Cash Cow Trading Strategy

It's no secret that technical analysis, one way or another, is built on various patterns. Many people mistakenly believe that patterns exist solely in analysis candlestick chart, however, this is far from the case.

In fact, a pattern is a kind of regularity that has been repeated many times in history.

That is why crossing moving averages, breaking through support and resistance levels, and entering the market based on an oscillator are pattern trading.

Actually, let's be honest, a pattern is just ordinary statistics that we record and process on a daily basis.

However, there is one unspoken rule among traders that has stood the test of time.

That's why, if you conduct a simple analysis of the most popular candlestick patterns and graphical analysis figures, the most common and obvious ones that we encounter daily have a fairly low success rate, while those that appear extremely rarely and require experience to identify are most often profitable.

The Cash Cow strategy is a trading method based on a simple pattern of movement of the Pound/Dollar currency pair and does not contain a single indicator or candlestick pattern.

The Cash Cow trading strategy can be applied to other markets as well currency pairs, however, to do this, it is necessary to calculate the average movement of the currency pair and determine what allocated distance is a deviation from the norm.

The strategy is used on a daily chart with subsequent entry into the market on an hourly time frame.

Cash Cow Strategy Overview and Trading Signals

If you are an experienced market player, you have probably noticed that the price almost always moves in a narrow range, and only on some days there are strong price surges that literally in a day carry the price equal to a week or more of movement.

Such situations are extremely rare, and among traders, they are commonly referred to as "price explosions." Each currency pair has its own specific value, which reflects a deviation from the norm. For example, for the GBP/USD currency pair, a price explosion is considered to be a price movement of 140 or more pips in a day on four-digit quotes.

When it comes to the reasons for price explosions, it can be noted that they occur at the moment of the release of strong fundamental statistics, which sets the trend for many days ahead.

Based on this, a simple pattern emerges: if a price explosion occurs in the market, there's a high probability that the trend will continue and move in the direction of the price explosion. So, let's take a closer look market entry signals.

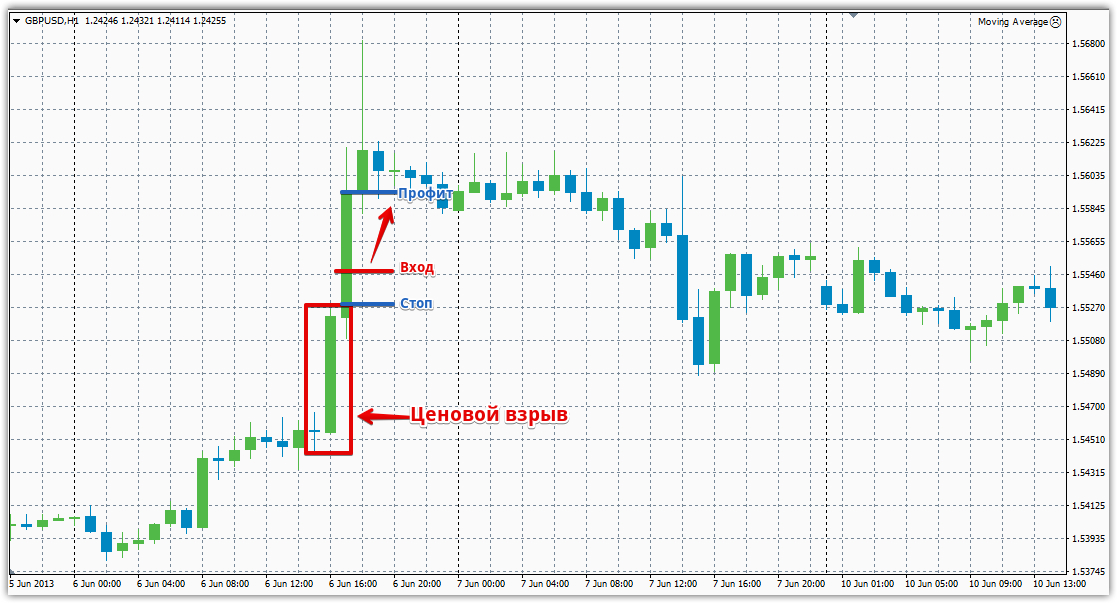

Buy signal:

1) An upward “Price Explosion” occurred in the market, namely, the price crossed 140 or more points in a bullish direction in one day.

2) On the next trading day, we wait for confirmation of the development of an upward trend in the market, namely, the price should move 70 points up from the closing price of the daily candle of the previous day.

After the price crosses 70 pips, enter the market on a closed candle. Risks should be limited with a static stop order of 60 pips, and exit at a profit of 100 pips. An example is below:

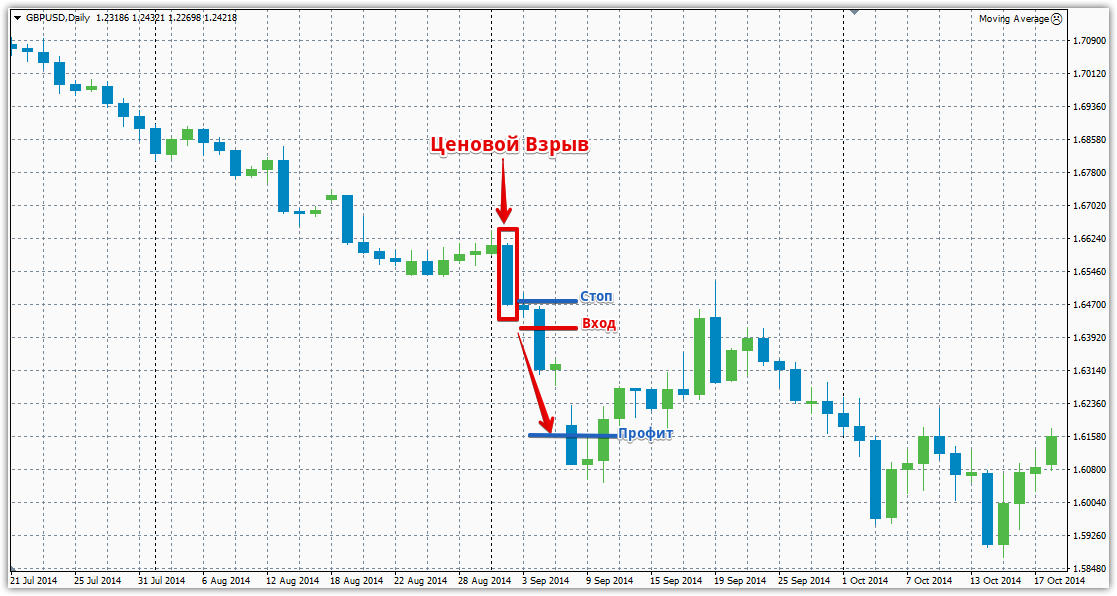

Sell signal:

1) The market experienced a downward "Price Explosion", namely, the price moved 140 or more points in a bearish direction in one day.

2) On the next trading day, we wait for confirmation of the development of a downward trend in the market, namely, the price should move 70 points down from the closing price of the daily candle of the previous day.

As with a buy position, entry occurs on a closed candlestick when the 70-point mark is broken. A static stop order should be used, specifically 60 points. Exit occurs at the set profit, which is 100 points. Example:

In conclusion, it's worth noting that the Cash Cow strategy is a simple, indicator-free trading method that can be used by both experienced traders and beginners.

Despite the fact that the strategy itself is focused on a currency pair Pound/Dollar You can easily adapt the tactics to apply to any currency pair, the only thing you need to know is the optimal number of pips for a price explosion on each currency pair.