether it can be effectively applied to your trading.

On the website, in the fundamental analysis section, you can find descriptions of various news items, as well as how they can affect a particular currency pair.

Reviews focused on the number of points the price moves, but if you have good money management, this becomes less important, as you can enter a position with a larger lot and a smaller stop and take the same amount of profit as if you had entered with a smaller lot but taken more points.

Therefore, to discuss the effectiveness of news trading, I propose calculating the percentage of the most popular economic indicators that worked over the year and drawing some conclusions.

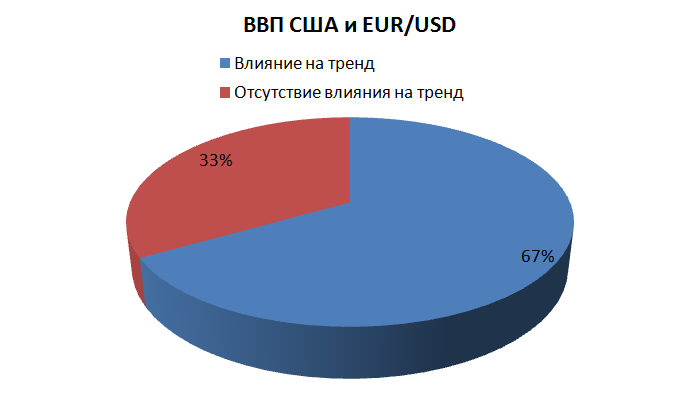

The first and most popular macroeconomic indicator to pay attention to when trading news is GDP . To calculate the effectiveness of this indicator, we analyzed the EUR/USD currency pair and counted the number of times the price chart responded to the news release over the course of a year.

To ensure that the market took the data release into account, we assumed a constant 15 points of distance traveled toward the indicator. The indicator is released quarterly, but updated information is published monthly, which traders use to guide their trading. Of the 12 months analyzed, a reaction to the news was recorded in eight cases, while a market reaction against the news was recorded in four cases. The percentage of news events that were triggered is shown in the image below:

The second equally popular dollar macroeconomic indicator, actively used by news traders, is the Consumer Price Index . We previously provided a detailed review of this indicator and calculated its profitability over the past couple of months. However, to get a clearer picture of the news' effectiveness on the GBP/USD currency pair, we calculated the percentage of news events that were triggered over the past year.

The second equally popular dollar macroeconomic indicator, actively used by news traders, is the Consumer Price Index . We previously provided a detailed review of this indicator and calculated its profitability over the past couple of months. However, to get a clearer picture of the news' effectiveness on the GBP/USD currency pair, we calculated the percentage of news events that were triggered over the past year.

As a reminder, this news item is released monthly and serves as an indicator of dollar inflation.

Over a 12-month period, there were seven instances where the CPI release impacted the price movement by 15 points or more, and five instances where the price moved against the news item.

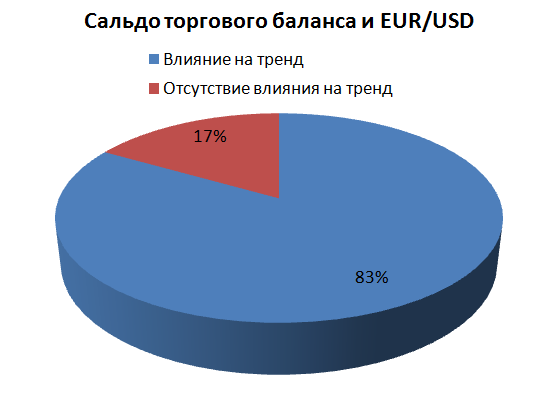

Analyzing the country's exports and imports has always allowed a savvy investor to assess the US economy, which is why a macroeconomic indicator like the trade balance is always popular with news traders. Previously, we calculated the average price move following a news release over the past four months, but to see the news's effectiveness, we calculated the percentage of triggered market movements over the course of a year for the EUR/USD currency pair. This allows us to assess the true impact of the news.

Analyzing the country's exports and imports has always allowed a savvy investor to assess the US economy, which is why a macroeconomic indicator like the trade balance is always popular with news traders. Previously, we calculated the average price move following a news release over the past four months, but to see the news's effectiveness, we calculated the percentage of triggered market movements over the course of a year for the EUR/USD currency pair. This allows us to assess the true impact of the news.

A 12-month calculation revealed 10 instances where the price chart moved between 15 and 100 pips following the publication of the Trade Balance. However, in two cases, the price simply failed to react to the news. The percentage of news events that occurred is shown in the image below:

The fourth news item will be familiar to almost any professional, as it is based on an analysis of the US manufacturing sector, which accounts for the majority of the country's GDP. This article concerns the Manufacturing Business Activity Index (PMI) and its impact on the dollar exchange rate. This indicator was previously reviewed and trading results for the past four months were calculated, but to assess the effectiveness of this news item, the annual percentage of news events was calculated for the EUR/USD currency pair.

Over the 12 months analyzed, there were six instances where the price reacted to the news release and six instances where it ignored it, ignoring the information. The percentage of news events that were triggered is shown in the image below:

Having calculated the market reaction to key news releases, we can confidently say that the trade balance and GDP indicators show high winning rates. For traders, 83 percent and 67 percent are high, as few strategies can generate such a winning percentage. It's also worth highlighting a clear underperformer, namely the Business Activity Index, as trading based on it is like playing roulette, where your odds are 50/50.